Bridgewater's big EU shorts that popped-up in January-March were cut in April-July and did not re-appear. So, who shorted EU? We had a look at hedge funds that currently short the most across EU. One fund stands out: Marshall Wace has, by far, the highest number of disclosed EU shorts, in our records.*

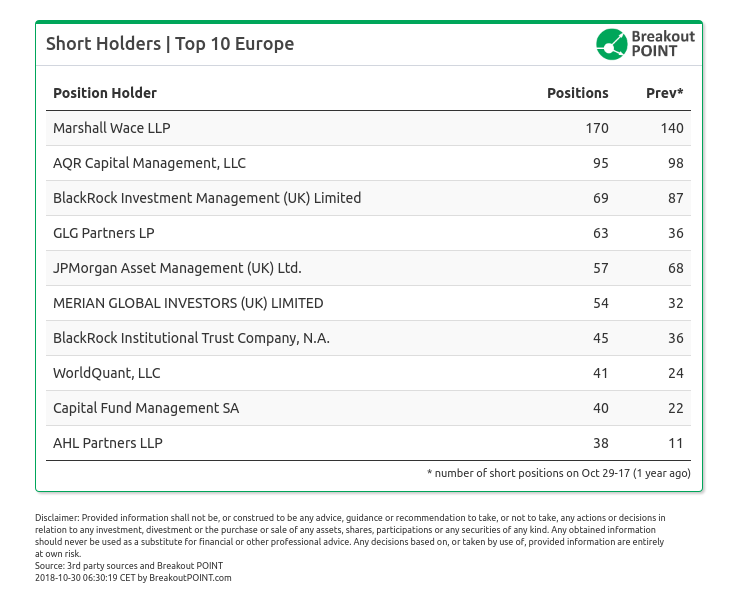

Top EU Short Holders

Who shorted EU and profited from the recent drop? In an attempt to answer this we:

- looked at the hedge funds with the highest number of disclosed EU short positions and,

- seeked those that currently hold much higher number of such short positions than one year ago.

Marshall Wace stands-out as the hedge fund with the most big shorts in our records, and also with considerably higher number of disclosed shorts than one year ago (170 vs 140 shorts). Besides Marshall Wace, and among those with at least 50 currently disclosed shorts, only GLG Partners (63 vs 36 shorts) and Merian Global (54 vs 32 shorts) have more significant shorts than one year ago.

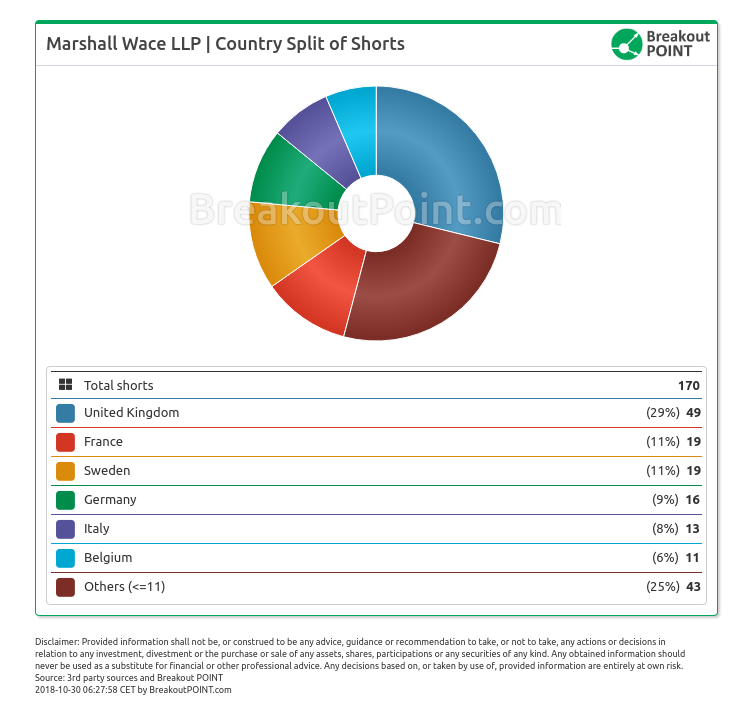

Marshall Wace Shorts - Country Split

Short selling activities by Marshall Wace are rather well distributed among a number of EU countries. About 30% of Marshall Wace's disclosed shorts are in UK, while in each: France, Sweden, Germany and Italy, are about 10% of their big shorts.

On the other hand, disclosed short positions of GLG Partners and Merian Global are much more UK centric. About 80% (GLG) and 60% (Merian) of their disclosed shorts are UK shorts.

