- Another productive quarter for the short-sellers with 44 major short camapigns is in the books and we provide an in-depth review.

- We write about some of the most memorable campaigns with the largest declines, be it a gravity-driven truck, or Dave Portnoy’s misstep and alleged Theranos 2.0 alongside, what media called, possible Wirecard 2.0.

- Gabriel Grego of QCM kindly provided several expert comments and insights on some of most relevant Q3 activist short selling developments.

- We also look at one campaign which featured strong allegations, but the share price seemed to have brushed them off so far.

- Finally, we highlight what we believe investors might get to see in Q4 from the standpoint of individual stocks and broader themes.

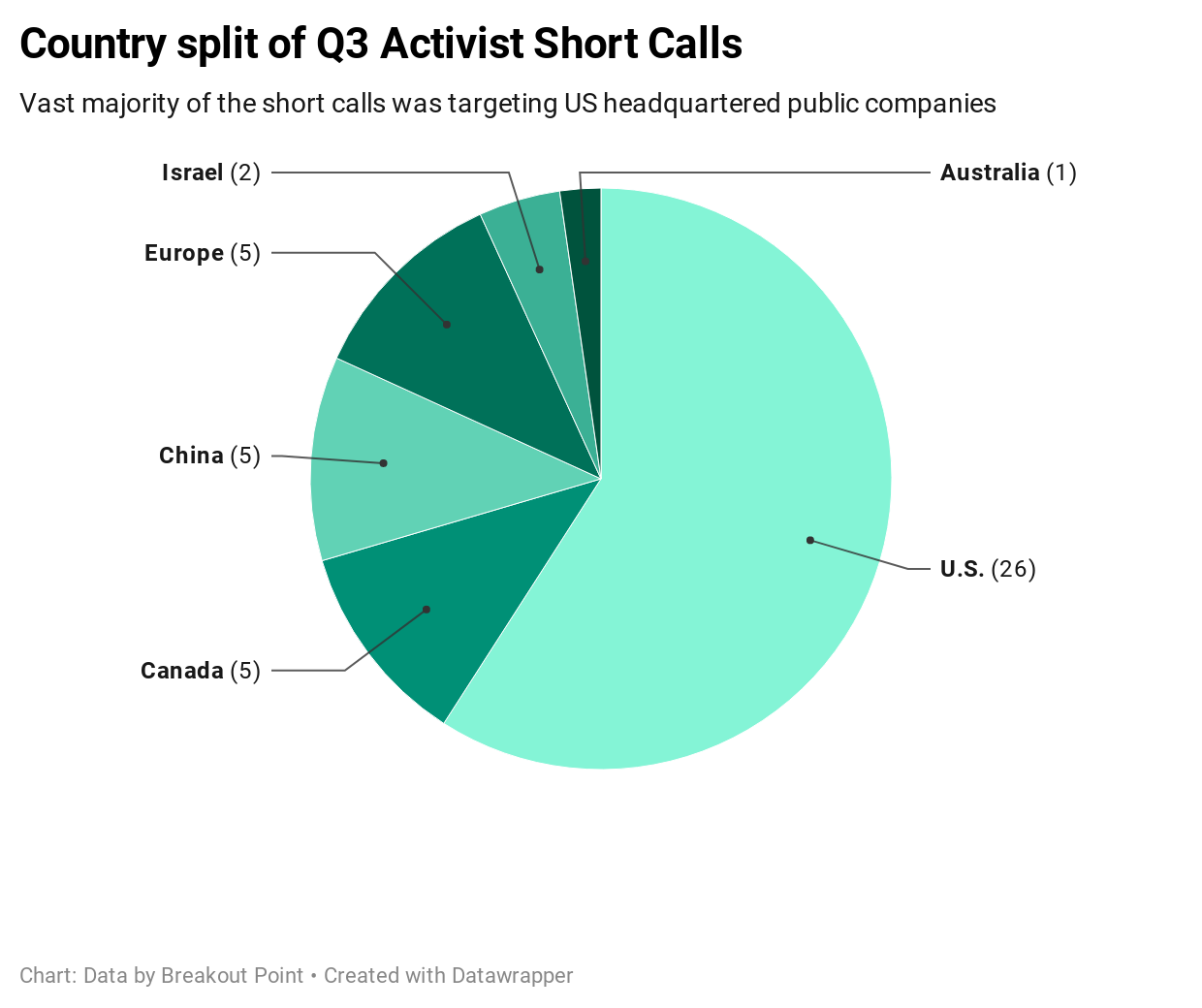

In Q3, we have registered and tracked 44 new major short campaigns which is similar to a number of short calls we recorded in Q1 and Q2 of 2020. On average, targeted stock dropped about 2% following a short call/report, but we also noted strong regional differences. While Chinese companies were quote resilient, German companies suffered the most following new short campaigns.

