Marshall Wace bets more than €150m against three online food-delivery companies. Three Marshall Wace’s targets, Delivery Hero, Takeaway.com and Just Eat, are also in short selling focus of several other hedge funds.*

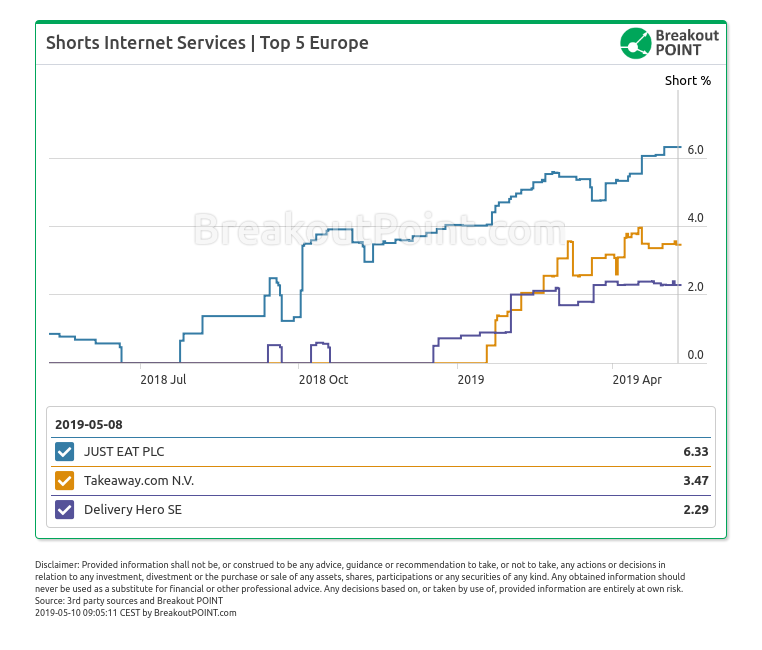

As of the latest disclosures, seven funds hold a big short (short > 0.5%) in Just Eat, five in Takeaway.com, and three in Delivery Hero. This is unlike one year ago, when the only active big short in any of these three stocks was a 0.86% Just Eat short by a well-known quant fund, AQR Capital.

We estimated total money values of disclosed shorts in these three stocks at around €670m. Three biggest short holders are: Marshall Wace (3 shorts, around €158m), AQR Capital (2 shorts, around €122m), Platinum Investment Management (1 short, around €78m).

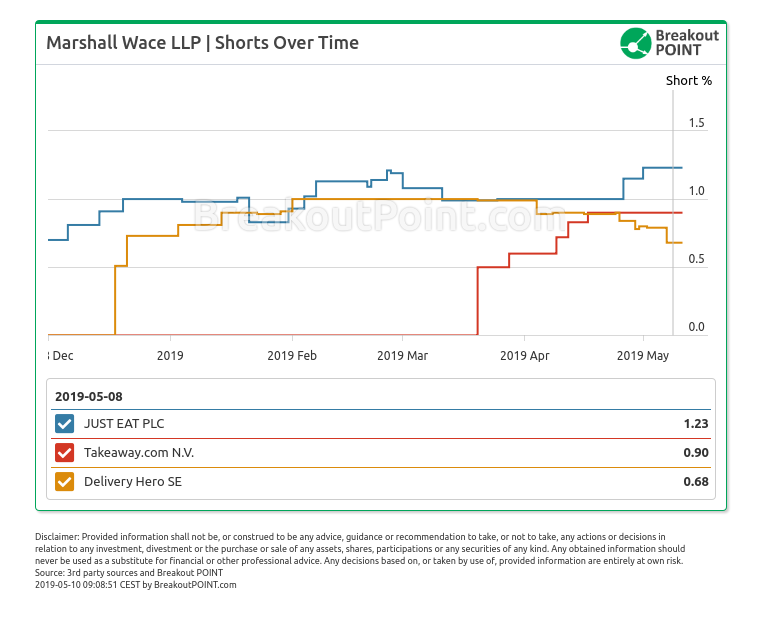

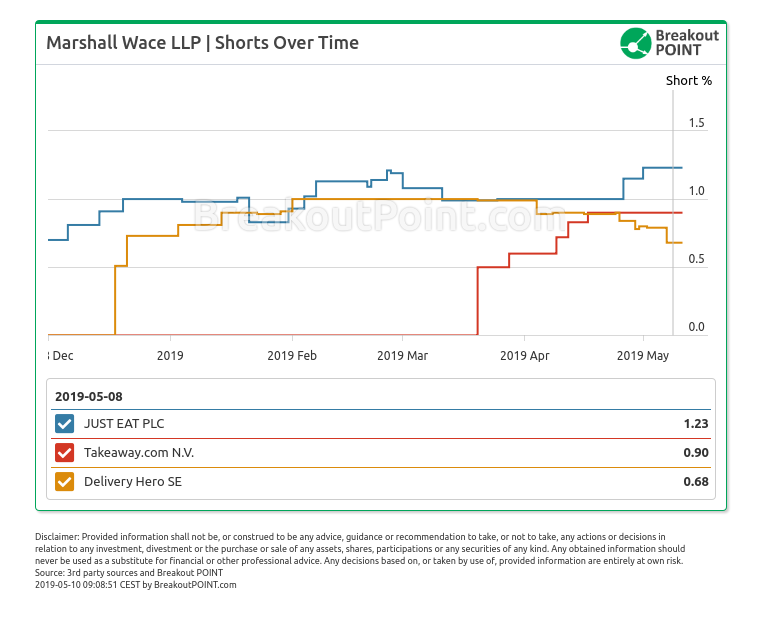

Marshall Wace is the only short seller with big shorts in all three stocks. Their big short in Takeaway.com appeared on 20 March and and is the biggest short in this stock (0.9% short, about €40m). Marshall Wace holds the second biggest short in Delivery Hero (0.68% short, about €53m) and Just Eat (1.23% short, about €65m).

Interestingly, by far the biggest short holder in Just Eat is Platinum Investment Management with a 1.46% short (about €78m). This is not only the biggest individual short in terms of percent and money value among three considered stocks, but is also, currently, the only big short in our records of Platinum, a fund that rarely pops-up in our records.

Don't want to miss the latest big shorts by your favorite funds? Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 2019-05-09.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.