A first ever short selling disclosure in Linde plc popped-up on our radar. It is a 0.69% short by Millennium International Management in Linde plc on 2018-10-31.

First Short Disclosure for Linde plc

Linde plc shares started trading on stock exchanges few days ago, following successful completion of merger between Linde and Praxair. The merger of Praixair and Linde created a company with a market cap of close to $90 billion. For more details see, for example, an article in gasworld here.

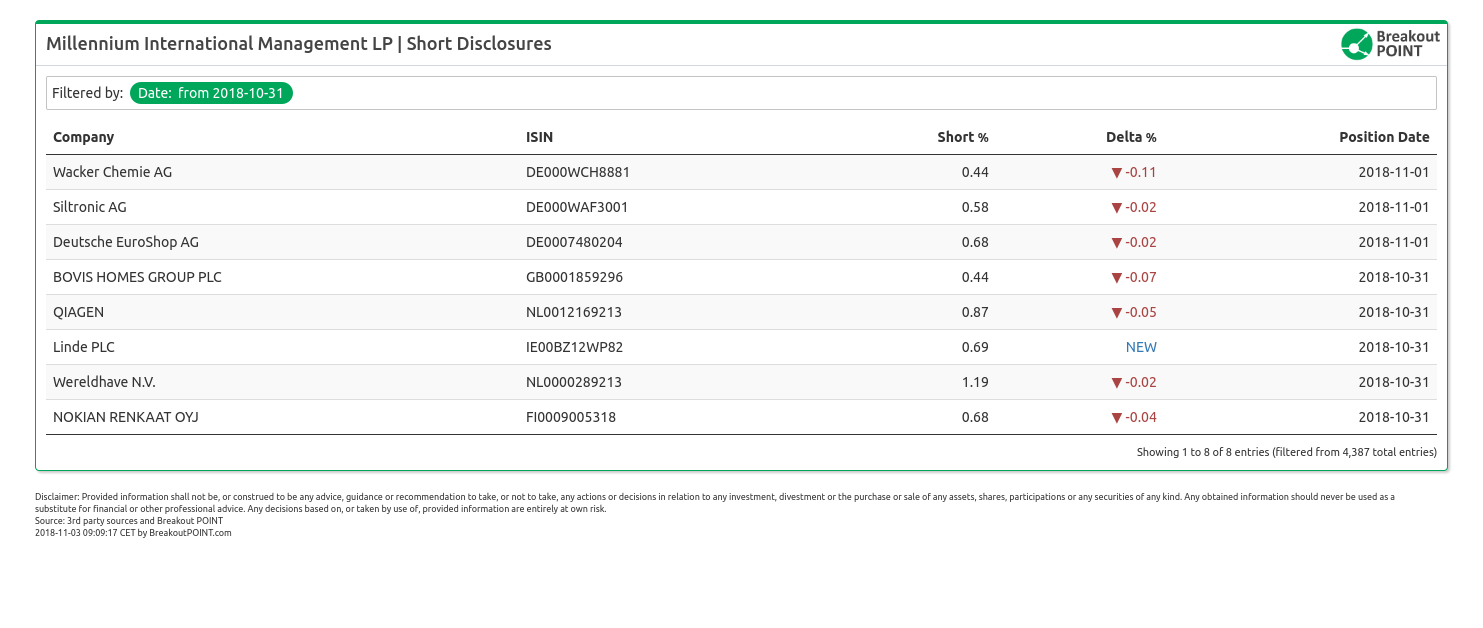

Following listing, a first ever short postition in Linde plc has popped up on our radar. This short position has been disclosed as required by EU Regulation on Short Selling. A well known hedge fund, Millennium International Management has disclosed a 0.69% short position dated 2018-10-31 in Linde plc.

Disclosed 0.69% short refers to % of company issued share capital, so by taking that into account and combining it with market cap of Linde plc of about $90 billion - one can obtain $ value of this short.

Short selling activities by Millennium regularly appear in our data and they currently hold more than 20 significant shorts across EU. Interestingly, according to our data, Millennium reduced their short in Wacker Chemie on 2018-11-01, leaving Linde plc short to be their only short >0.5% in Commodity Chemicals sector.

Previous company, Linde AG, has not been subject of much short selling and our records show only a single short position from 2017 by PSquared Asset Management.

Update: A follow-up short disclosure appeared on 2018-11-05. Millennium International Management decreased Linde PLC short from 0.69% to 0.57% on 2018-11-02.

Know what influential investors and activists do. Cancel anytime. Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.