Same as we already observed in the past, by far the highest number of target companies are U.S. companies.

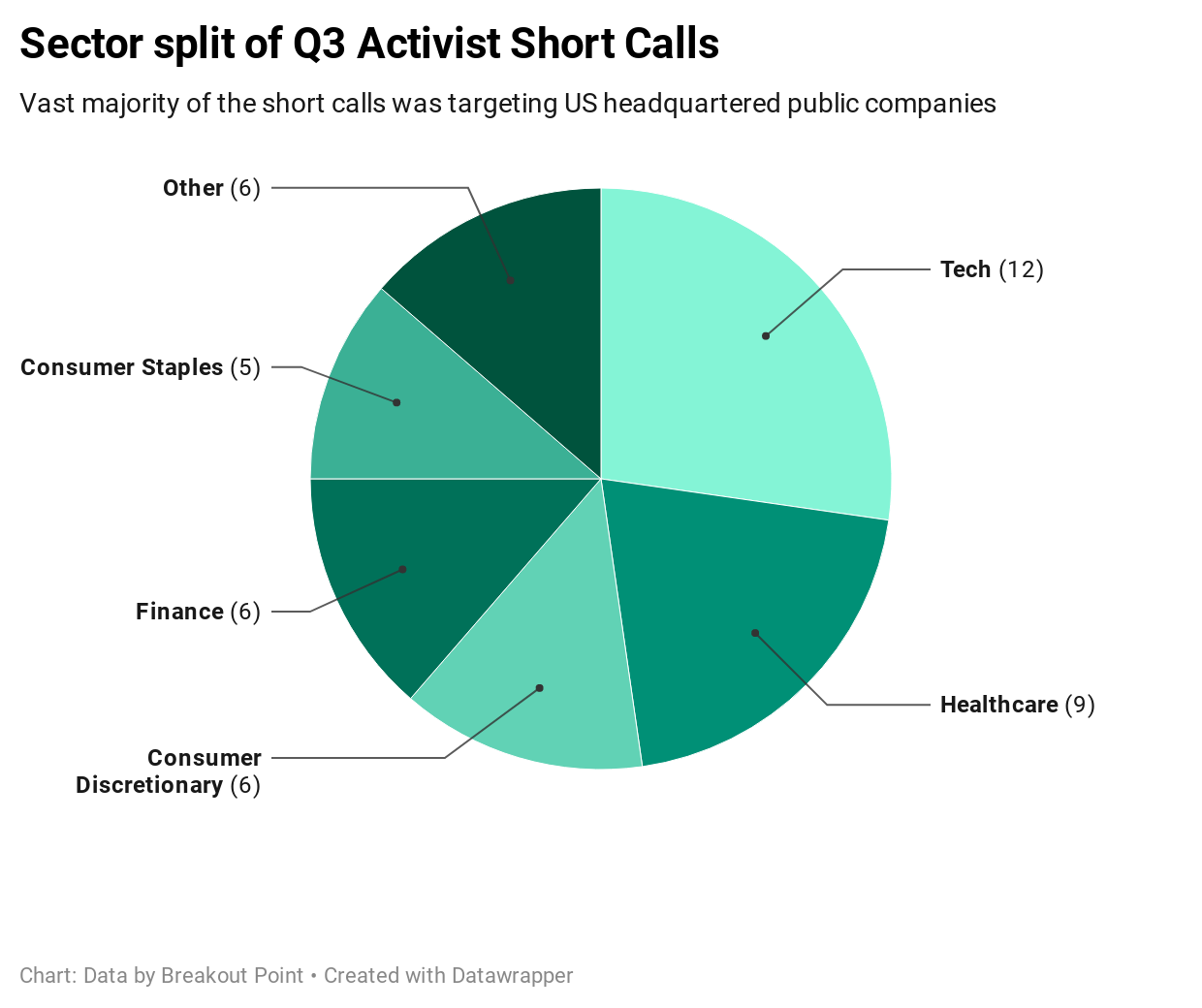

We have noticed a somewhat more unusual development at sector level. In the third quarter, the tech sector overtook the traditionally most targeted sector, the healthcare sector, as the most targeted sector.

