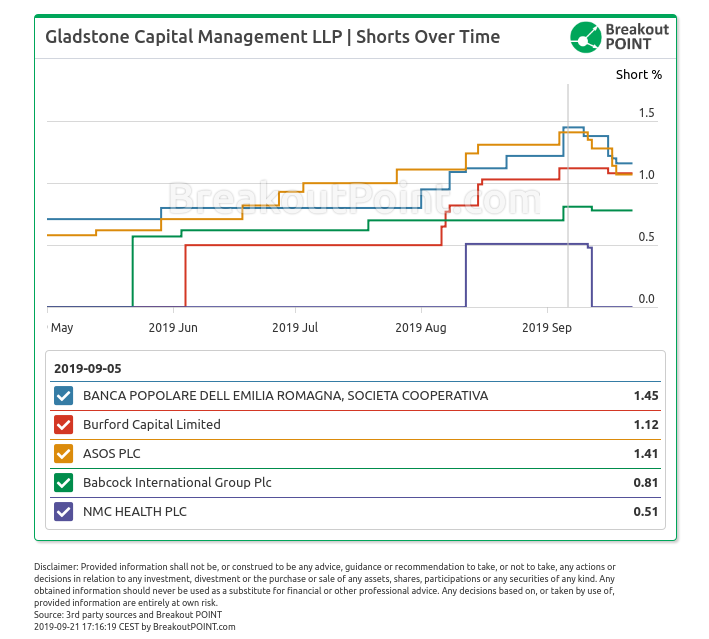

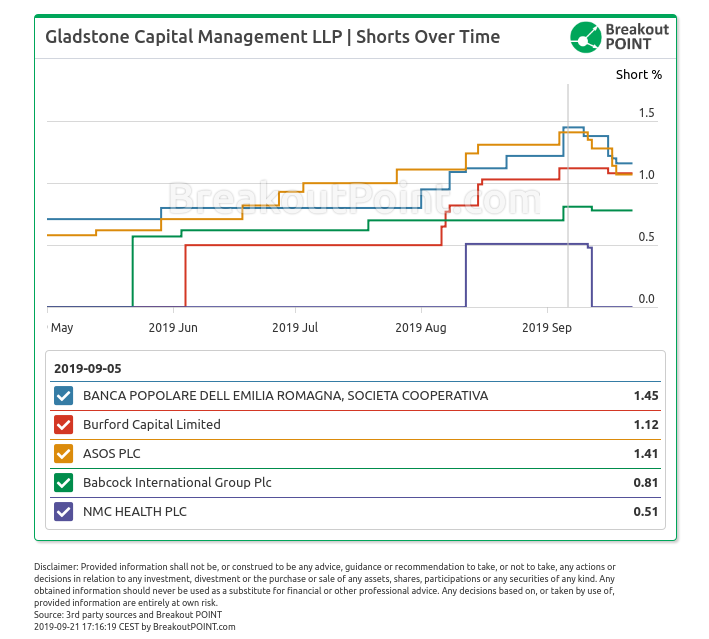

TL; DR: Gladstone Capital has been reducing almost all of their EU big shorts in the past two weeks. This is in strong contrast to previous 3-4 months, during which we, almost exclusively, noted many increases in Gladstone's EU short positions portfolio*

Since September 6, we noted twenty short position reductions and no increases in the big shorts EU portfolio of Gladstone Capital. We rarely observe such rather synchronous activities across a short portolfio of a single hedge fund.

For example, short position in UK's online fashion retailer, ASOS has been cut four times starting on 2019-09-11 and short position went from 1.41% to 1.07%.

Ten of eleven Gladstone Capital's short positions, in our EU records, have been reduced. The only exception is their 0.72% short in Österreichische Post that has not been changed since 2019-08-01. Three big shorts have been cut below disclosure threshold in September, while eight are still above it. Short portfolio remains rather balanced, both country-wise and sector-wise, with three bets against UK firms, and two each in: EU Banking and EU Machinery, Equipment & Components sector.

Notably, Gladstone Capital is still holding the biggest short in Burford Capital. Burford was in focus of two recent activist short reports by: ShadowFall in July (down about 51% vs prior to the report) and Muddy Waters in August (down about 28% vs prior to the report). Gladstone's short in Burford first appeared in June, long before activist short-sellers reports, and, according to our records, was reduced for the first time on 2019-09-16, after seven consecutive increases.

Interestingly, two well-known European hedge-funds have also been reducing many of their big EU shorts in the past weeks, but to a somewhat lesser extent than Gladstone Capital.

Recent development of Italian and UK big shorts of Gladstone Capital:

Get short-selling insights. Sign up for Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. „Big short“ refers to a short position above 0.5% of company issued capital. Presented data and analytics is as of available on 2019-09-20.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.