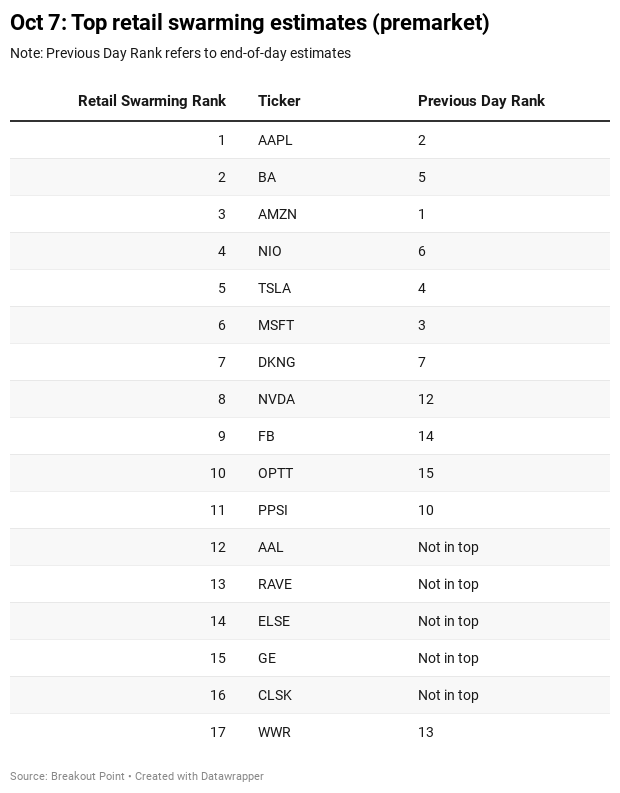

Today on October 7 we are seeing the following stocks with unusual positive retail interest estimates;

Positive Sentiment Highlights

The first stock we want to highlight is DraftKings (DKNG), a $20bn betting company, which has been included in the retail swarming lists for several days in the row now. The focus of the retailers on DKNG is of no surprise. The company, which is going to be public through SPAC, has been posting strong revenue and user numbers. DKNG is trading about 8% lower in the premarket.

One Redditor summarized the bull case in a few words;

Sportsbooks opening up at Wrigley Field and Lincoln Financial Field. More and more states legalizing gambling and public opinion towards gambling is more positive. Fantasy sports growing in general. The list goes on. What’s not to like?

The share price has been steadily increasing in the month of September. This prompted the company to do a share offering in the past few days to lock in the opportunity. The bulls do not seem too bothered. Some others are not convinced by the astronomical valuation while profits are nowhere to be seen as marketing costs surge.

We also see Westwater Resources (WWR), a small mining company, continuing their increase in share price which is why the stock remained in the list. The stock got boosted by Trump administration which mentioned the need for US supply of graphite.

Another stock that landed in the crosshairs of retailers due to Trump is American Airlines (AAL). The president urged the government to provide a bailout for the airline companies. The news quickly spread on the usual channels such as r/wallstreebets.

Rather surprisingly another new stock in the list is General Electric (GE), a large conglomerate. Yesterday it dived after receiving 'Wells notice' from the SEC which indicates the regulator is likely interested in the company's accounting. It should be noted Harry Markopolos released a detailed report about the company's accounting in their insurance business last year. One well-known member of the fintwit area showcased why the interest from the retail side could be possible.

I see $GE got a Wells Notice. There's only one question now. How many calls should I buy and at what strike???

— TC (@TESLAcharts) October 6, 2020

Lastly, we would like to note two peculiar cases. The first is Pioneer Power Solutions (PPSI), a $45m electronic component company, which has entered the list yesterday on the back of a strong price surge. The reason for this share price action is elusive as of now. There are no clear fundamental news that would support the move apart from the usual chatter of penny-stocks traders.

Retweet/favorite this for a video lesson detailing my nearly $7k in trading profits so far this week due to the volatility created by the awesome $WWR$PPSI short squeezes & how I NAILED the $OPTT buy alert for https://t.co/dNDoBj4uQc peeps @ 1.17 before it doubled to 2.33 today! pic.twitter.com/ZnMdIHijZ2

— Timothy Sykes (@timothysykes) October 6, 2020

Another such case would be Electro-Sensors (ELSE), another electronic component company worth $30m in market cap. The stock ripped over 100% yesterday without any discernible reason part from Twitter mentions which suggested a connection to PPSI.

$PPSI going nuts. I found the next one to run. $ELSE also makes generators. Perfect and just like $PPSI no reason for $ELSE to not go.

— PJ Matlock (@PJ_Matlock) October 6, 2020

Long $ELSEhttps://t.co/hN2TVHCSrG

In the last two quarters, they generated $0.24m of operating cash and their tangible book stood around just $12m in June of this year.

Dominant retail selling pressure

Finally, we mention tickers with estimated dominant retail selling pressure: ZM and AYTU.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented data and analytics is as of available on 2020-10-07, UTC 13:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.