Top Short Campaigns in Q3

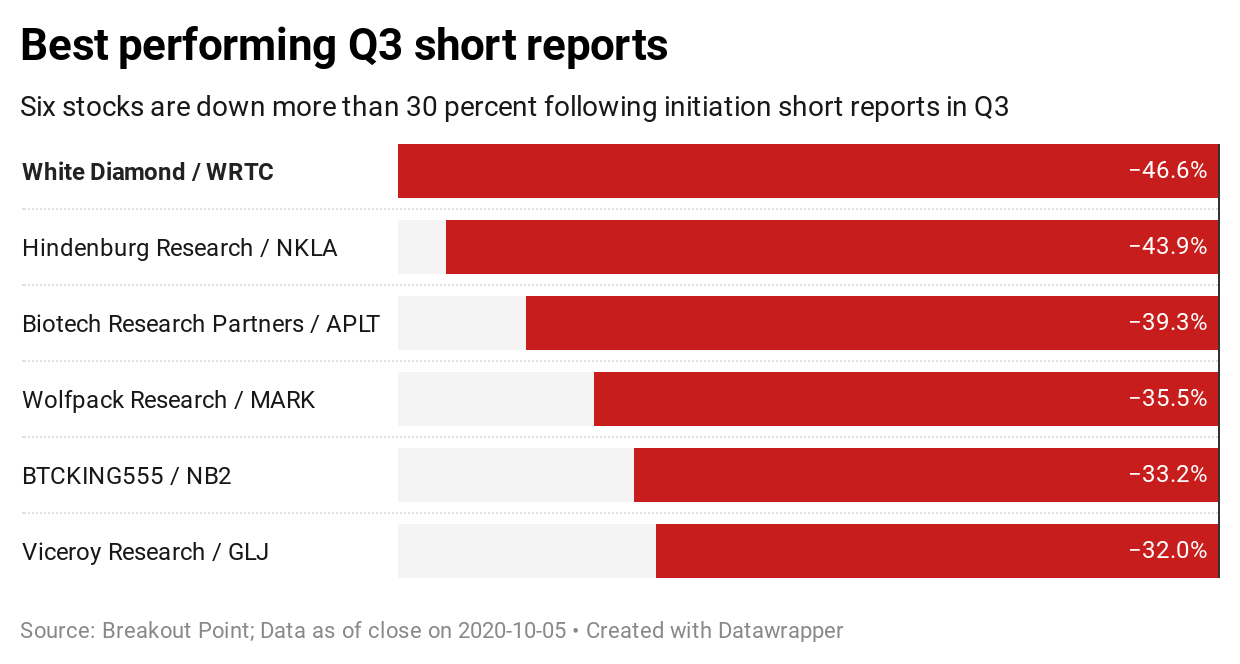

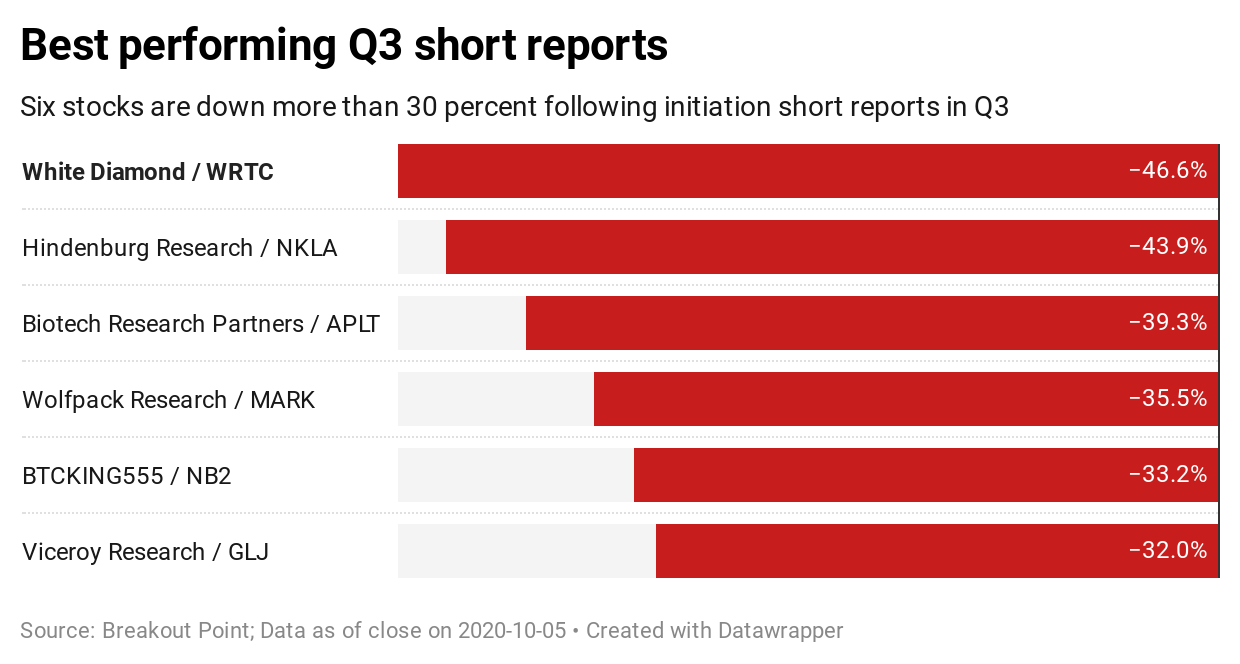

White Diamond Research, a sub-billion market cap short activism specialist that had three new short reports during Q3, leads our list of the best performing short reports with their short report on Wrap Technologies. As of close on October 5, besides Wrap Technologies trading about 46.5% lower, five other stocks declined more than 30% versus prior to corresponding reports.

Unsurprisingly, we would also like to highlight Hindenburg’s takedown of Nikola (NKLA). In early September, Hindenburg released an investigative report showcasing several claims which suggested the company is not what market perceives it to be. Shareholders of NKLA supposedly did not do enough due diligence and let themselves be misled in certain points by the founder of NKLA, Trevor Milton.

While we now know that following this investigative report, the founder stepped down, deleted his twitter and ‘lawyered up’, the initial reaction to the report was in some cases relatively cold even some short-sellers joined in and looked at Hindenburg’s report sceptically. However, it did not take a long time to see that the team around NKLA was failing to produce a response that will satisfy the markets. They released the now infamous response which, in spite of providing an unexpected clarification of what was meant by "In Motion", basically confirmed one of the Hindenburg's key claim. The shares plunged as much as 61%, but somewhat rebounded and stabilisied since.

All this is just the tip of the iceberg. There is so much to unpack in this campaign that we believe a feature-film or a documentary should certainly be in someone’s mind.

One of the best performing short activists in our records, QCM, kindly commented for our Q3 overview. We asked Gabriel Grego of QCM about his views on the most memorable Q3 development in activist short selling space. Mr Grego said:

Probably Hindenburg Research short report on Nikola. Remarkable for quality and size of the target.

