Newcomer hedge fund, D1 Capital Partners ("D1"), put a 0.5% short bet against Adidas on Wednesday. We have not seen a big short (short >0.5%) in Adidas since Ray Dalio's Bridgewater shorted them about a year ago.*

At a market cap of about €43.3b this 0.5% short translates to an about €216m short. The big shorts in Adidas have been rare in the past several years. The highest short selling interest we recorded was back in 2015, when six hedge funds had a big short position in Adidas, including, Odey, Lone Pine and Marshall Wace.

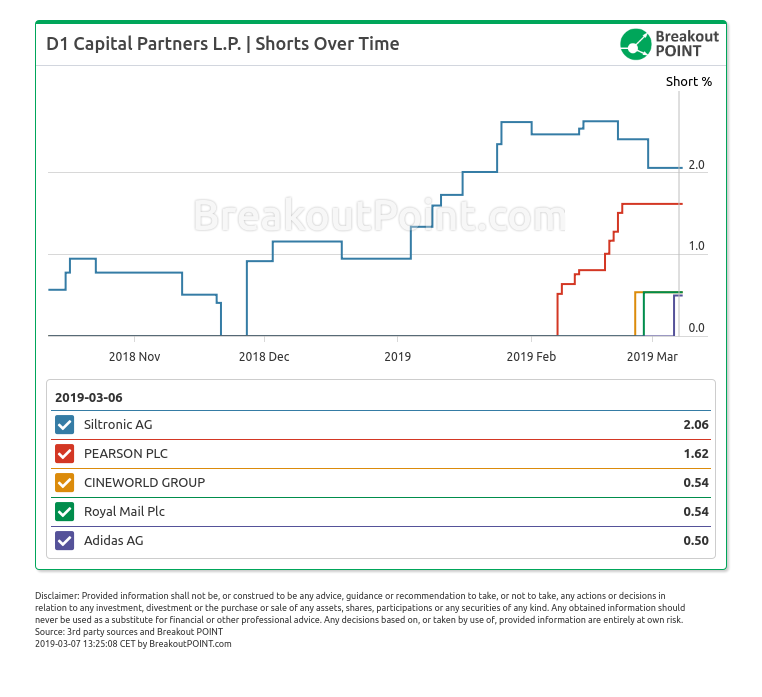

This is a 2nd big short by D1 in a German company. They also hold a 2.06% short in Siltronic that first appeared in October 2018. Also, D1 has recently been quite active on the short selling side in UK and they popped-up on our radar with three new UK shorts during February:

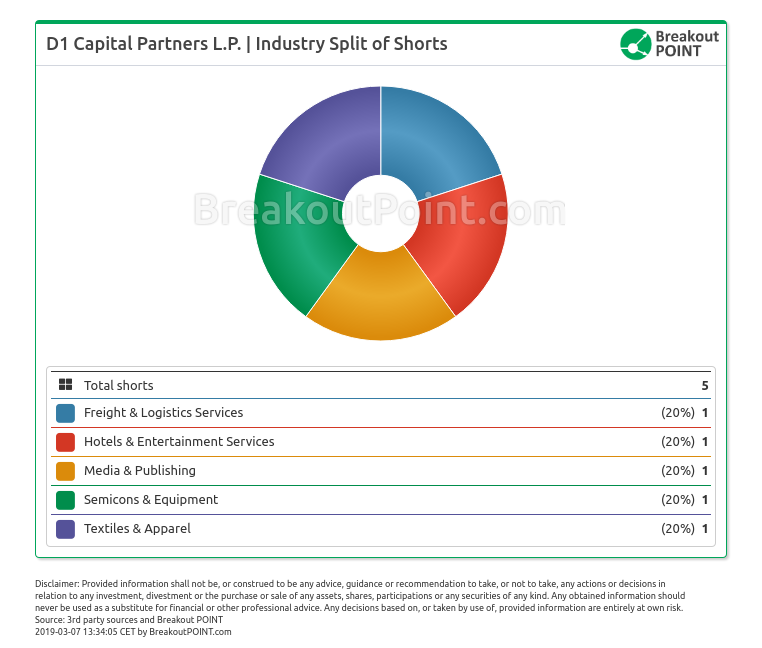

Shorts by D1 in Siltronic (2.06% short) and Pearson (1.62% short) are the biggest short positions in these stocks, and we rarely see that with a newcomer. When it comes to a sector split, three of these five short positions are in Consumer Discretionary companies.

Daniel Sundheim’s D1 Capital Partners is a rather new multi-billion hedge fund and is among WSJ's "The Money Managers to Watch in 2019" (ref. WSJ).

The big shorts in DAX companies are not frequent. However, this week another DAX short appeared: a 0.6% short in Merck KGaA by Marshall Wace on Monday. Beyond this DAX short, Marshall Wace also holds a 0.99% short in Deutsche Bank AG and a 0.5% short in Daimler AG. Interestingly, Marshall Wace has been reducing Deutsche Bank short recently, which was as high as 1.9% in January.

Want to know who and when is shorting DAX companies? Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.