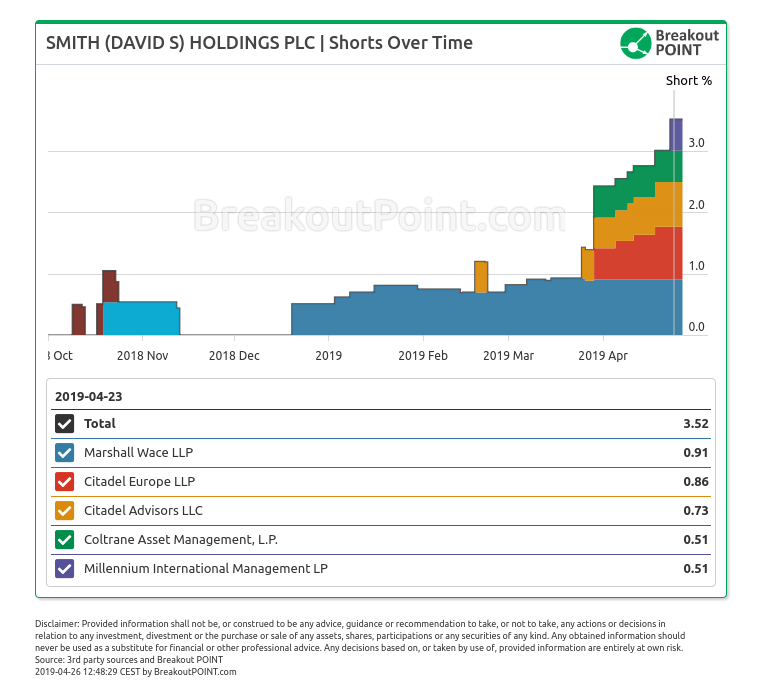

Coltrane Asset Management, Millennium International Management and two Citadel entities have recently popped-up with shorts > 0.5% ("big shorts") in DS Smith Plc.*

Five big shorts in packaging company, DS Smith Plc, combine for a 3.52% short interest, as of the latest disclosures. This is both the highest number of individual big shorts and highest % short that we, so far, recorded for this company. At a market cap of about £5 billion, these five short positions correspond to an about £176 million aggregate short.

The latest big short that (re)appeared is Millennium's big short (0.51% short) on 2019-04-23. Millennium was also holding a big short back in 2017, while, according to our records, Coltrane and Citadel did not have big short bets against DS Smith prior to 2019.

Two of the five big shorts are held by Citadel entities: Citadel Europe LLP a 0.86% short and Citadel Advisors LLC a 0.73% short. Interestingly, these are not the only big short positions in this sector by Citadel. They also hold two big shorts in Mondi Plc (market cap about £8.3 billion): Citadel Europe LLP a 0.52% short and Citadel Advisors LLC a 0.5% short. If one counts both Citadel entities together, Citadel holds an about £85m short in Mondi and an about £80m short in DS Smith.

Don't want to miss the latest big shorts by your favorite funds? Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 2019-04-25.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.