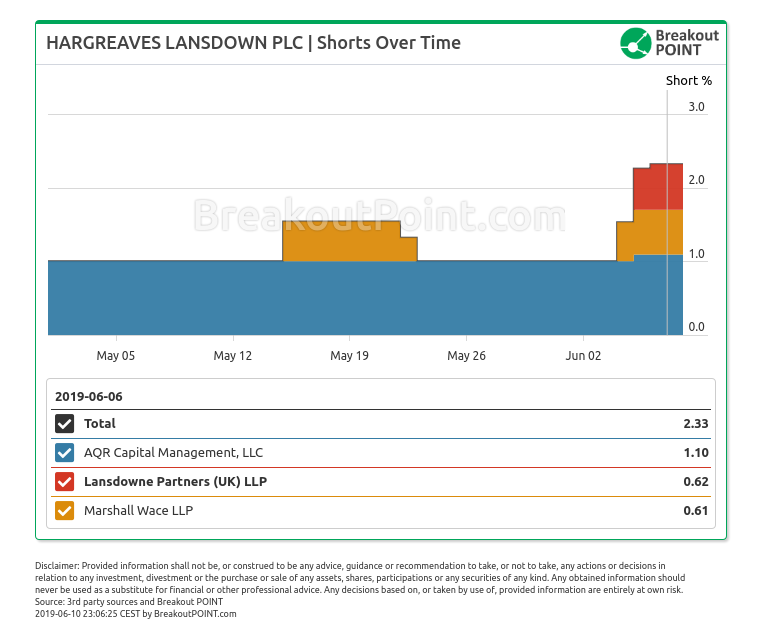

Three hedge funds hold big shorts (shorts > 0.5%) in Hargreaves Lansdown. All three increased their shorts last week.

A total of 2.33% short interest (about £211 million short at a market cap of £9.07 billion), is split among: Lansdowne Partners (0.62% short, about £56 million), Marshall Wace (0.61% short, about £55 million) and AQR (1.1% short, about £100 million).

The big short of Lansdowne Partners was initiated last week on Thursday and this is the first time that they appear in our records with a big short in Hargreaves Lansdown. Masrhall Wace and AQR both increased their big shorts last week.

Last week a potential withdrawal halt in Hargreaves Lansdown was speculated, in relation to Woodford suspension (ref. The Telegraph).

We estimated, last week, about £1 billion in big shorts in stocks that are among reported holdings of Woodford funds. Following redemption requests, Woodford Investment Management has been reducing a number of their investments (ref. ZeroHedge). Simultaneously, we noted that short positions in a number of related stocks have been added and/or increased last week. A few examples:

- a first ever big short in Burford Capiital was disclosed, a 0.5% short (about £17 million short at a market cap of £3.93 billion) by Gladstone Capital Management LLP, while

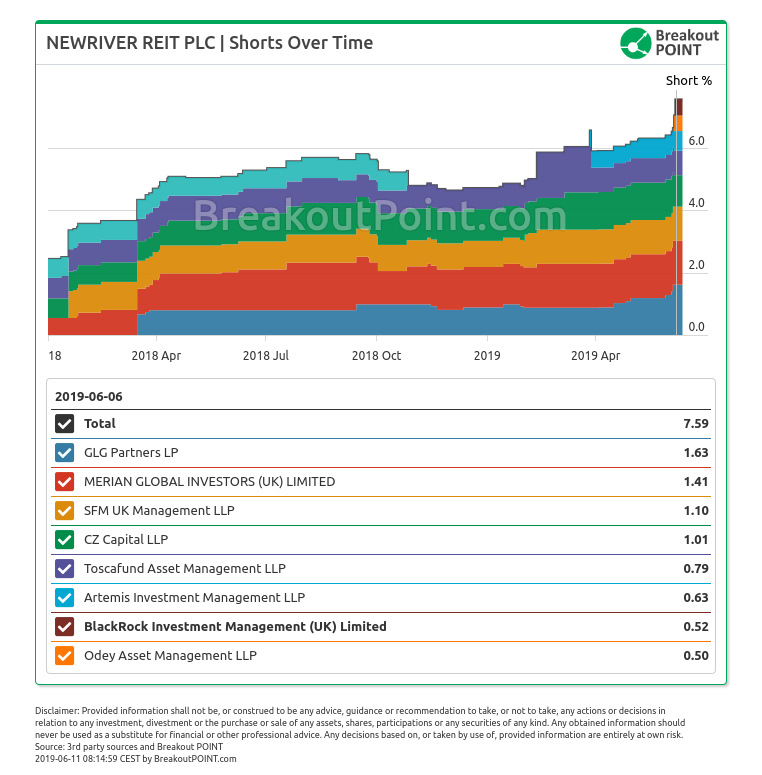

- Odey and Blackrock emerged with big shorts in Newriver REIT, pushing the overall short interest to new all time highs in our records.

Don't want to miss the latest big shorts by influential hedge funds? Join Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 2019-06-10.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.