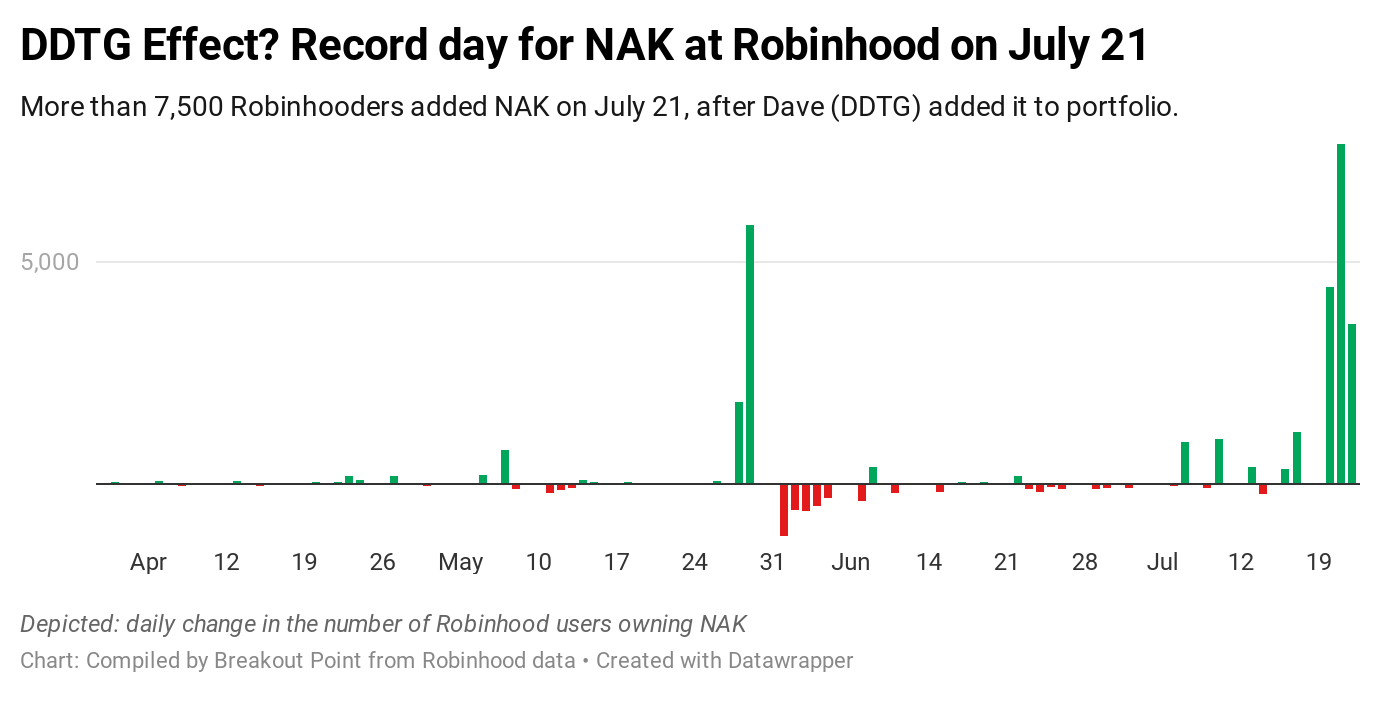

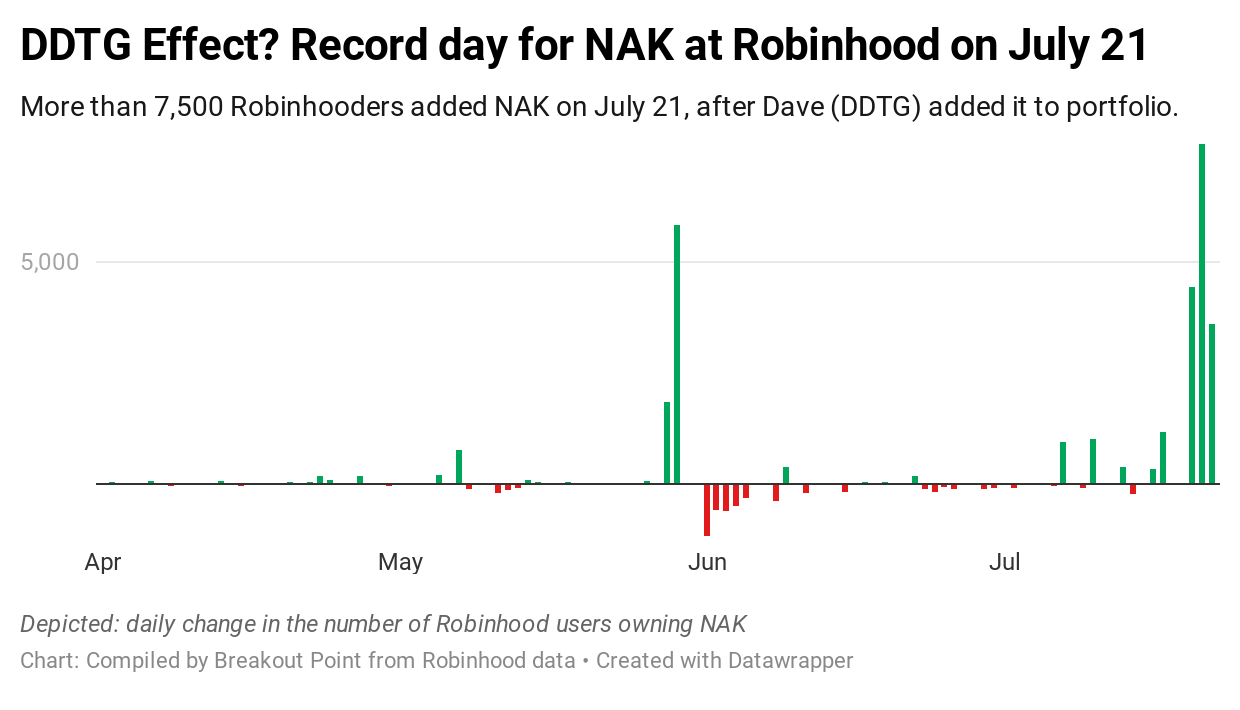

More than 7,500 people at Robinhood added Northern Dynasty Minerals (NAK) to their portfolio on Tuesday, July 21. According to our records, this is a record day at Robinhood in terms of daily increase in number of people holding this Canadian mineral exploration company.*

According to our retail flows records, around market open on July 21, Davey Day Trader said to have bought NAK shares. NAK position has also been later communicated in DDTG's unmistakable style via a number of tweets such as this one:

The birds have spoke. #ddtgpic.twitter.com/fHBumUkacc

— Dave Portnoy (@stoolpresidente) July 22, 2020

On July 21, shares reached a new multi-year high of $2.42 on intra-day basis, trading as much as 23.4% up versus close of previous day. Shares closed up about 12.2% higher, while the market cap achieved one billion.

As of close on July 22, NAK is up about 446% on YTD basis, while more than 42,500 people own NAK on Robinhood. As recently noted in WSJ: "investors favor shares that have risen sharply in recent weeks like the electric auto maker and vaccine makers".

The Robinhood crowds and activist shorts

The first half of 2020 also saw many activist short selling campaigns targeting companies that captured a lot of interests of newly minted retail traders, usually operating through Robinhood.

