TL; DR: In spite of recent media reporting that singled out GLG Partners, Marshall Wace, and few other asset managers in terms of continued UK short selling, our analysis shows that the two largest UK short position holders were, actually, predominantly covering and not boosting their short positions in recent weeks.*

- Recent article "Hedge funds continue to short sell UK companies despite Bank of England calls to stop" got wide attention on social media, in particular on Twitter, where it was retweeted and liked thousands of times. We had a look at that article, as well as, at provided analysis and drawn conclusions.

- To a considerable extent, provided analysis revolves around number of weekly UK short positions disclosures made by different asset managers and recognises recent jump in these numbers. The article argues that this suggests that hedge funds continue to short sell UK listed companies and do so despite the proposal of BoE governor.

- However, one very important point does not seem to be properly recognised. Actually, some of the reported short disclosures are to increase % short positions, while some are to decrease % short positions.

- For example, one article's chart depicts that GLG Partners had record 68 short disclosures in a single week. We can confirm that number. We can also confirm that 50 of 68 were actually to reduce and only 18 to increase % short positions. Meaning, vast majority (about 73%) of 68 UK short disclosures by GLG in that week was towards covering short positions.

- Actually, according to our records, in six weeks period W8-W13, about 60% of GLG's UK disclosures were to decrease % short positions. Note that wide-scale market weakness started, pretty much, in W8.

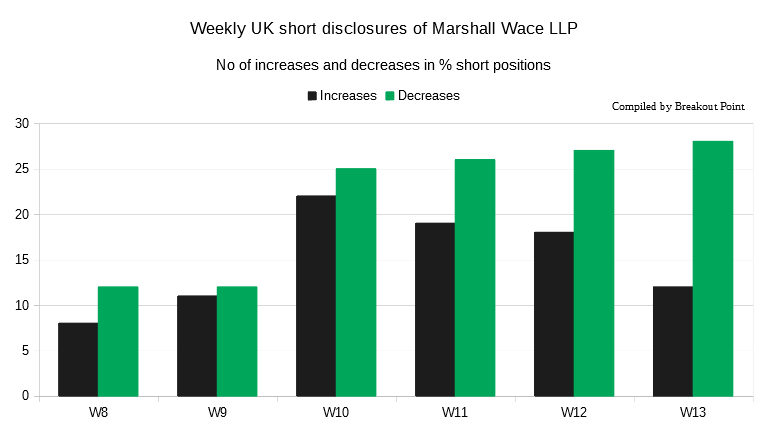

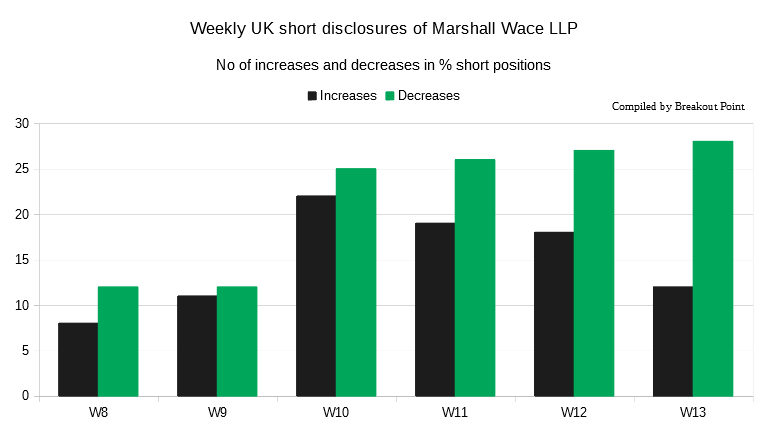

- Similar observations are valid for Marshall Wace LLP - they were predominantly reducing short positions. According to our records, in each of weeks W8-W13 they had more UK short disclosures to reduce % short positions than to increase. During these six weeks about 60% of short disclosures were towards % reduction (eg about 70% in W13).

- Concerning recent sharp jump in a total number of UK weekly short disclosures, to a certain extent, this should be explained by increased volatility. Increased volatility, typically, also requires more frequent portfolio adjustments.

- Obviously, there are many ways to expand and make our above analysis more insightful. Such as, we could evaluate magnitudes of decreases and increases in short positions, observe sector-wise activity, observe European-wide activities by these two hedge funds, or other relevant very active short sellers. However, that is not the goal of this brief post and our more detailed custom analytics is, on-demand, available to our clients..

Stay on top of short selling developments. Sign up for Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: How can I get more related data and analytics? A: Join Breakout Point to benefit from unique short-selling insights.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. „Big short“ refers to a short position above 0.5% of company issued capital. Presented data and analytics is as of available on 2020-04-09.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.