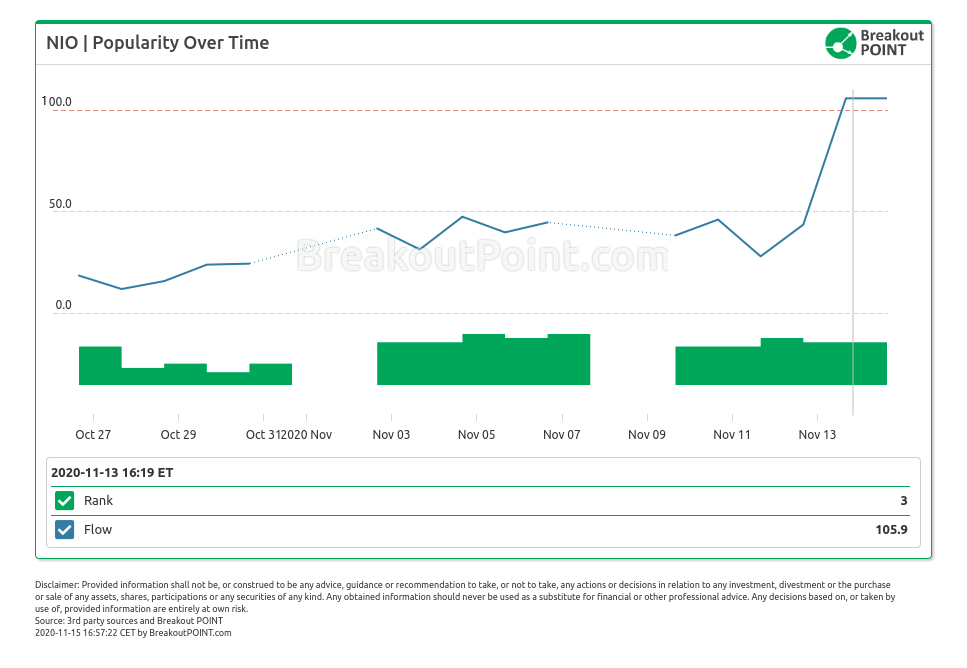

On Friday the 13th, Citron Research, a well known short-seller, released a brief short call on the $60 billion Chinese EV company Nio Inc (NIO). According to our analyses, this stock has recently been a big favorite of retail investors and has regularly occupied the top spots on our retail popularity list.

In Breakout Point's retail flows and retail popularity records, NIO has been among the four most popular retail stocks on day-to-day basis since the U.S. election's week. It actually often occupied one of two top positions. By comparison, in the days leading up to the elections, NIO was also very popular, but somewhat less and ranked 8th-10th in our intraday records.

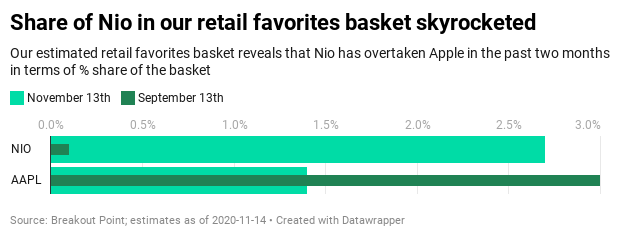

As noted in the next section, NIO is not the only Chinese EV stock that has been among the most popular retail stocks recently. However, our records show that NIO's retail popularity stands out even among the peers.To put NIO's retail popularity in an additional perspective, we note that our estimated retail favorites basket reveals that NIO has overtaken even Apple in the past two months in terms of % share of the basket:

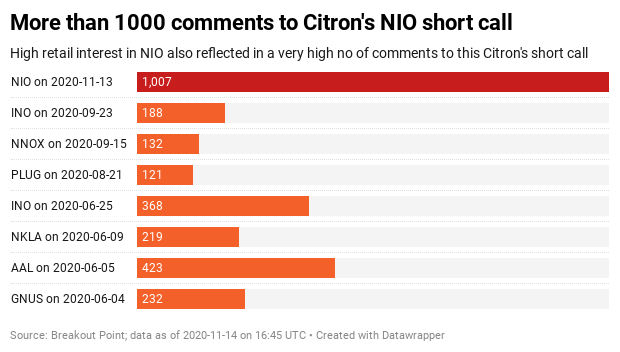

Another interesting side-effect of high retail popularity of NIO has been the record number of often rather negative replies to Citron's NIO tweets:

Citron's short call saw potential trouble for NIO due to the Tesla Model Y pricing which could, according to the short-seller, undercut competitors. Citron set an almost 50 percent lower price target of $25, while the stock closed about 7.7 percent lower on Friday. It will be interesting to see whether Citron's claims and/or Friday's price weakness will affect retail sentiment. Our intraday, real-time retail popularity engine will closely monitor for any signs of change in both sentiment and popularity in the upcoming days.

The U.S. Elections and Retail Popularity

Following the U.S. elections, we noted two major positive retail investor's trends.

Chinese EV Companies

Our recent retail popularity lists have been packed with Chinese EV-related names, the strongest amd the most persistant retail favourites of the past several weeks. This popularity trend among retail investors especially got pronnounced directly after the US elections, as we timely uncovered it here: 'US Elections - Retail Popularity Trends'.

The stocks in question are what some might call the current holy trinity of the Chinese EV space, NIO, XPEV and the most recent addition LI. All three are Chinese-based EV manufacturers which have seen tremendous increases in their share price in the past weeks (so far in Q4, NIO and XPEV are up by more than 100%, while LI is up about 80%).

Recently, the share price action got even more bullish after XPEV released their earnings results which initially further fueled a boom in all three stocks. The company showcased its strong growth in deliveries and improvements in gross margins which, according to some, might be confirming the ultimate bull thesis that future is electric and that the Chinese EV market is going to be much larger than that of the US. Redditors have been mentioning this idea for several weeks, pointing to various 'macroeconomic' factors such as Chinese middle-class and others.

After XPEV, it was time for LI's earnings which topped Q3 estimates. The story is very similar here. Growth in deliveries and revenue seemed to be in focus. NIO reports their earnings on the 17th of November.

While the Wall Street machine has been feeding the retailer's interest in these three stocks (via many sell-side buy calls and assessments of the overall Chinese market), Reddit and Twitter proved equally adept at maintaining the interest. Reddit is filled with stories about people mortgaging their house to invest in NIO, about making someone's father a millionaire and other stories from the corners of r/wallstreetbets and r/stocks.

The share price action turned even some sceptics into short-term options trader hungry for some 'tendies' in the parlance of the subreddit worthy of being a number one example why efficient market hypothesis should perhaps be reworked to include the stocks' potential to 'da moon'.

I bought some NIO short term calls, as one thing I have learned is don't fight the stupidity of markets. Could go to $60 or $100 for all I know, but eventually it will shit the bed.

— Long Short Value (@LSValue) November 12, 2020

Cannabis Companies

The other notable positive post-election trend were cannabis stocks. This trend occured most likely due to some US states approving of relaxation regarding marijuana laws and the hope that Joe Biden will not stand in the way of the ongoing further deregulation. However, as has been seen on many previous occasions with fast and extreme retail positioning, this retail trend also did not last too long and has faded days ago. The increase in the retail popularity of cannabis stocks that we detected preceded most of the recent price increase, while the remarkable decline in this trend preceded subsequent price decreases.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Unless otherwise stated, presented data and analytics is as of available on 2020-11-14, UTC 16:45.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.