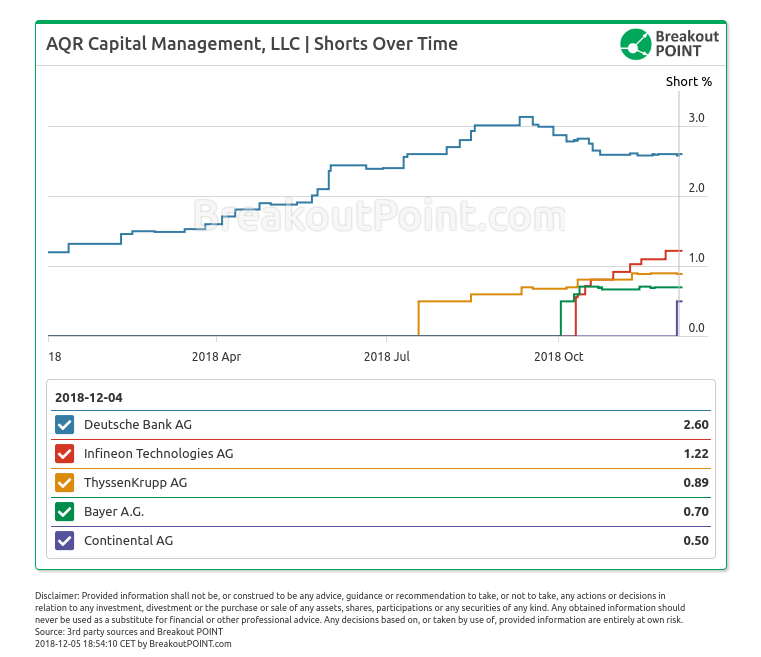

Three new bets by AQR Capital Management against DAX companies popped-up in Q4, bringing the total number of their disclosed DAX shorts to 5. According to our records, currently, no other hedge funds targets so many DAX companies with shorts >0.5% ("big shorts").*

AQR bets against 5 DAX members

Famous quant fund, AQR has disclosed a 0.5% short in Continental on 2018-12-03, making it their 5th big DAX short:

- Deutsche Bank - 2.6% short (about €435m)

- Bayer - 0.7% short (about €420m)

- Infineon - 1.22% short (about €255m)

- Continental - 0.5% short (about €130m)

- thyssenkrupp - 0.89% short (about €90m)

We estimate current total money value of these shorts to be at about €1.33b.

Except for Deutsche Bank short, all AQR's DAX shorts appeared in the second half of the year. The current big Deutsche Bank short has been in place since September 2017 when Deutsche Bank was trading around €14 versus around €8 today (Note that Deutsche Bank is the most shorted DAX member in our records. Total short interest of 4.58% is split as follows: AQR 2.6%, Marshall Wace 1.46%, and Simon's Renaissance Technologies 0.52%).

According to our records, this is the highest number of big shorts in DAX by a single hedge fund since Q1, when more than dozen DAX shorts by Bridgewater appeared. All of Ray Dalio's German shorts were cut under <0.5% in April and never re-appeared. Similarly, all Bridgewater's EU big shorts (Italy, Spain, France, Netherlands, UK,...), were cut latest in July. Interestingly, as of latest disclosures, Bridgewater holds only one big short: OUTOKUMPU OYJ, 0.61% short, that popped up on our radar on 30th of October.

When it comes to current number of big shorts in DAX, behind AQR are:

- Marshall Wace with a 1.46% short position in Deutsche Bank and a 1.4% short in thyssenkrupp, and

- Merian Global Investors with a 0.91% short position in HeidelbergCement and a 0.5% short in Deutsche Boerse.

More about short selling and the biggest short positions in Germany can be found in WELT's article here.

AQR's short portfolio

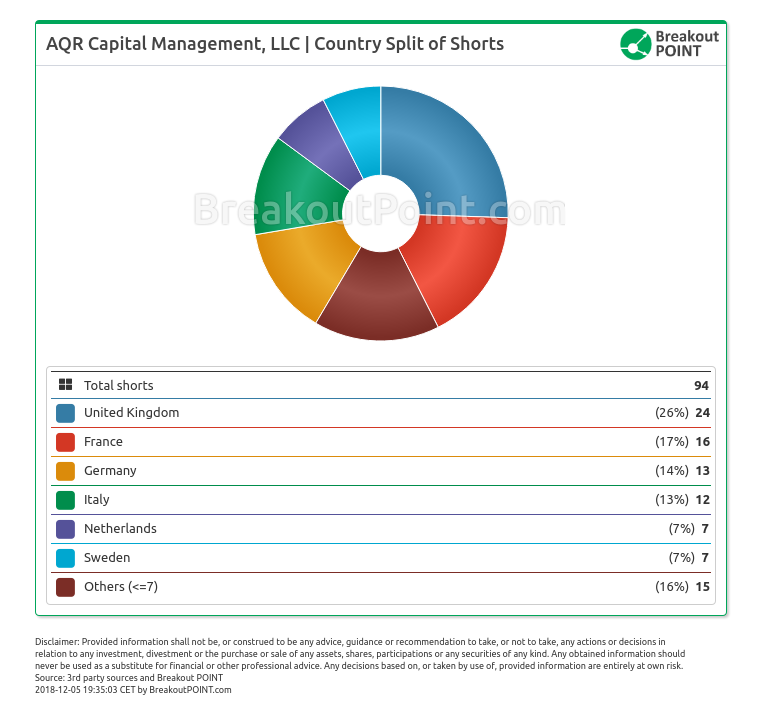

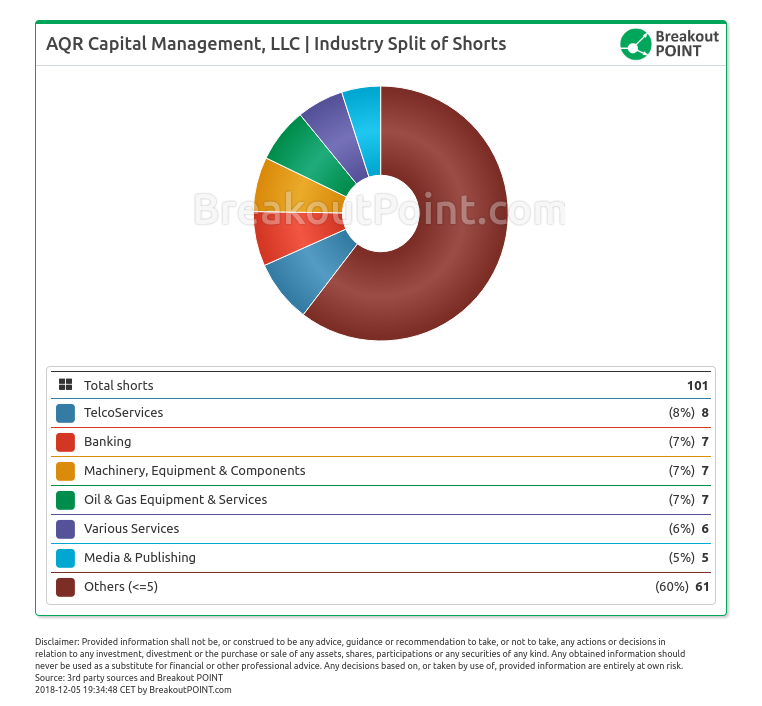

Overall AQR's EU big shorts portfolio appears to be rather well diversified among EU countries, as well as sectors. As comparison, one of the currently most active short sellers in our records, GLG Partners holds about 80% of their shorts in UK.

Know what influential investors and activists do. Cancel anytime. Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.