TL; DR: With Wirecard down as much as 71% today, we estimate that eight biggest short position holders are up as much as €800m.*

- Today, Wirecard delayed again the publication of its eagerly awaited 2019 annual report, as Wirecard’s auditor did not sign off its 2019 accounts due to missing $2.1b, sending shares as much as 71% lower. Today, shares recorded a low under €30, while yesterday's close was above €104;

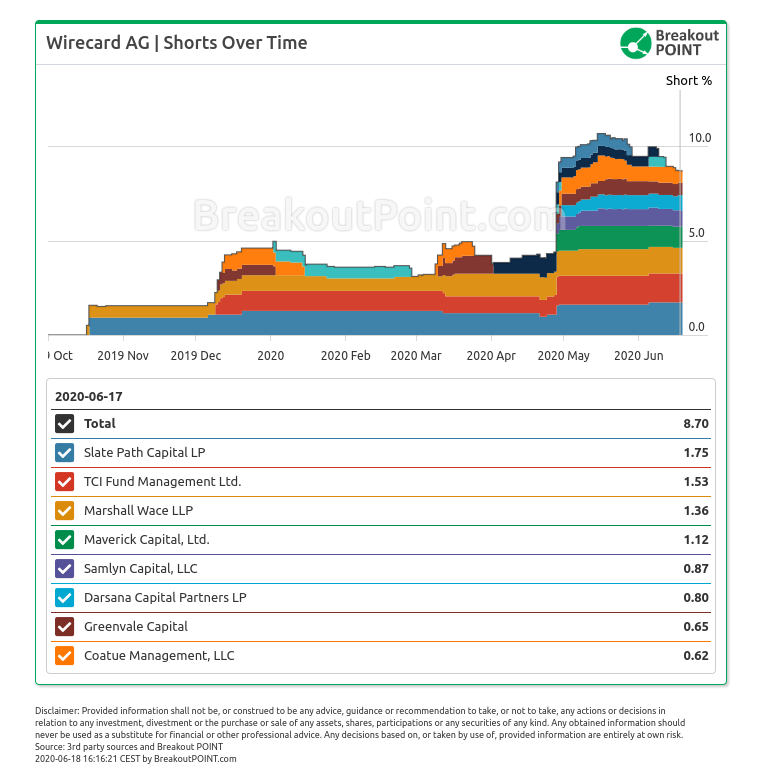

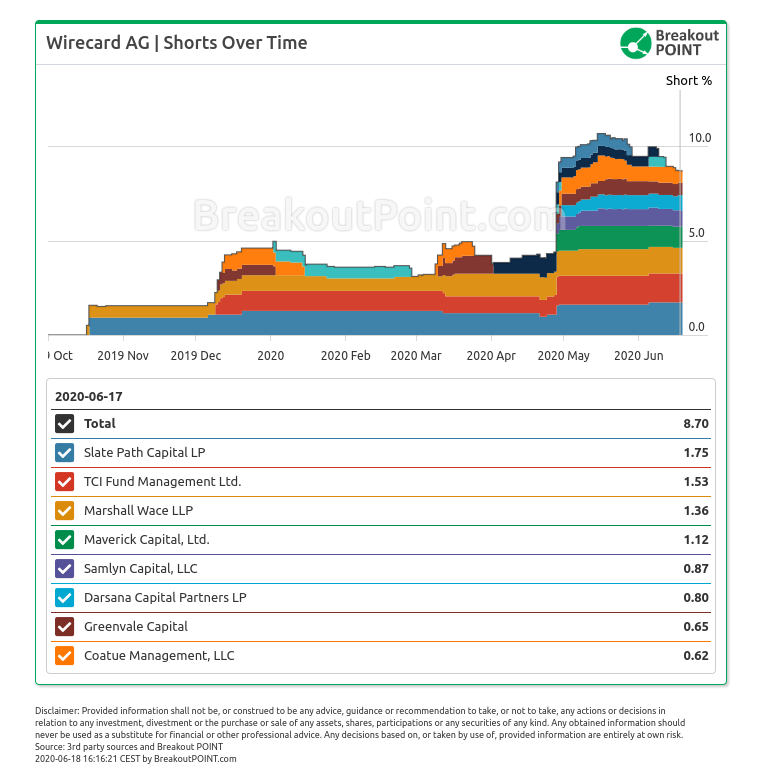

- This was a field day for Slate Path Capital, TCI and six other money managers, that, taking into account latest available short disclosures, were up, as much as, €800 today on their combined 8.7% short position in this German payments company;

- If these big shorts are observed on its own, we estimate that today, three biggest short position holders, Slate Capital (1.75%), TCI (1.53%) and Marshall Wace (1.36%), are up as much as, €161m, €141m and €125m, respectively;

- Today's events also seem to represent a long-awaited vindication for a number of critics, investigative journalists and activist short sellers that had their eyes on this DAX company for a number of years;

- However, short sellers, historically, had anything but easy in Wirecard, even if we purely look at attempts to short-sell this name and, for a moment, disregard all other aspects of this book worthy saga. This tweet by head of Bronte Capital summarises it:

Wirecard is the biggest loser in the history of my firm.

— John_Hempton (@John_Hempton) June 18, 2020

We have been short a decade - and been forced to keep covering it by the relentless rise in the stock.

I wish I had never heard of it.

Development of short positions in Wirecard:

Stay on top of short selling developments. Sign up for Breakout Point!

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: How can I get more related data and analytics? A: Join Breakout Point to benefit from unique short-selling insights.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. „Big short“ refers to a short position above 0.5% of company issued capital. Presented data and analytics is as of available on 2020-06-18 15:00h UTC.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.