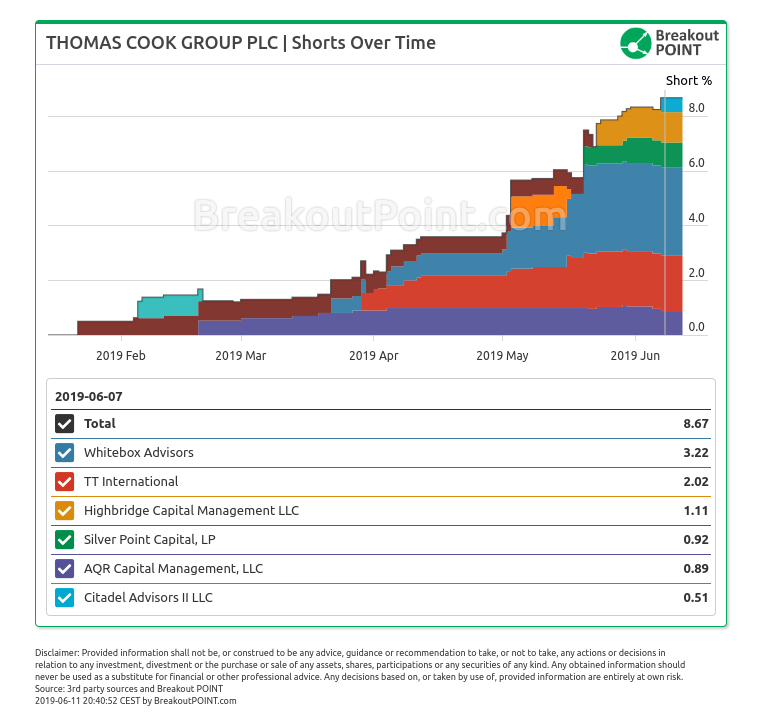

In spite of recent 140% rise in Thomas Cook Group stock prices, so far, we noted little reduction in the biggest short positions.*

Thomas Cook stock price moved from a low of 8.33p on May 20, to as much as 20p on June 10, resulting in as much as +140% from May lows (ref. investing.com).

During the recent rise, AQR Capital somewhat reduced their short (three reductions, overall from 1.11% to 0.89% short), while Silver Point Capital and Highbridge Capital increased their shorts.

Citadel appeared with a new 0.51% short on 2019-06-07, pushing the overall short interest to 8.67%, the highest levels we ever recorded for this stock.

Capital Fund Management cut their short below 0.5% on May 21, the day when prices were approximately in 10-12p range. Prior to that, Capital Fund Management's short was continuously above 0.5% since January 22. Having in mind that Thomas Cook Group closed around 38p on January 22, stock prices declined about 70% during the holding period of this big short.

According to Breakout Point records, Thomas Cook is the most shorted stock in Hotels & Entertainment Services sector in EU and, also, had the highest increase of % short interest among UK stocks in 2019.

Thomas Cook was in focus of media in the past days after they were approached by China’s Fosun (ref. The Guardian) and after "could double or go to 0p" by analyst at Barclays (ref. Reuters).

Don't miss latest UK short selling trends. Sign up for Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 2019-06-11.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.