TL; DR: D1 Capital Partners LP disclosed a 1.09% short position in Luckin Coffee (LK). LK was a subject of several short reports in Q1. Following outcomes of internal investigation, shares are down about 86% YTD, but up more than 300% from YTD low. Many Robinhood users were adding this stock to their portfolio recently.*

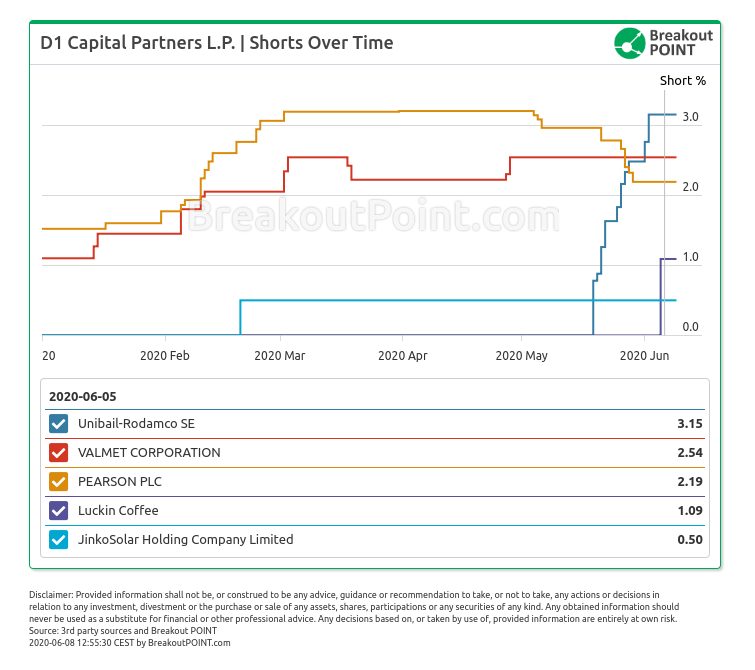

- First Luckin Coffee (LK) short disclosure within European short disclosure framework has been reported today. This is a 1.09% short position by D1 Capital Partners LP on 2020-06-05. At a market cap of about $1.39b, this short translates to about a $15m position;

- LK has been a subject of several short reports in Q1. Most notably, on 2020-01-31, Muddy Waters pointed-out an unattributed short report. Several other short selling related entities also flagged and/or shorted this company: J Capital Research, Ash Illuminations Research and Kynikos Associates;

- On April 2, LK disclosed results of an internal investigation. The investigation has found that COO fabricated 2019 sales. The results were devastating for LK shareholders and shares closed about 75% lower on that day. More recently, it has been reported in media that LK boss is likely to face criminal charges for financial fraud;

- On year-to-date basis, shares are lower about 86%. This is in spite of recent surge of more than 300%;

- Also notable is recent surge of interest of Robinhood's clients into LK. According to Robinhood data compiled by Breakout Point, in the past week, LK was among stocks that were most often added to portfolios of this group of retail clients. As of the latest available data, more than 135k people hold LK on Robinhood;

- This is not the first time that D1 Capital discloses a short in US-listed Chinese company. Back in February they disclosed a 0.5% short in JinkoSolar Holding Company Limited (JKS). JKS was also a subject of an activist short sellers report by Bonitas Research in March;

- Disclosures of US ISINs within European short disclosures framework are rare. There are several reasons why some US ISINs fall under European regulation eg due to dual-listing;

Stay on top of short selling developments. Sign up for Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: How can I get more related data and analytics? A: Join Breakout Point to benefit from unique short-selling insights.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. „Big short“ refers to a short position above 0.5% of company issued capital. Presented data and analytics is as of available on 2020-06-08 12:00h UTC.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.