- One European asset manager has recently been very active in boosting their bets against EU shopping centres.

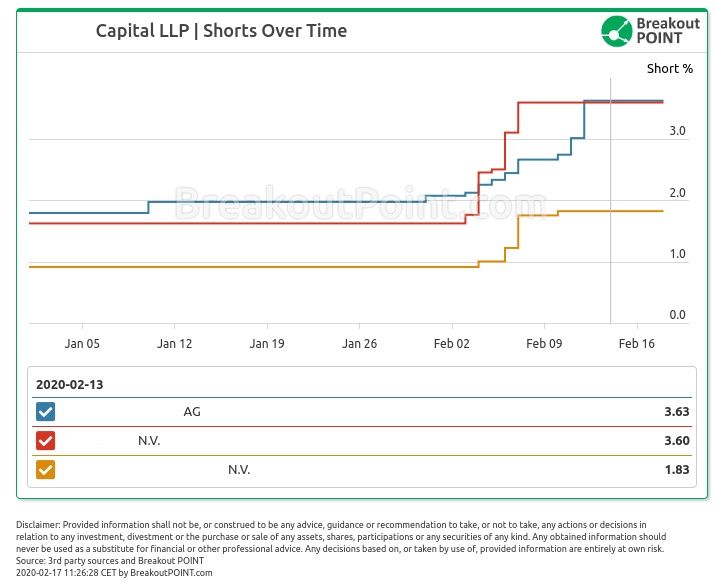

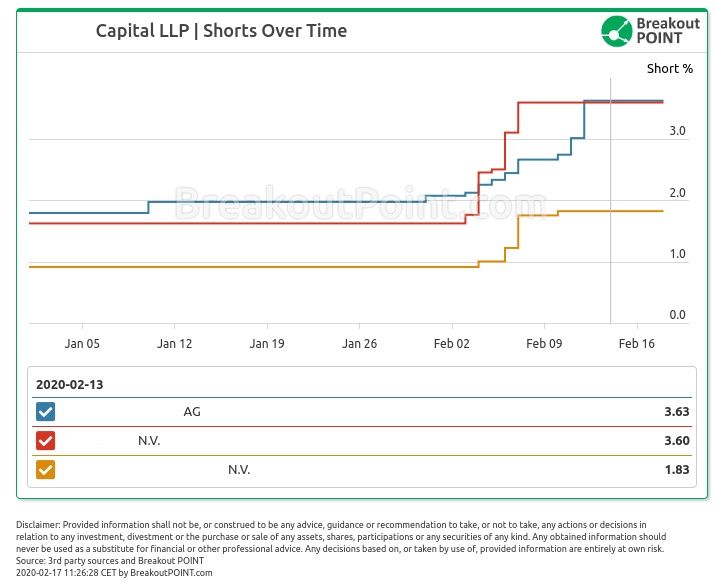

- So far in February, we recorded 17 increases across three sector big shorts by this asset manager. While two of the short positions were approximately doubled, third has been increased by about 50% in terms of % short interest.

- This asset manager is not lonely in their negative view. Whooping 15 entities are holding a big short in one Netherlands-based REIT with one of the main focuses on shopping centres. With short interest above 19%, this is currently by far the most shorted stock in our Netherlands records. We also noted a steep increase in disclosed short interest in 2020 in this stock: from 11.81% to above 19%. Perhaps somewhat unsurprisingly, shares are down about 20% YTD.

- We also noted that that Kuvari Partners appeared in one of these three shopping centres related stocks for the very first time in February. Kuvari is an UK fund best-known for their short pitch and a big short in Kier Group

- More details are available here for our clients.

We crunch and analyse short-selling data 24/7 and uncover big shorts. Sign-up now for our monthly plans!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. „Big short“ refers to a short position above 0.5% of company issued capital. Presented data and analytics is as of available on 2020-01-17.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.