The biggest Odey's short holding in our records is, as of Friday's close, up about 30% YTD. Still, Odey has been adding to this short in the past weeks.*

One of the most prominent hedge fund bears, Odey, is up more than 50% in 2018, but has a negative 2019 start (ref. FT). We examined Odey's biggest short holdings and looked at Odey's short positions that have been increased or cut so far in 2019.

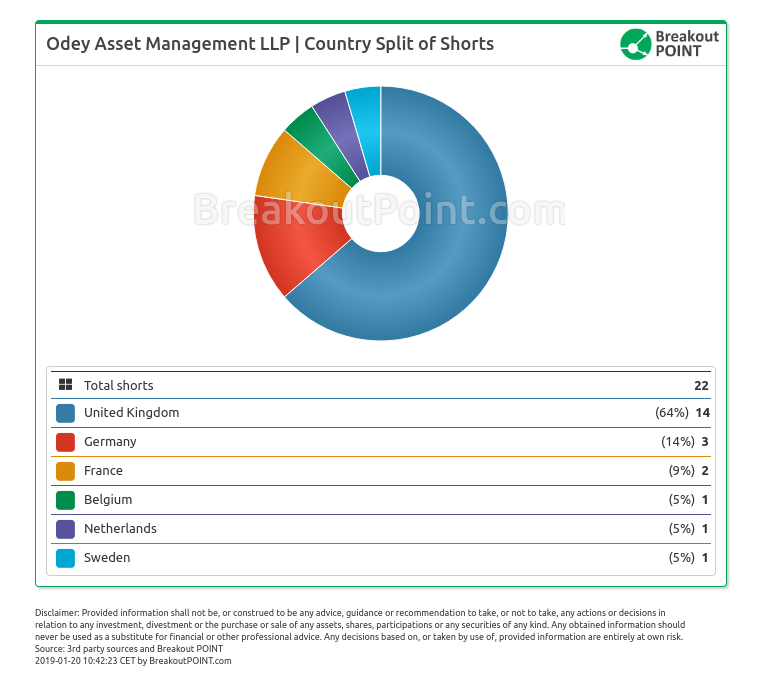

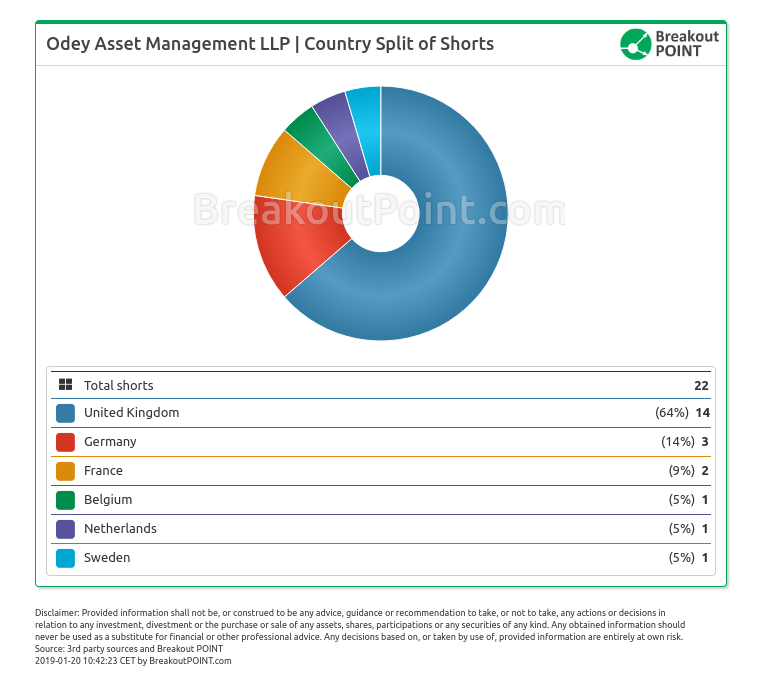

Country and Sector Split of Shorts

As of latest short disclosures, Odey Asset Management holds 22 shorts >0.5% ("big shorts") in EU, with 14 of them against UK companies. Such strong short selling focus on UK is not unusal for Odey and we have observed that in past as well. Our estimates of money values of these 22 big shorts confirm UK focus:

- EU big shorts: total about £660m,

- UK big shorts: total about £480m,

- France big shorts: total about £65m,

- Germany big shorts: total about £50m, and

- remaining big shorts: total about £65m.

