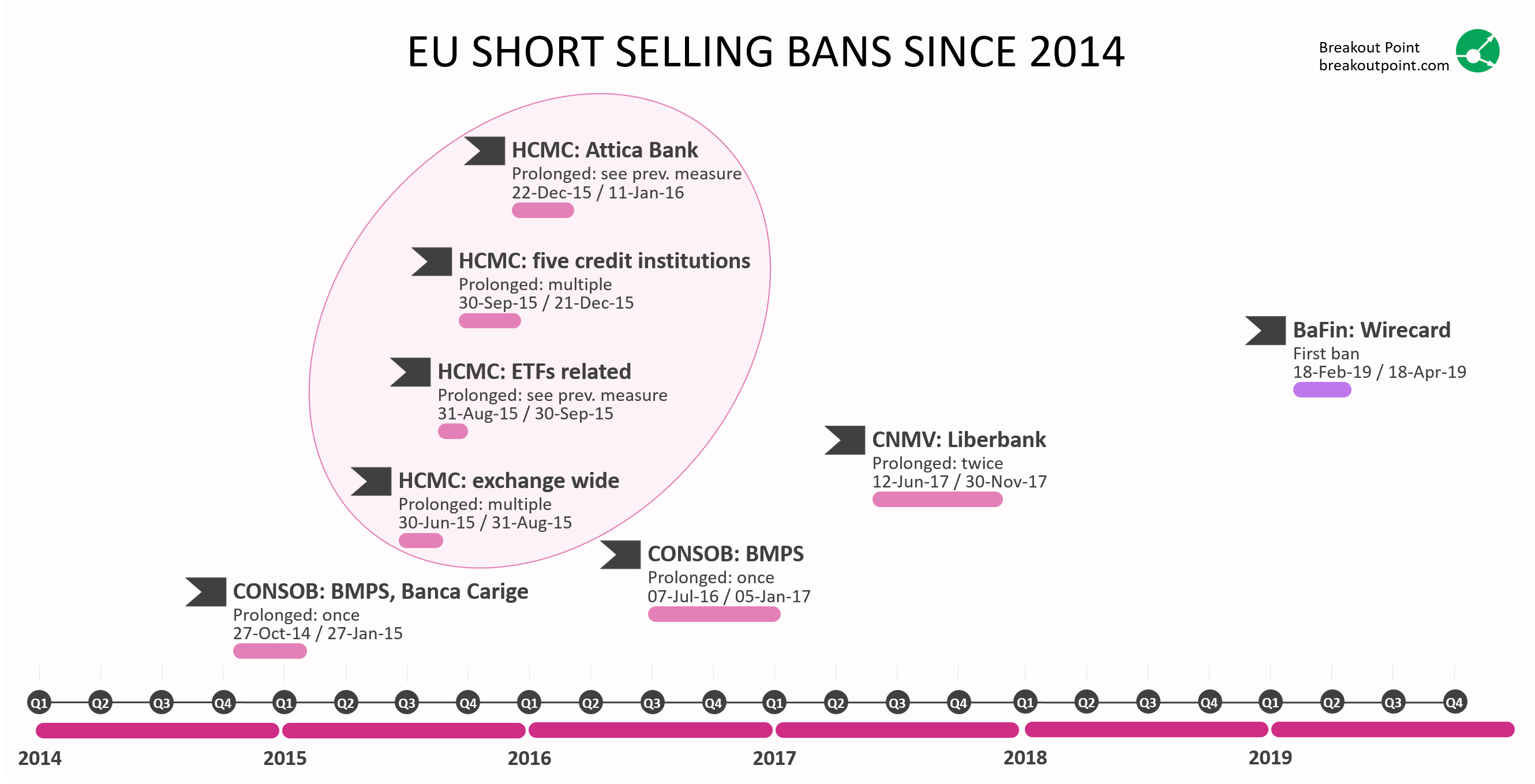

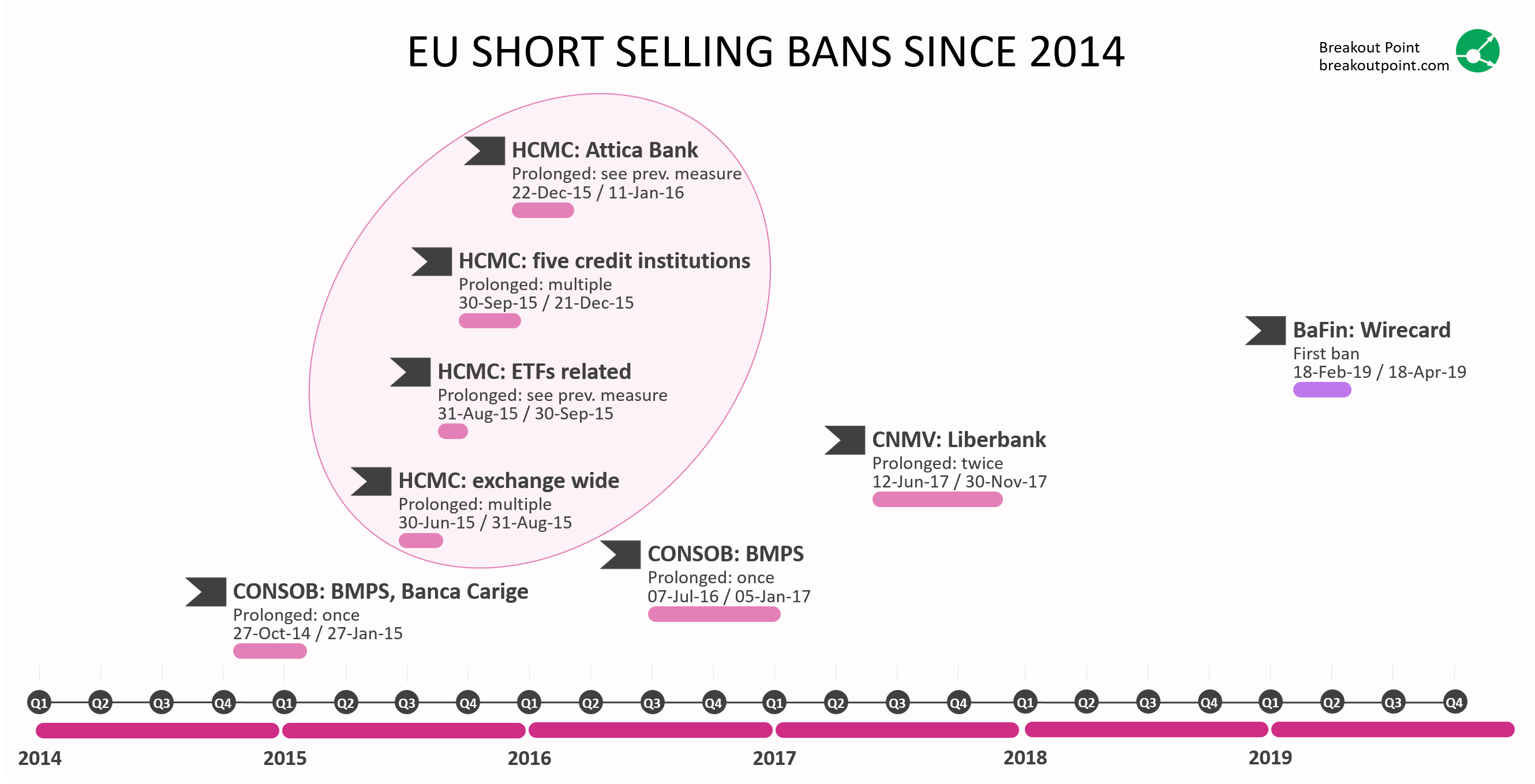

With Wirecard short selling ban expiring on April 18, we looked into all EU short selling bans since 2014 that we could identify. Interestingly, all of analyzed EU short selling bans were extended, in one or other way, at least once.

While each short selling ban was rather unique, it is somewhat indicative that, in all analyzed cases, respective EU regulators renewed the bans once, or even multiple times. Thus, it should not be a complete surprise if such pattern continues. For example, when it comes to previous two short selling bans:

- Short selling in Liberbank (CNMV, Spain) was initially banned for period 12 Jun 2017 - 12 July 2017, and subsequently extended twice. The first time until 12 September 2017 and the second time until 30 November 2017.

- Short selling in BMPS (CONSOB, Italy) was initially banned for period 7 July 2016 - 5 October 2017 and then prolonged once until 5 January 2017.

In terms of number of short selling ban extensions, Greece stands out: initial exchange-wide short selling ban from 30 June 2015 was extended five times, then, immediately after that, an alternative emergency measure (ETF-related short selling ban*) was implemented. This was followed by a short selling ban in five credit institutions, which also got extended a couple of times. Finally, from five credit institutions, the short selling ban was reduced to only one, Attica Bank, and measure came to an end in January 2016 with ESMA issuing a very rare negative opinion on the renewal of the short selling ban in Attica Bank. This is the only such negative opinion by ESMA that Breakout Point came across during our evaluations.

Reasons for renewals of emergency measures

