- Weekly short selling bits and pieces: TCI exits their big WDI short; Internal investigations and likelihood of delisting; More on Wirecard and its critics.

- This week, we recorded three new campaigns, with targeted stocks trading 33.8% lower on average.

- We highlight the team effort of JCap and Hindenburg on a US-listed Chinese company. Both allege it is a pump and dump scheme based on doctored and fake press releases. The stock ended 20% lower on the day of the report, but still maintains some of its gains from the flurry of the PRs just a few days ago.

- We also look at three European short campaigns in the wake of the Wirecard scandal. Two of them are Shadowfall’s targets which are not working out so far, yet the thesis might not be completely impaired. The other is down materially since the initial reports of activists, but, according to some short sellers, plenty of downside seems to be still available.

Short Selling: Bits and Pieces

Internal investigations as a bad omen: As per new working paper analysing company responses to activist short sellers:

Firms that announce internal investigations launched by the board are significantly more likely to be delisted, face enforcement action, and are less likely to become an acquisition target.

Above is not overly surprising for those following activist short selling. For example, recent QCM's Akazoo short report, the subsequent internal investigation and its disastrous results for shareholders, immediately come to mind.

Wirecard and its critics: There is a lof being written and is seemingly yet to be written about experiences of short sellers with Wirecard, eg a few days ago in Bloomberg "Wirecard Shows Life at Hedge Funds can be Agony". Head of Safkhet Capital, activist short seller that was vocal about Wirecard, spoke to Global Capital about the treatment of Wirecrad's critics and said:

What Wirecard put its critics through is heinous

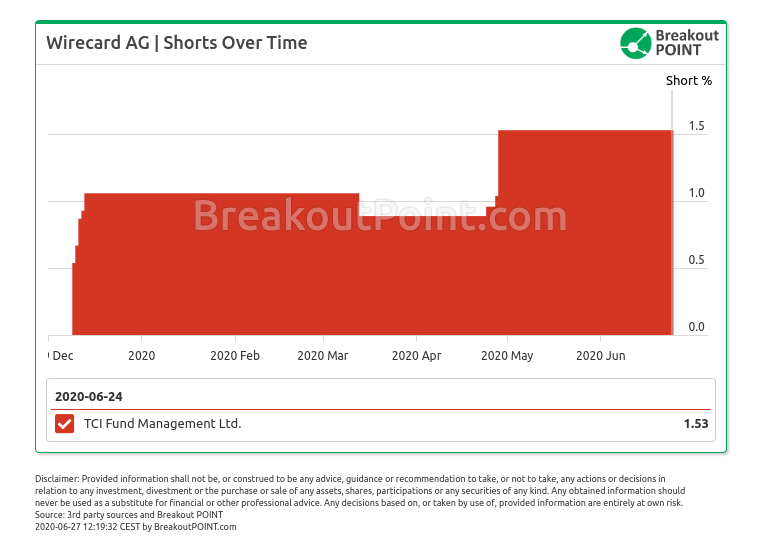

Profit time for TCI: Our analysis, also mentioned in FT "Hedge funds reap €1bn in a week", shows that a group of the biggest Wirecard short sellers is up more than €1b since collapse started. However, Wirecard short by TCI probably particularly deserves a big short designation. It was greatly timed (continuously above 0.5% since 2019-12-09), had a pinch of activism, and was not jittery (constant since late April, until profit taking on Thursday):

New Campaigns

...

(Get full weekly report and stay on top of activist short selling developments - Join Breakout Point).

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

* Note: Presented data and analytics is as of available on 2020-06-27, UTC 10:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.