TL; DR: Kier Group and Thomas Cook Group top our list of most shorted UK stocks. TT International holds the biggest short positions in both these stocks.*

Two UK stocks with the highest short interest in our records are: Kier Group (short 11.4%, split among 6 HFs) and Thomas Cook Group (short 10.33%, split among 6 HFs). Both stocks declined more than 85% vs one year ago. Especially profitable were shorts by three persistent Kier short-sellers that are continuously holding a short > 0.5% in Kier for more than a year. These are: Marshall Wace, BlackRock Investment Management (UK) Ltd and Kuvari Partners, a HF that also pitched this short at Sohn Conference in 2018.

Interestingly, TT International is a HF that is betting the most against both: Kier (3.56% short position) and Thomas Cook (3.7% short position). We noted a particular build-up in these two negative bets since Q2-2019.

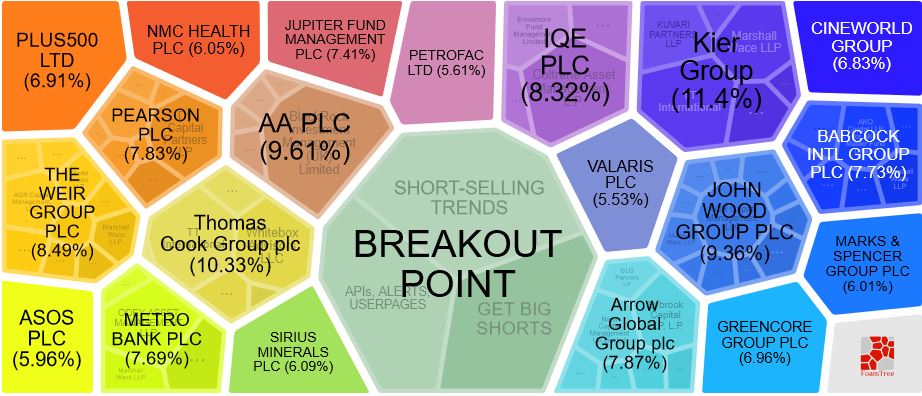

Top 20 UK stocks with highest short interest in our records (Note: % short interest is given in brackets):

Most notable short interest increases vs one year ago (for top 20):

- Thomas Cook Group, short interest from 0.6% to 10.33%,

- Jupiter Fund Management, short interest from 2.11% to 7.41%, and

- NMC Health, short interest from 0% to 6.05%.

Most notable short interest decreases vs one year ago (for top 20):

- Marks and Spencer Group, short interest from 10.46% to 6.01%,

- Greencore Group, short interest from 9.38% to 6.96%, and

- IQE, short interest from 11.04% to 8.32%.

Gladstone Capital holds a 1.03% short in Burford Capital. This is the only short position above 0.5% in Burford Capital, company that was in focus of recent activist shorts reports by ShadowFall (July) and Muddy Waters (August).

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. Presented data and analytics is as of available on 20:00 UTC on 2019-09-02.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.