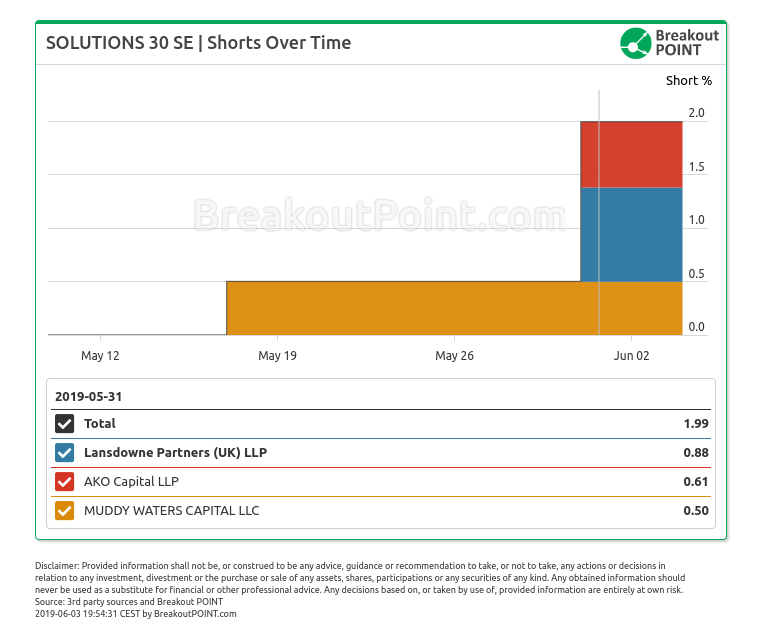

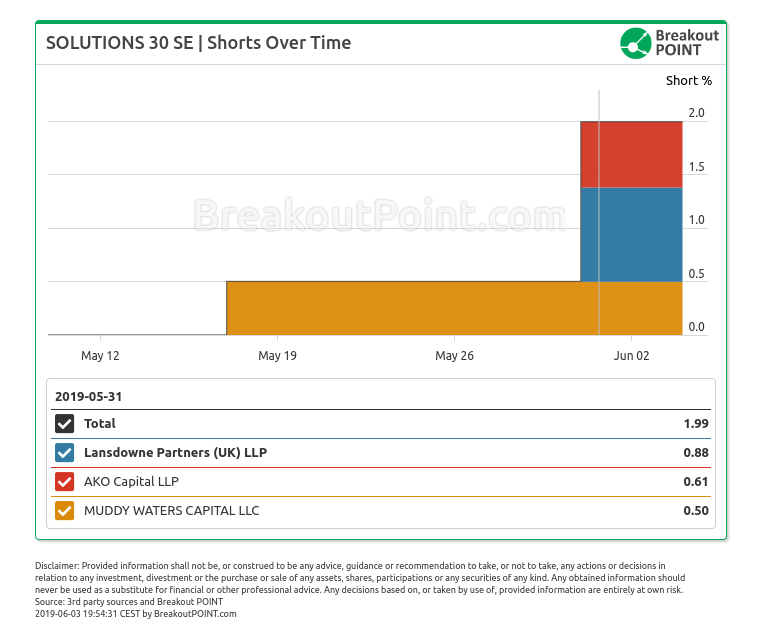

After Muddy Waters Capital LLC, two more hedge funds popped-up with a short > 0.5% ("big short") in French company Solutions 30.*

As of the latest disclosures, AKO Capital has a 0.61% short and Lansdowne Partners has a 0.88% short in Solutions 30. At a market capitalization of about €915 million, these shorts translate to about €5.5 million and €8 million. Both shorts appeared on the last trading day of May, on 2019-05-31.

When it comes to further shorts in EU IT Services & Consulting sector, AKO Capital also holds a 1.3% short in Danish Netcompany Group, while Lansdowne Partners holds a 0.98% short in Spanish Amadeus IT Group. Accoridng to our records, Lansdowne Partners holds two more big shorts in France, one of which is a 1.44% short in Rallye, while AKO Capital has four more big shorts in France.

Muddy Waters Capital LLC put a 0.5% short position in Solutions 30 on May 17. This position was reported during the weekend by the French financial regulator, the AMF. Following this disclosure, share price dropped more than 30% on intraday basis on Monday, May 20 and closed about 25% lower on the same day (ref. Business Insider). On May 17, Solutions 30 closed at €12.2, while on June 3 it closed at €8.8. This translates into a drop of about 27.8% during the observed period.

Muddy Waters Capital LLC short position marked the first time that we recorded a short >0.5% in Solutions 30.

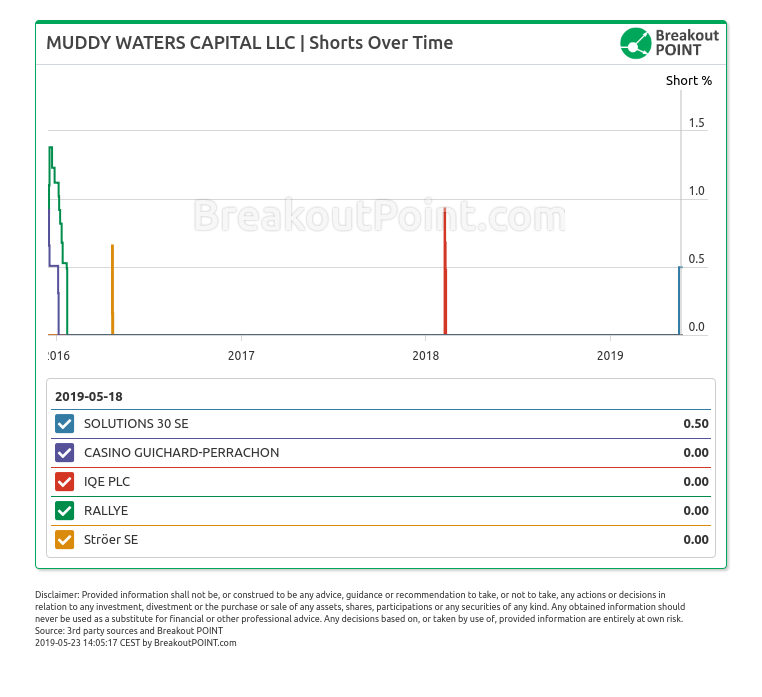

Muddy Waters Capital appears rarely in our EU short selling records. Previously, Muddy Waters Capital popped-up with short positions in IQE, Stroer, Casino Guichard-Perron and Rallye. Positions in IQE and Stroer were quickly reduced:

- a 0.93% short in IQE appeared on 2018-02-07, but was reduced to 0.68% on 2018-02-08 and then to 0.48% on 2018-02-09, and

- a 0.66% short in Stroer appeared on 2016-04-20, but was reduced to 0.16% on 2016-04-21.

Short positions in Casino Guichard-Perron and Rallye were held above the disclosure threshold for several weeks in the period Dec'15-Jan'16.

Muddy Waters briefly commented on Twitter about their Solutions 30 short position (see on Twitter here and here).

Solutions 30 issued a press release on May 20, taking notice of Muddy Waters Capital LLC short position and reaffirming its confidence in its activities and business model (ref. GlobeNewswire).

Don't want to miss the latest big shorts by Muddy Waters Capital and other influential funds? Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 2019-06-03.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.