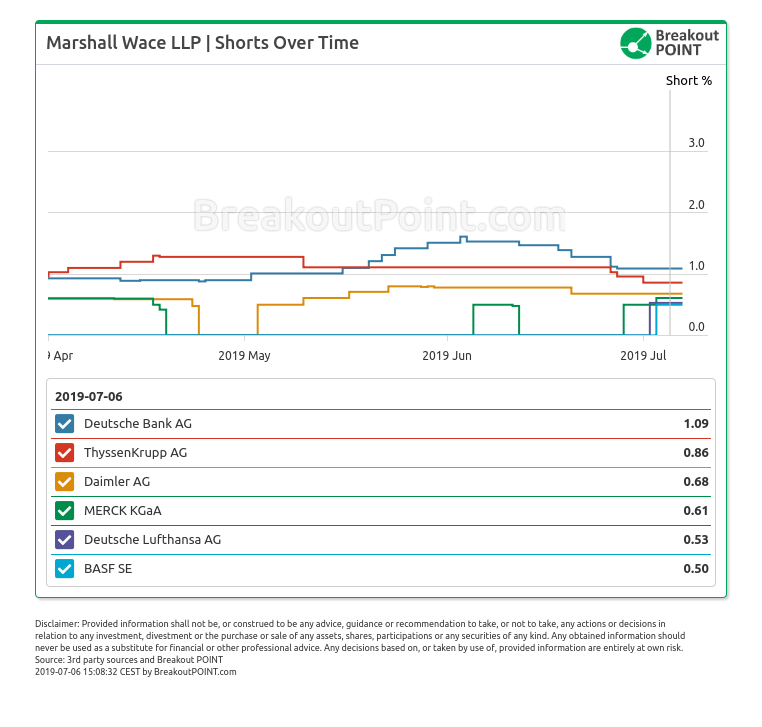

TL; DR: An about €287m short in BASF is the latest big short (short >0.5%) by Marshall Wace against DAX stocks. They currently hold about €1.1.6b in their six big DAX shorts. According to our records, since Bridgewater in Q1-2018, no one had so many big DAX shorts.*

Discover latest short selling trends by Marshall Wace now. Sign up for Breakout Point!

A 0.5% short in BASF on 2019-07-03 is the latest big short by Marshall Wace in Germany. At a market cap of about €57.5b, this 0.5% short translates to an about €287m short.

Short positions above €200m are very rare in our records and this is the first time that Marshall Wace appears with a big short in BASF. We have not seen a big short in BASF since Dalio's Bridgewater shorted it along a number of other DAX stocks in Q1-2018.

With 27 big shorts Marshall Wace is by far the most active short seller in Germany. This is much higher than 17 German big shorts we noted a year ago for them. With about €1.16b in six DAX shorts Marshall Wace also has the highest number of big bets against stocks from the German main stock index:

- Daimler AG 0.68% short, about €357m at a market cap of €52.55b,

- BASF SE 0.50% short, about €288m at a market cap of €57.5b,

- MERCK KGaA 0.61% short, about €252m at a market cap of €41.3b,

- Deutsche Bank AG 1.09% short, about €161m at a market cap of €14.8b,

- Thyssenkrupp AG 0.86% short, about €65m at a market cap of €7.6b, and

- Deutsche Lufthansa AG 0.53% short, about €39m at a market cap of €7.3b.

When it comes to EU Chemicals sector, Marshall Wace holds about €462m in four big shorts, which is higher number of shorts than any other fund in this sector.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 2019-07-05.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.