- We have seen some wild swings in Tesla this week. Considering that this is one of the most popular stocks among retail investors, the question arises: what have retail investors been doing in Tesla this week?*

- We resorted to our Robinhood-popularity-proxy feed and found that our estimated retail sentiment and our estimated retail flows were an useful leading indicator of corresponding price swings in Tesla stock.

Retail Investors and Tesla

Here are bits and pieces of our retail flows data and analytics on Tesla and Apple that were, to a great extent, twitted out by Breakout Point, during this week:

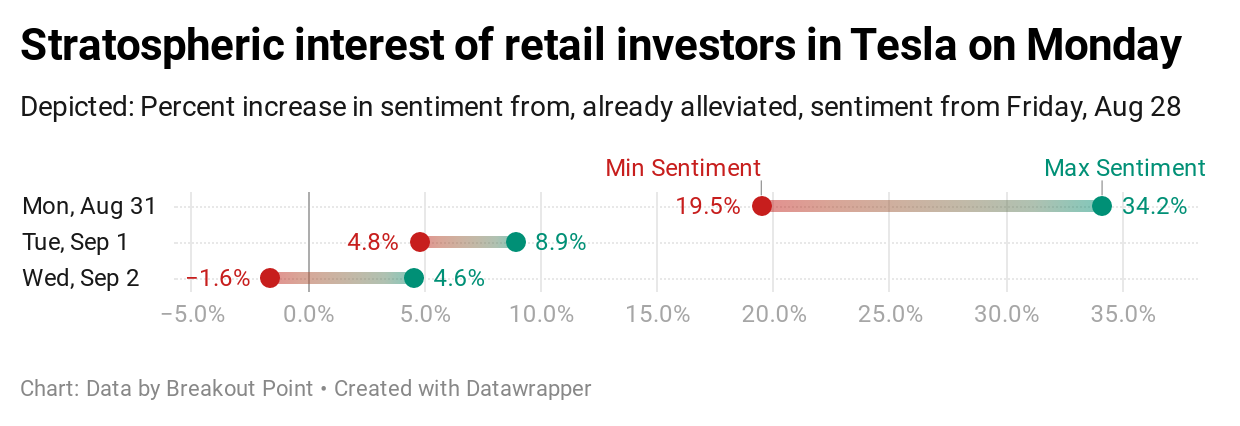

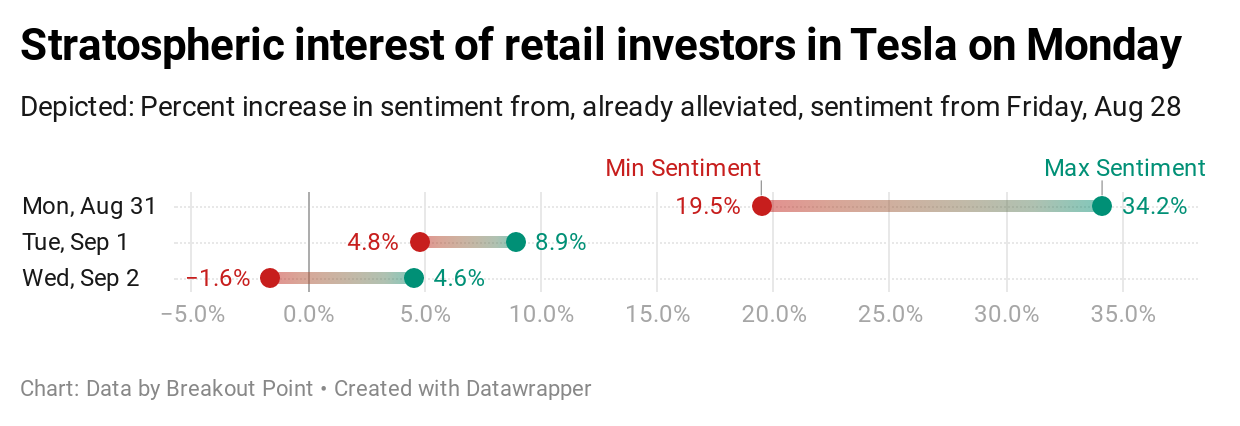

- On Monday, August 31st, already in pre-market, we noted unusual stratospheric spike in positive retail flow and sentiment in Tesla (TSLA) and Apple (AAPL). This should be compared with TSLA price development on that day (up about 12.6% from previous daily close and up about 12.1% from open). Cherry on top of the below tweet, was our retail flows analytics pinpointing high positive retail sentiment in Zoom Video Communications Inc (ZM) that jumped as much as 8.8% on Monday and then as much as amazing 47% on Tuesday.

$TSLA and $APPL easily topping our list of today's top retail swarming estimates

— Breakout Point (@BreakoutPoint) August 31, 2020

Further notable swarming$WMT$NIO$ZM

...

Go check our Retail Flows analyticshttps://t.co/1jNttfERdI

- By the end of the day on Monday, August 31st, our retail flows and sentiment feed for TSLA and AAPL determined an estimated twice the value of the largest daily retail inflow ever recorded at our side (which would be more than twice the inflow for Kodak on July 29th). If we were to estimate change in Robinhood popularity for TSLA and AAPL on that day, we would probably go for twice of what we have seen for Kodak on infamous July 29th.

New record of retail investor activity in our records:$AAPL and $TSLA today

— Breakout Point (@BreakoutPoint) August 31, 2020

...more than double of what we have for $KODK on July 29

- According to our feed, Monday's retail flow/sentiment spike was still very strong on Tuesday, August 2nd, but clearly started turning down already on Tuesday and continued declining on Wednesday. On Tuesday Breakout Point's estimated retail sentiment was down more than 20% from Monday's high, while early in the trading session on Wednesday it has been down more than 25% from Monday's highs;

- On Thursday, September 3, already in pre-market, we noted that huge Monday's spike in positive retail sentiment in TSLA and AAPL completely evaporated. Cherry on top of the below tweet, was our analytics pinpointing retail sentiment in Kensington Capital Acquisition Corp (KCAC) very timely - this should be compared with KCAC price development on that day (up about 87.4% from previous daily close and up about 15.4% from open).

Today's top retail swarming estimates:$KCAC (new)$DKNG

— Breakout Point (@BreakoutPoint) September 3, 2020

...$AAPL and $TSLA sentiment back down from stratospheric levels of Mon and Tue

Go check our Retail Flows analyticshttps://t.co/1jNttfERdI

Need retail flows and sentiment? Robinhood's API, which provided popularity data, recently ceased operation. This data was popular not only with journalists and momentum investors, but also with short sellers, who frequently applied reverse Robinhood swarming strategies. The good news is that there are a few great alternatives and proxies for Robinhood's popularity data, eg our Retail Flows plan provides real time retail sentiment, estimates retail flows and positioning, and alerts about activities of VIP retail investors.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, join Breakout Point and start benefitng from our services.

* Note: Presented data and analytics is as of available on 2020-09-04, UTC 10:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.