TL; DR: Kier Group more than doubled in value since a multi-year low on July 31. Kier is the most shorted stock in all of our UK short-selling records.*

As of this morning, Kier is up as much as 136% versus a multi-year low that it reached on July 31 (ref. Investing.com). Rise of the share prices coincides with the news that Kier is in talks to sell its house building business (ref. City A.M.)

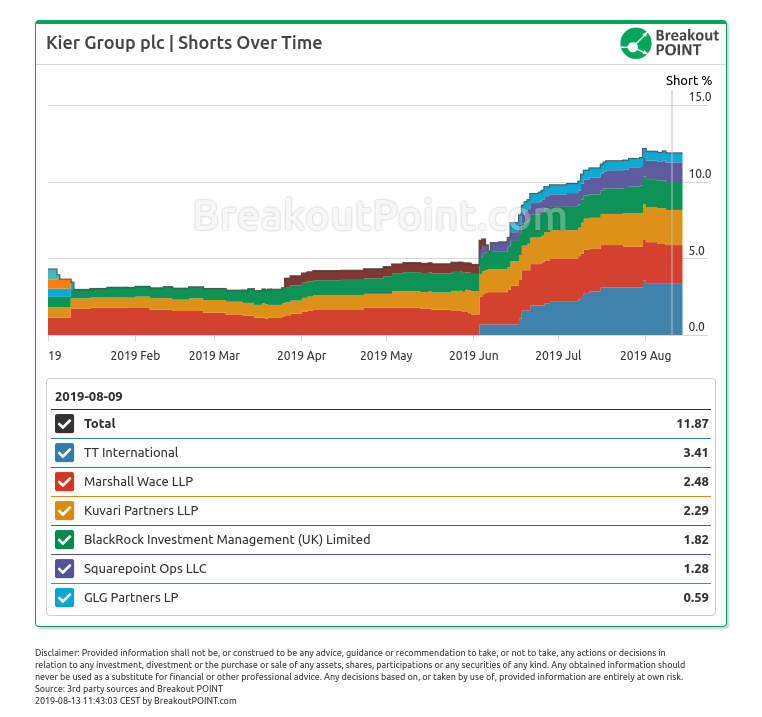

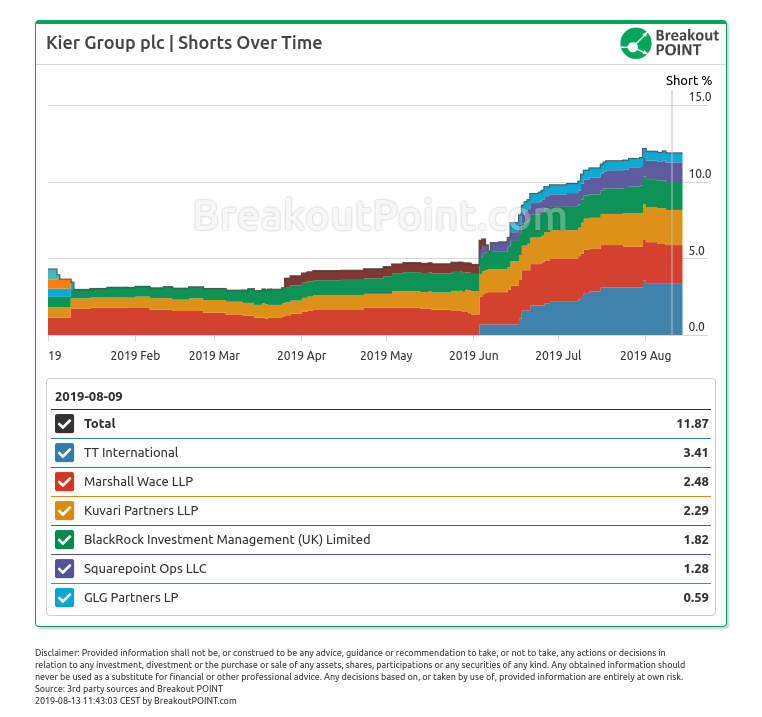

With disclosed short interest in Kier at 11.87%, Kier is, in Breakout Point's records, both:

- the most shorted UK stock, and

- the most shorted in all of EU construction and engineering sector.

Six hedge funds (HFs) hold a big short (short >0.5%) in Kier Group. Three of these short positions have been continuously around since H1-2018: by Kuvari Partners, HF that also pitched Kier short at Sohn Conference in London last year; by BlackRock Investment Management (UK) Ltd; and by Marshall Wace.

With a short position at 3.41%, TT International holds the biggest short position in Kier Group. Their big short popped up on 2019-06-03 and they added to this short a number of times since. On 2019-06-03 Kier stock closed at 163.8, while this morning, it traded as high as 137.9 (ref. Investing.com).

Get 15% off in August with code "sgCWZyYs" (limited availability). Join Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 10:00 UTC on 2019-08-13.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.