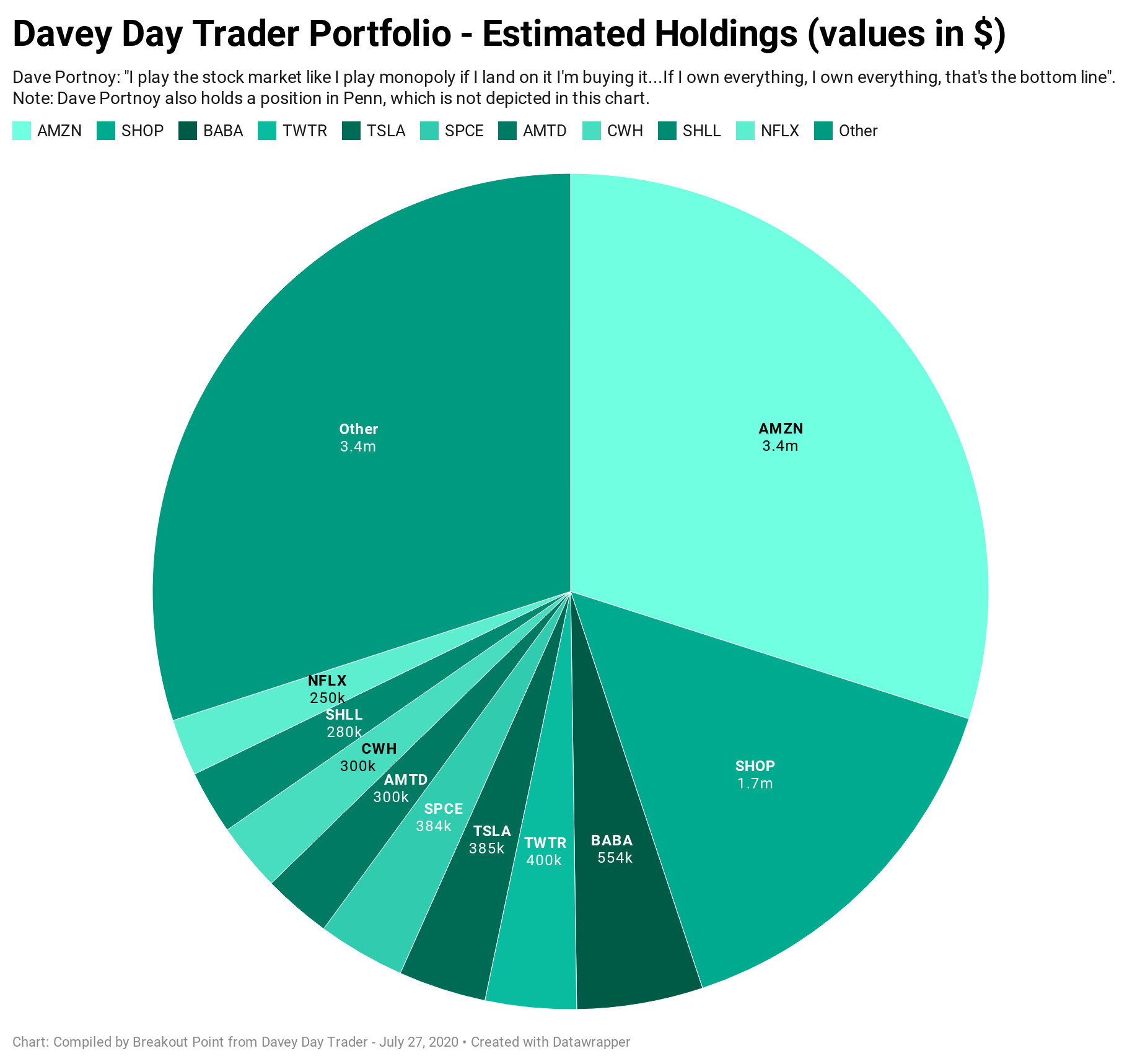

Amazon (AMZN), Shopify (SHOP), Alibaba (BABA), Twitter (TWTR), Tesla (TSLA) and Virgin Galactic (SPCE) are among the biggest holdings in portfolio of Davey Day Trader.*

The Biggest Holdings

We had a brief look at stocks that constitute portfolio of this most prominent retail investor that already in his twitter profile emphasises:

"Don’t trust anything I say about stocks"

We estimated close to 11.4 million dollars spread among 38 holdings, with ten biggest holdings at about 70% of that. Interestingly, and in spite of what some might have expected, among ten biggest holdings is only one company with a sub-billion market cap. This is an about $280k holding in Tortoise Acquisition Corp. (SHLL), an about $500m special purpose acquisition company (SPAC) that was recently in the news due to merger with Hyliion.

Top 10 holdings, which are dominated by well-known tech companies, such as Amazon, Shopify and Netflix, also include recreational vehicles specialist, Camping World Holdings (CWH) and a retail brokerage, TD Ameritrade (AMTD).

Smaller Holdings: Scrabble, Shorts and Birds

In the remaining 30% of portfolio are further 28 stocks. These include:

- An about $183k position in Raytheon Technologies Corp (RTX), a famous scrabble choice of Dave Portnoy:

$RTX comes out of the scrabble bag. Smush letters and buy it. Give it a try Ron, you might not bankrupt your clients. #DDTGpic.twitter.com/semLRi6yBF

— Dave Portnoy (@stoolpresidente) June 19, 2020

- An about $57k position in Microvision (MIVS), stock in which 'Retail Bros' and 'Activist Short Sellers' universes recently collided. This happened after a well-known activist short seller, Wolfpack Research, published a negative call on this holding of Davey Day Trader:

You're for two things 1) Dave 2) Portnoy, so just shut up already you're not fooling anyone. We've been publishing the truth for over a decade while you were playing with your pepperoni. https://t.co/w6rDnibBTy

— Wolfpack Research (@WolfpackReports) July 22, 2020

- An about $136k position in Northern Dynasty Minerals Ltd (NAK). Position in this about $850m mineral properties exploration company, best known for their Pebble Project in Alaska, has also been communicated in DDTG's unmistakable style via a number of tweets such as this one:

The birds have spoke. #ddtgpic.twitter.com/fHBumUkacc

— Dave Portnoy (@stoolpresidente) July 22, 2020

- And last but not least, we would like to point out an about $130k position in Remark Holdings Inc (MARK), that Dave Portnoy often denotes as 'WOAT', but keeps in the portfolio.

Davey Day Trader mentioned to be up $1.2m, and had this to say to a well-known critic of his perfromance and approach:

Look at Ron Insana hanging out in #DDTG message board getting stock tips and the chirping the king. I was down 2 million at one point cause I listened to fools like Ron Insana. Once I changed philosophies and trusted my brain I’m now up 1.2 total That’s 3.2 million change https://t.co/0Vs2i4P7N8

— Dave Portnoy (@stoolpresidente) July 27, 2020

Finally on the subject of Dave Portnoy vs Warren Buffet, we found this Google Trends depiction of rise of Dave's popularity very illustrative, even if not that surprising:

Emergence of so called 'retail bros' in H1, will, we except, translate into even higher importance of retail investors in H2. At Breakout Point this includes tracking and flagging of all relevant retails flows, such as, global retail investors activities, Robinhood's swarming, Dave Portnoy's views and developments at r/wallstreetbets.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: How can I get more related data and analytics? A: Join Breakout Point to benefit from unique retail flows and short-selling insights.

* Note: Unless otherwise stated, presented data and analytics is as of available on 2020-07-28, UTC 10:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.