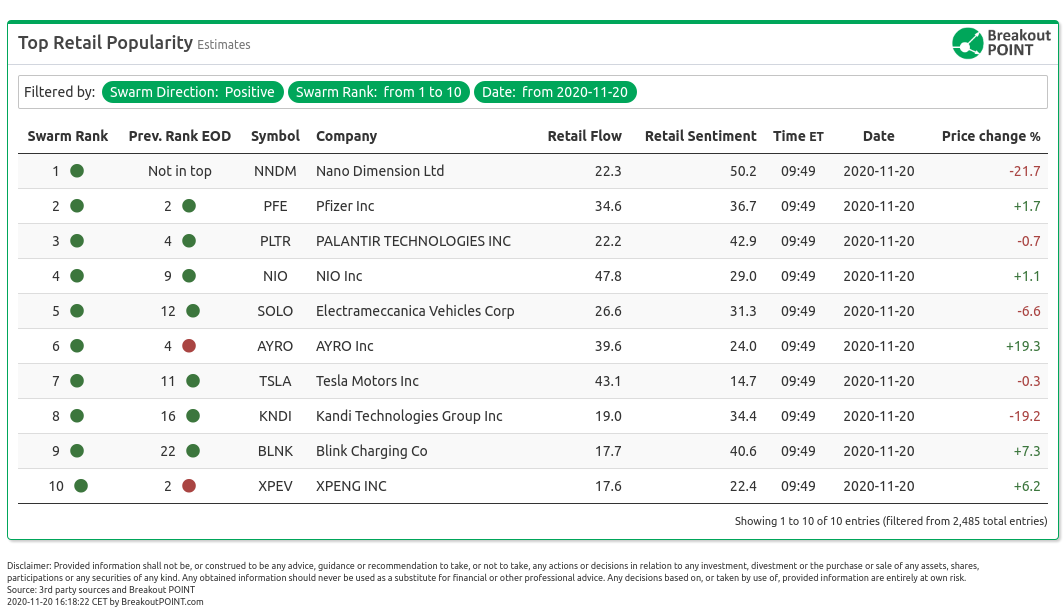

Today in premarket on November 20 we are seeing the following stocks with estimated high retail interest:

Positive Retail Sentiment

Today's notable positive retail sentiment stocks on our top retail popularity list include Nano Dimensions (NNDM), Ayro Inc. (AYRO), Workday (WDAY) and Blink Charging Co. (BLNK).

Today's list is no exception to the previous ones and includes several EV-related stocks. Apart from the obvious darlings of the retail community such as TSLA, NIO or SOLO about which we have written in the past, we are also noting the presence of AYRO and BLNK. AYRO is a $170m company focused on manufacturing of EV vehicles. They just started to sell their product in small numbers.

Despite the start-up nature of the stock, retailers quickly latched on the gains that the stock saw the beginning of this week. r/wallstreetbets started to write about it as another NIO. r/pennystocks even already had other ticker suggestions based on the success of the stock as it went up over 100% in just two days. Twitter day traders were also bullish.

BLNK is an EV charging company which owns charging stations. Thus it eventually started to pump as traders see BLNK catching the potential growth of the whole EV space. r/wallstreetbets went bullish and threads started to pop about gains and further growth. Redditors even acknowledged past short-selling campaigns of Culper and Mariner which alleged the company overstated their business and questioned the track record of the insiders. However, they dismissed the claims via the following reasoning which nicely shows in what kind of environment we are currently in;

Day 4 in a row of double digit growth and they might even be committing fraud who cares this is bull season baby.

Apart from the EV-craze we also note the rise of NNDM. The stock likely landed in the retailers' crosshairs due to their focus of the company (3D printing and 5G tech) and the share price performance as the stock was climbing higher in the past few days. r/pennystocks noted the action and wondered whether the move is likely to continue. It seems though that for now, the upside might be limited as pre-market trading suggests a red day. This is likely due to the announcement of $100m direct offering which is going to dilute the current shareholders. One of the more prominent Twitter traders shared this exact sentiment.

$NNDM funny timing of tweet last night - had peak FOMO missing that huge swing and just like last time they slam it with an offering. This time $100M at $4 ... phew

— Nathan Michaud (@InvestorsLive) November 20, 2020

The company generated $0.4m in the past three months and has reported EBITDA of negative $30m. The current market cap is roughly $400m.

Finally, we are seeing retail interest in WDAY, a $54bn enterprise cloud business. This is due to their earnings report yesterday. The company was able to report solid numbers but did not manage to surprise the market with better-than-expected guidance regarding backlog. The sell-side was rather neutral regarding the report as was one Seeking Alpha author.

Dominant retail selling pressure

Finally, we mention tickers with estimated dominant retail selling pressure: slight negative sentiment in DKNG.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, join Breakout Point and we'll try to help as soon as possible.

* Note: Presented data and analytics is as of available on 2020-11-20, UTC 13:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.