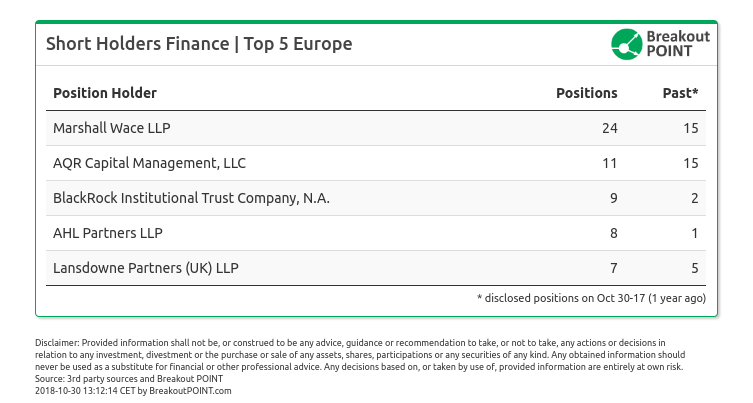

EU Financial Sector Shorts

Marshall Wace also holds, by far, the highest number of significant short positions in EU's financial sector. They hold 24 such shorts, while second on the list is AQR with 11 disclosed short positions. In terms of % of issued share capital, two biggest financial shorts of Marshall Wace are in Italian banks. As of latest disclosed values, these are: a 4.27% short in Banco BPM and a 1.93% short in Unione di Banche Italiane.

How about Ray Dalio's Bridgewater?

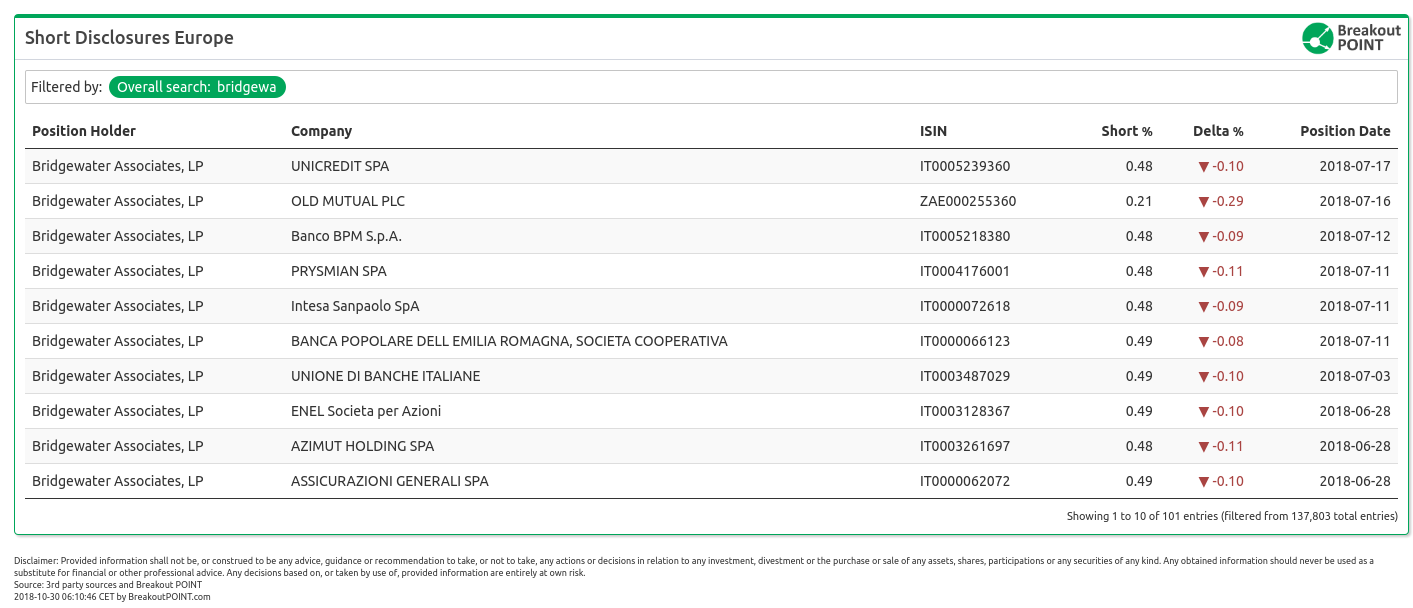

In Q1-2018, Ray Dalio's Bridgewater disclosed more than 50 EU short positions (in Italy, Spain, Germany, France, Netherlands, UK,...), receiving a lot of media attention. For example, only in Germany 14 such shorts appeared. However, the last of these short positions were cut under 0.5% of issued share capital in July and, according to our records, Bridgewater holds no significant European shorts since then.

Know what influential investors and activists do. Cancel anytime. Join Breakout POINT.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.