Short selling ban in Wirecard entered into force on 18 February and is applicable until 18 April. After that, the ban will be lifted or extended. We briefly look at factors that EU regulators considered when facing similar situations in the past.

Depending on the market conditions the emergency measures can be extended and have been extended in the past. In addition to specific fundamental conditions (e.g. related to plan for reduction of NLP / total loans ratio in case of BMPS in 2016), also conditions related to share price and short selling are often looked at. Without ambition to provide a comprehensive list of possibilities for the latter, here are several that we encountered:

- Share price: How did price of shares develop during the ban? How does this compare to performance of the relevant (national or sector) index? How does the performance during the ban relate to share price declines prior to the ban?

- Volatility: How high is volatility? How does it compare to the volatility of the similar shares and to the historical volatility preceding relevant events?

- Short interest: What happened to the short interest during the ban? By how much did it decline?

- Borrow activity: What happened to the number of borrowed shares during the ban? Big increase of shares borrowed could indicate significant borrow with intention to short sell immediately after the ban is lifted.

Update (media mentions of this note): Precedent suggests Wirecard short ban will be extended | GlobalCapital

Don't want to miss the latest big shorts by your favorite funds? Join Breakout POINT. Access data and our analytics.

* Note: This particular emergency measure has not been extended, but it represents a direct continuation of the previous measure.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.