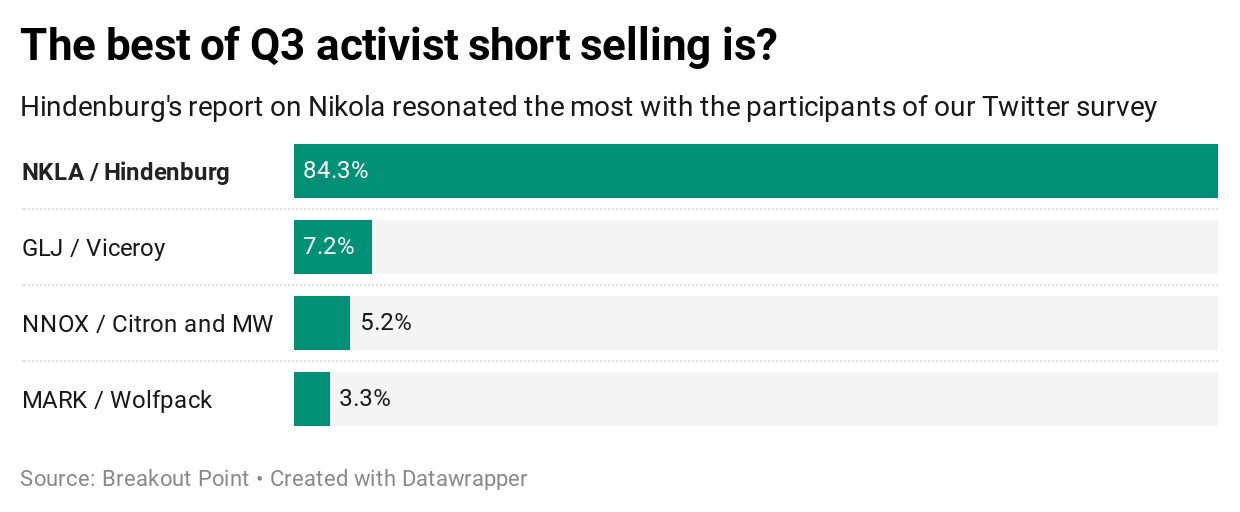

This campaign also got a lot of public resonance. For example, overwhelming 84 percent of participants in our recent poll, voted for this report as "the best of Q3 activist short selling".

Another impactful campaign which happened only five days after NKLA's bombshell was by Viceroy Research who published a report about a German leasing company called Grenke. Viceroy draw parallels to Wirecard as Grenke allegedly acted as an enrichment scheme for its insiders who allegedly hid related-party transactions.

As with NKLA, the story here is still unfolding by the day, and a ping-pong between Viceroy and Grenke continues. Most recently, Grenke issued a press release saying KPMG, its auditor, has proof for almost all of Grenke's cash balances, shares surged, while Viceroy followed up with another report:

Viceroy's latest on Grenke is now live, evidencing middlemen of Viewble fraud were spouses of Grenke employees. Grenke refer to this as "enhanced due diligence", & shows disregard for insiders profiteering at every level $GLJ#grenkehttps://t.co/XqEVI3dp6Opic.twitter.com/VXcXnV4R98

— Viceroy (@viceroyresearch) October 6, 2020

Last but not least, we would like to highlight Wolfpack’s campaign on Remark Media (MARK), once a stock talked about by Dave Portnoy, one of the darlings of the new generation of Robinhood traders.

The campaign was presented on 3rd Contrarian Conference and had interesting and strong allegations of improper disclosure and supposedly poor corporate governance. We would also highlight it for the entertainment value which was delivered by this clash of retail bros and activist shorts universe, eg check out related New York Post reporting "Dave Portnoy lost ‘close to seven figures’ on controversial Remark stock" .

Down and Up in Nano-X

The ‘retro’ feel to some of the Q3 campaigns was also maintained by both Muddy Waters and Citron Research who targeted NANO-X Imaging, a recent IPO trying to innovate in the X-ray space. However, both short-sellers believe the company could be Theranos 2.0.

Citron fired first and released several allegations of inefficient product and questionable client base. Muddy followed-up just a week after Citron’s first report and provided further allegations for the claims the company supposedly does not have a functioning product and that the customers are dubious.

The shares were down over 50% since Citron’s report, however, on Friday, Nano-X Imaging (NNOX) jumped 56%. This jump followed company's announcement it will demo its product in late November. The product was the point of contention between the two sides. Retail investors were on it as well and even before the market opened on Friday, our retail flow and retail sentiment analysis showed that NNOX is one of the handful of stocks with strong positive retail interest.

Speaking of retail investors, we asked Gabriel Grego of QCM what his message to all newly minted retail investors would be. Mr. Grego said:

The message is be very skeptical and think conservative when acting in the stock market. I think too many people are playing with fire, their carelessness enable by recent easy gains. There are no shortcuts in life or in the equity market.

What has not moved?

While we have seen big wins for short-seller this quarter there are always several campaigns which are worthwhile talking about even if they did not yet impact the stock price.

We asked QCM about the one 2020 short target they thought has a significant downside but did not move yet. This is what Gabriel Grego had to say:

(...)

Get full Q3 report and stay on top of activist short selling developments. - Join Breakout Point

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Unless otherwise stated, presented data and analytics is as of available on 2020-10-05, UTC 22:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.