We denote related short calls 'inverse Robinhood strategies'. While some of these targets have been declining recently as the hype left them, many are still substantially up even after the short-seller raised serious allegations about the businesses. Most interesting examples can include Cytodyn (CYDY), biotech short of Culper Research which is up over 250% or Wins Finance Holdings, a recent target of Hindenburg which is up roughly 15%.

This week we witnessed a direct collision of these two, so far, rather parallel universes: 'Retail Bros' and 'Activist Short Sellers'. It happened on Tuesday after Wolfpack Research tweeted a negative short call on Microvision Inc (MVIS). Interestingly, MVIS is not only a popular retail investors' long holding, but is also a part of Davey Day Trader's portfolio. Subsequent exchange between Wolfpack and DDTG included a number of remarkable tweets, eg:

You're for two things 1) Dave 2) Portnoy, so just shut up already you're not fooling anyone. We've been publishing the truth for over a decade while you were playing with your pepperoni. https://t.co/w6rDnibBTy

— Wolfpack Research (@WolfpackReports) July 22, 2020

Emergence of so called 'retail bros' in H1, will, we except, translate into even higher importance of retail investors in H2. At Breakout Point this includes tracking and flagging of all relevant retails flows, such as, global retail investors activities, Robinhood's swarming, Dave Portnoy's views and developments at r/wallstreetbets.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: How can I get more related data and analytics? A: Join Breakout Point to benefit from unique short-selling insights.

* Note: Unless otherwise stated, presented data and analytics is as of available on 2020-07-23, UTC 10:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.