D. E. Shaw's flagship fund is one of the quant funds that posted double digits returns in 2018 (ref. CNBC). We had a peak at current EU shorts >0.5% ("big shorts") of D.E. Shaw, as well as some of their recently reduced big shorts.*

As of latest short disclosures, D. E. Shaw & Co, LP holds 5 big shorts in EU, with three of them against UK companies.

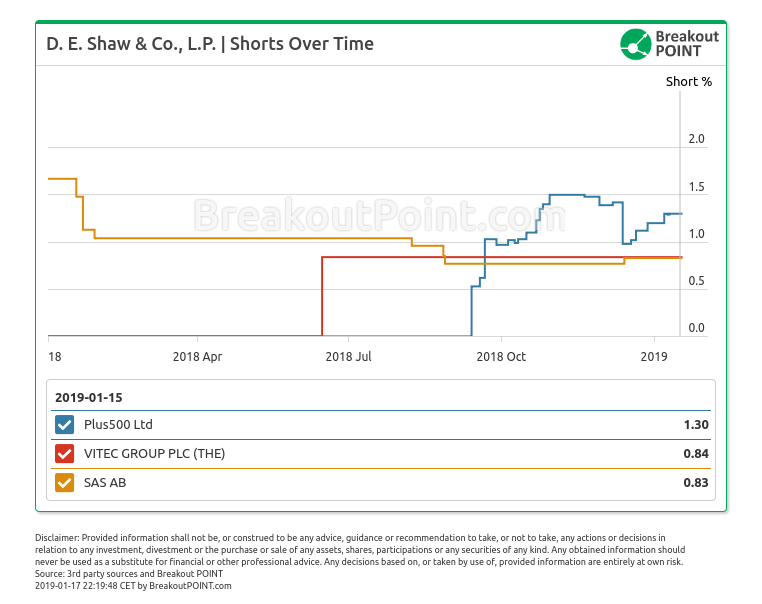

The biggest % short is a 1.3% short in Plus500. Plus500 is a popular target among short sellers and has the highest short interest of all UK companies and 3rd highest in EU, with 12 hedge funds holding big shorts.

In terms of % size, the second biggest EU short position of D. E. Shaw is Vitec Group (0.84%), while the third biggest is SAS AB (0.83%). Currently only D. E. Shaw holds a big short in Vitec Group, while SAS AB is also a big short of BlackRock Institutional Trust Company.

One of shorts that D. E. Shaw recently reduced is a short in Ferrari that first appeared in Aug'18, but was cut under 0.5% in Dec'18. Interestingly, another famous quantitative fund, AQR is the only current holder of a big short in Ferrari. AQR's big short is in place since Mar'18 and, as of latest disclosures, is 1.1% big.

Overall, D. E. Shaw is not among the most active funds in our EU short selling records. In fact, with five big shorts, it is not among top 20 of most active funds. For comparison, we currently count 90 big EU shorts of AQR.

Want to know what big players are short selling across EU? Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.