At the 2018 Sohn London Idea Conference on Nov 29, Kuvari Partners pitched a short of Kier Group, a primarily UK's construction & services business, citing narrowing of margins and aggressive accounting (ref. Sohn Conf Foundation). During the talk, Vikram Kumar, CIO of Kuvari Partners, said he believes the stock could drop by 50% and that he thinks they'll need to raise capital (ref. FT).

Today Kier Group reached target price mentioned by Kuvari and is as much as 50% down vs prior to the Sohn conference. The main contributor to price falls has been Kier's plan to raise cash (ref. The Guardian).

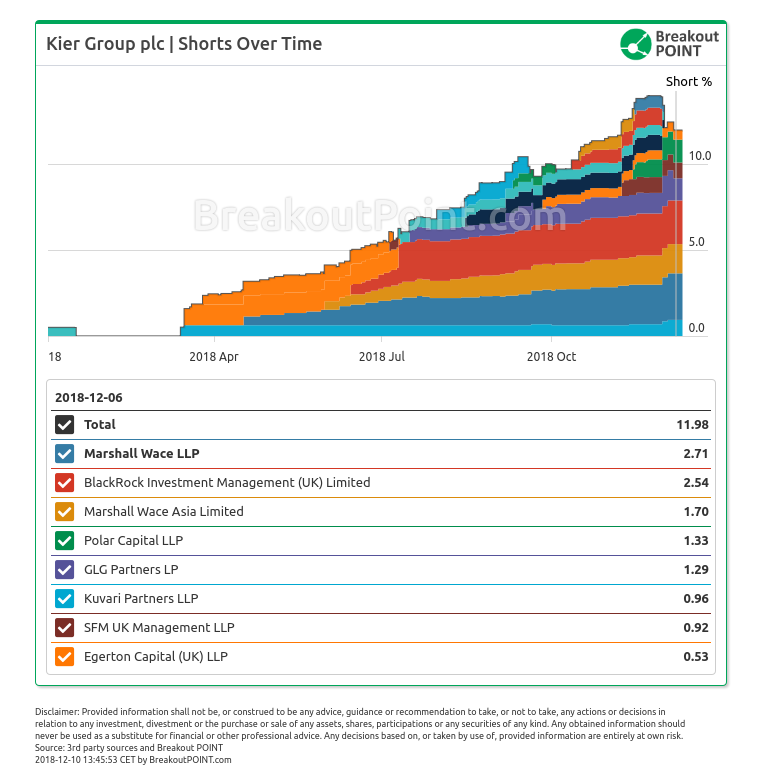

According to our records, Kuvari is the holder of the longest standing short >0.5% ("big short") in Kier Group, and is also one of the hedge funds that benefited the most of the price drop. Kuvari's short has been in place since mid-March 2018, when Kier has been trading at about 1000 vs about 370 today. Besides Kuvari, 7 other hedge funds hold a big short in Kier as of latest short disclosures. Marshall Wace entities hold two of three biggest short positions:

After Sohn conference, Kuvari increased short in Kier from 0.71% to 0.96%. It will be interesting to observe what happens next with this short position, especially having in mind that prices have halved since Kuvari's talk at Sohn conference.

This is currently the only big short of Kuvari in all of our EU records. Kuvari appears only sporadically with big shorts and Carillion is among their previous big shorts.

Discover what influential investors and activists do. Cancel anytime. Sign up for Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.