Sector split of the big shorts is more balanced than the country split. Considering number of big Odey's shorts top 3 sectors are: Finance (6 big shorts), Consumer Discretionary (5) and IT (5).

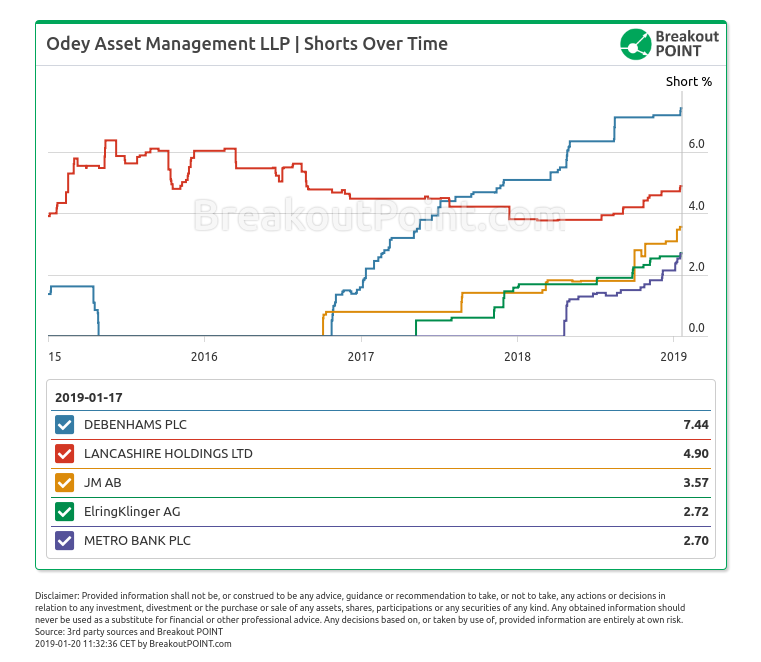

The Biggest Big Shorts

In terms of % size, the biggest Odey's short position remains a 7.44% short in Debenhams. This short has even been increased in 2019 (from 7.21% to 7.44%) and remains, by far, the biggest % short by any hedge fund in all of our European short selling records. Also, a long-term character of some of Odey's big shorts is rather unique compared to other hedge funds. For example, the second biggest % short, a short in Lancashire Holdings, has been continuously in place for more than 5 years, and goes back to September 2013.

When it comes to money value of Odey's shorts, Debenhams is actually among the smallest big shorts with a size of about £3m (market cap < £40m). We estimated the biggest Odey's shorts, out of 22 disclosed shorts, in terms of £ size:

- Metro Bank plc about £58m (stock about +30% YTD)

- Lancashire Holdings ltd about £58m (stock about -3% YTD)

- Ashmore Group plc about £54m (stock about +3% YTD)

- Auto Trader Group plc about £47m (stock about +0% YTD) and

- Eurofins Scientific SE about £46m (stock about +10% YTD).

Interestingly, so far in January, and in spite of stock rise, Odey increased Metro Bank short four times (from 2.15% to 2.70%) and holds by far the biggest short in Metro Bank of all hedge funds. The remaining five short holders kept shorts pretty much unchanged.

Metro Bank has been on our radar throughout 2018 due to increasing short selling interest. Metro Bank is not the only stock with high short interest that had a sharp rise in 2019. For example, the most shorted EU company in our records, Fugro, is up about 21% YTD and we recorded a number of short holders reducing their shorts in 2019 (Note: big shorts interest went from 20.31% to 16.73% since start of the year).

Increasing and decreasing Shorts

So far in 2019, Odey Asset Managment increased short bets against 11 companies, and decreased three short bets.

Short in IG Group was cut four times from 1.27% down to 0.87%, while shorts in ITV and Fresnillo have also been somewhat reduced.

Besides above mentioned short increases in Metro Bank and Debenhams, among notable short increases are JM AB (from 3.1% to 3.57%) and Lancashire Holding (from 4.73% to 4.9%).

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data is as of 2018-18-01.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.