TL; DR: Egerton Capital profited from yesterday's 20.22% drop of NIO Inc stock by having a 0.52% short position. This is the only disclosed short position in NIO Inc in our records, thus, potentially making Egerton Capital the biggest winner of the plunge.*

- UK's Egerton Capital is up estimated $3m on Tuesday with their short position in NIO Inc;

- Egerton Capital (UK) LLP disclosed a 0.52% short in NIO Inc dated 2019-09-23;

- This is the very first time that a hedge fund (HF) discloses a big short (short > 0.5%) in NIO Inc. Meaning also that, according to the public disclosures, this HF, potentially, profited the most from the plunge of NIO stock;

- Timing by Egerton Capital could hardly be any better. China's Tesla competitor, NIO closed 20.22% lower yesterday, on 2019-09-24, following a larger-than-expected quarterly loss reported (ref. Yahoo! Finance);

- Yesterday's price drop translates to an estimated gain of about $3m for Egerton Capital, assuming that they did not reduce their short position;

- NIO Inc has been in significant short-selling focus and more than 20% of float have been recently reported short (ref. WSJ). However, no other HF reported a short position as big as Egerton Capital.

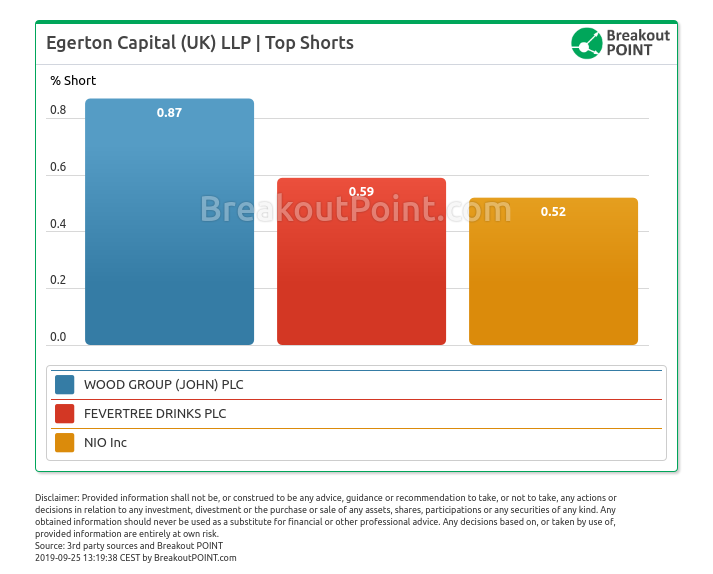

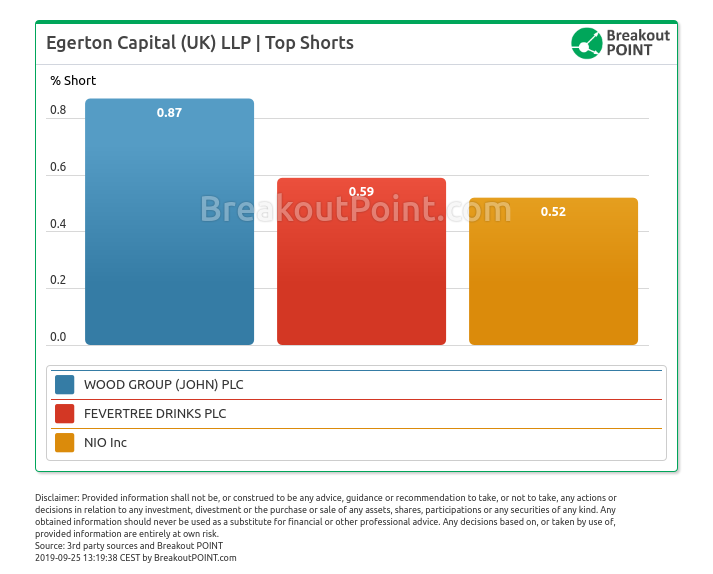

- Egerton Capital is not among the most active short-sellers in our records. According to our analysis, besides NIO short, they also hold big shorts in two UK's firms, Fevertree Drinks and John Wood Group:

Get short-selling insights. Sign up for Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. „Big short“ refers to a short position above 0.5% of company issued capital. Presented data and analytics is as of available on 2019-09-24.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.