- In W45, we have not registered any new major activist short selling campaigns but have seen several material developments to previous targets.

- We highlight the back-and-forth between Blue Orca and its Australian target. The company seemingly partly admitted to one of the allegations. The stock however rebounded and is down only 3%.

- We also look at stocks which have moved significantly in the past month. Hindenburg was again a clear winner with two of their stocks tanking. Spruce on the other hand saw one of their campaigns go sharply against their claims so far.

- Finally, we look at this week’s price action in a medical device company targeted by Wolfpack and a cannabis-related REIT short of Grizzly Research.

Bits and Pieces

BaFin in focus of ESMA: ESMA issued their eagerly awaited report and identified a number of deficiencies in German supervision of Wirecard financial reporting. There are many memorable parts in this 189-pages long report, eg on short selling ban:

"the short-selling ban was interpreted by FREP as a sign that BaFin had good reasons to believe the allegations against Wirecard were unfounded."

4x Short Certificate on Wirecard: More details about Wirecard trades by BaFin staff came to light this week. A nice overview of April - June activities, including trading in '4x Short Certificate on Wirecard', is available here.

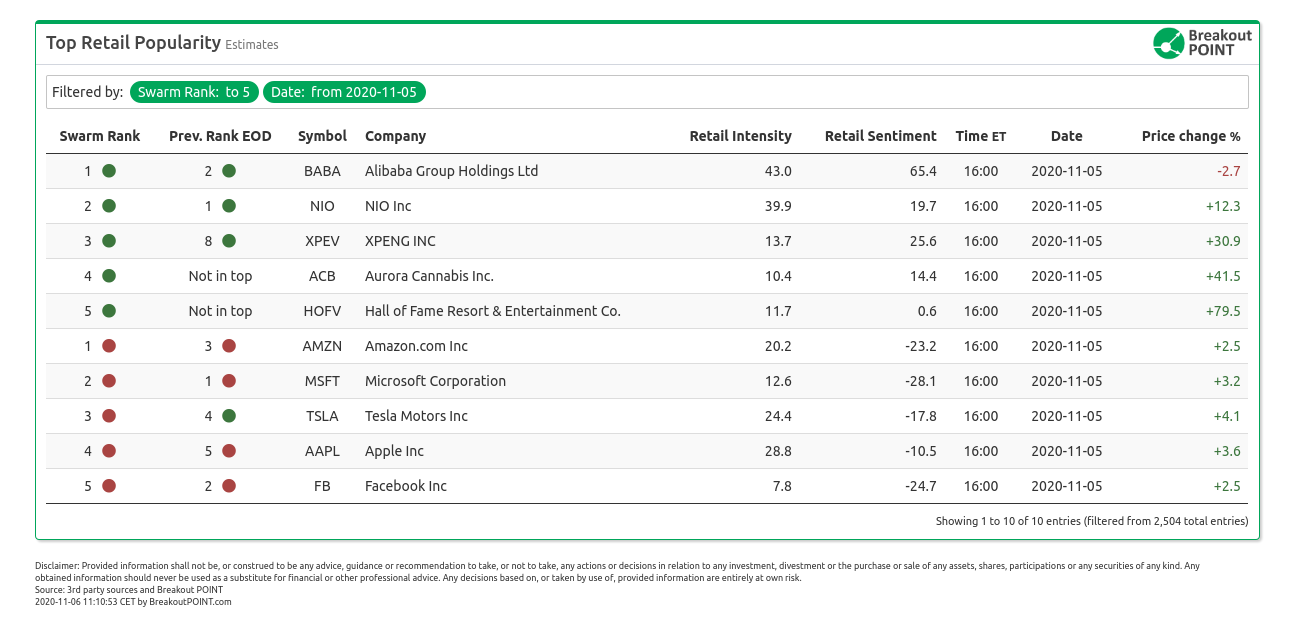

Retail Bros and Elections: Following the U.S. elections, we are seeing three new popularity trends among retail investors:

- Positive: Cannabis stocks (ACB, CGC, TLRY and APHA);

- Positive: Chinese US-listed stocks, most notably EV related stocks (NIO, XPEV, KXIN);

- Negative: Most of FANGMAN-stocks (FB, AAPL, MSFT and AMZN).

Need retail flows and sentiment? Robinhood's API, which provided popularity data, recently ceased operation. This data was popular not only with journalists and momentum investors, but also with short sellers, who frequently applied reverse Robinhood swarming strategies. The good news is that there are a few great alternatives and proxies for Robinhood's popularity data, eg our Retail Flows plan provides real time retail sentiment, estimates retail flows and positioning, and alerts about activities of VIP retail investors.

Big Movers

October was an eventful month for many of the activist campaigns.

Hindenburg was among the most successful in October. First, it was Wins Finance Holdings (WINS) which got hammered as it was delisted from NASDAQ on the basis of asset-freeze which Hindenburg noted three months ahead of the stock exchange as per below.

Update: Nasdaq is delisting $WINS over the undisclosed freeze of its Chinese assets that we first revealed in June.

— Hindenburg Research (@HindenburgRes) October 21, 2020

This is the 2nd company we've reported on this year to subsequently be delisted (the other being $PRED).

We are still short both.https://t.co/oP40z0a11Dhttps://t.co/pk1GLqka5M

The second win for Hindenburg came in Loop Industries (LOOP) which got crushed after the initial report and failed to rebound. This is likely due to the SEC action also highlighted by the short-seller.

Update: $LOOP just disclosed an SEC investigation and receipt of a subpoena from the SEC requesting information about its technology and partnership arrangements.https://t.co/XigJn4Bi2Chttps://t.co/ecYbyLuqht

— Hindenburg Research (@HindenburgRes) October 16, 2020

On the other hand, few short-sellers also saw their campaigns go against them.

One of the worst-performing stocks (for short-sellers) was...

(Get full weekly report and stay on top of activist short selling developments - Join Breakout Point).

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, join Breakout Point and start benefitng from our services.

* Note: Unless otherwise stated, presented data and analytics is as of available on 2020-11-06, UTC 12:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.