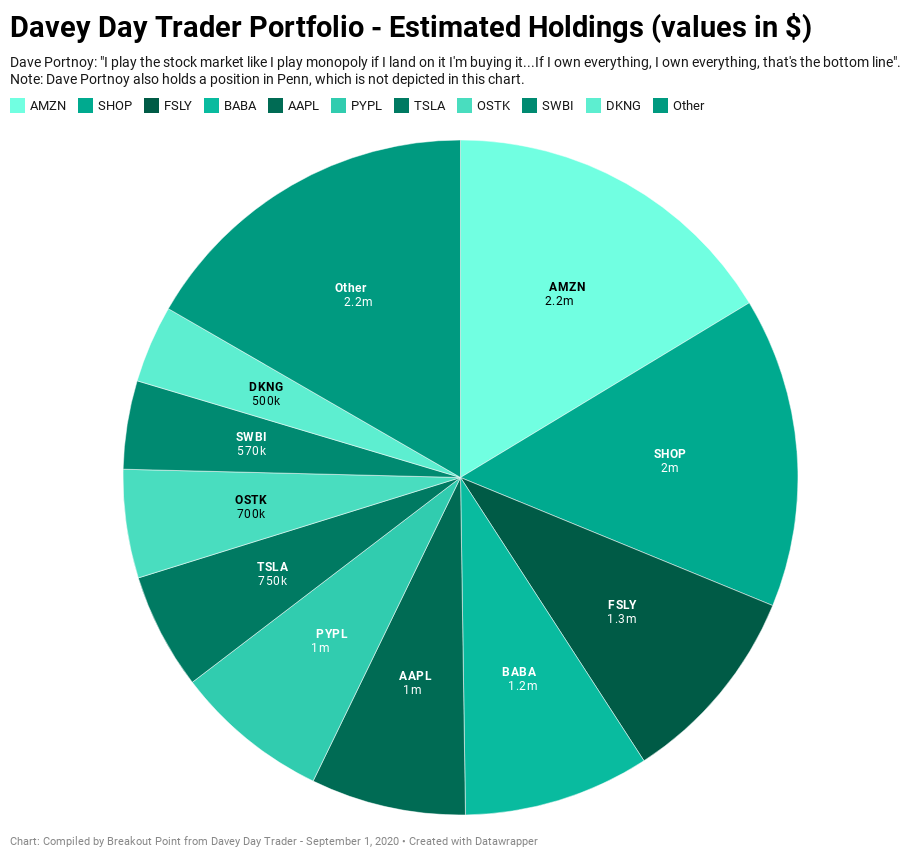

Amazon (AMZN), Shopify (SHOP), Fastly (FSLY), Alibaba (BABA), and Apple (AAPL) are among the biggest holdings in portfolio of Davey Day Trader.*

Need retail flows and sentiment? Get our great proxy for Robinhood's popularity data. Our Retail Flows plan provides real time retail sentiment, estimates retail flows and positioning, and alerts about activities of VIP retail investors.

The Biggest Holdings

We took a brief look at stocks that make up the portfolio of this most prominent retail investor, who already points out in his Twitter profile:

"Don’t trust anything I say about stocks"

We estimated close to 13.5 million dollars spread among 19 holdings, with ten biggest holdings at about 85% of that. Interestingly, and in spite of what some might have expected, there are no companies among the ten largest holding companies with a market capitalization of less than one billion.

Top 10 holdings, which are dominated by well-known tech companies, such as Amazon, Shopify and Apple, also include famous US firearms manufacturer, Smith & Wesson (SWBI) which Dave Protnoy mentioned on Monday and which shoot up as much as 20% on Tuesday:

All of #fintwit has to ask themselves this question. Can you afford not to be a #DDTG client. Gave out $swbi yesterday. Going PARABOLIC today. Up 18% It’s a crime my brain is free. pic.twitter.com/VOr7DZWdvu

— Dave Portnoy (@stoolpresidente) September 1, 2020

Estimated holdings in Dave Day Trader's portfolio:

Compared to the holdings of about half a month ago, we noticed that especially the positions in FSLY and BABA were increased, while AMZN and SHOP were somewhat reduced. Notable stocks that are seemingly not anymore in the portfolio are Etsy and Camping World Holdings.

Riot Blockchain is a holding from sub-billion market cap segment, but represents less than 1.5% of the portfolio.

As far as we could analyse, famous scrabble choice of Dave Portnoy, Raytheon Technologies Corp (RTX) is not in portfolio anymore.

$RTX comes out of the scrabble bag. Smush letters and buy it. Give it a try Ron, you might not bankrupt your clients. #DDTGpic.twitter.com/semLRi6yBF

— Dave Portnoy (@stoolpresidente) June 19, 2020

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: How can I get more related data and analytics? A: Join Breakout Point to benefit from unique retail flows and short-selling insights.

* Note: Unless otherwise stated, presented data and analytics is as of available on 2020-09-01, UTC 15:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.