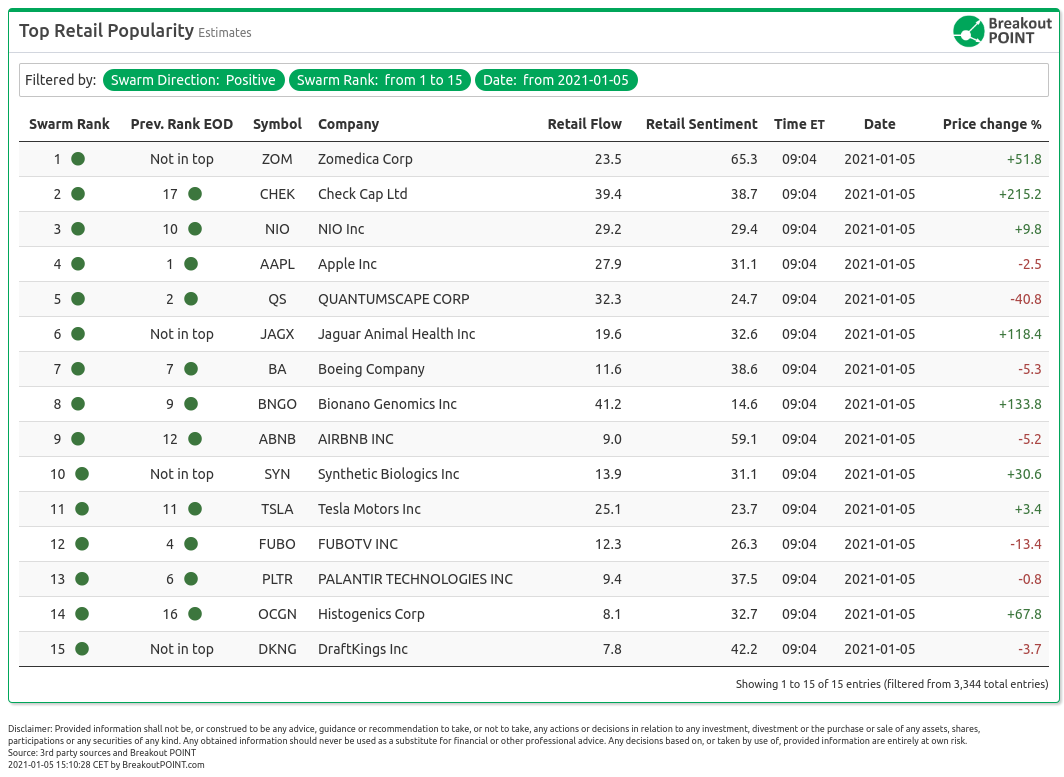

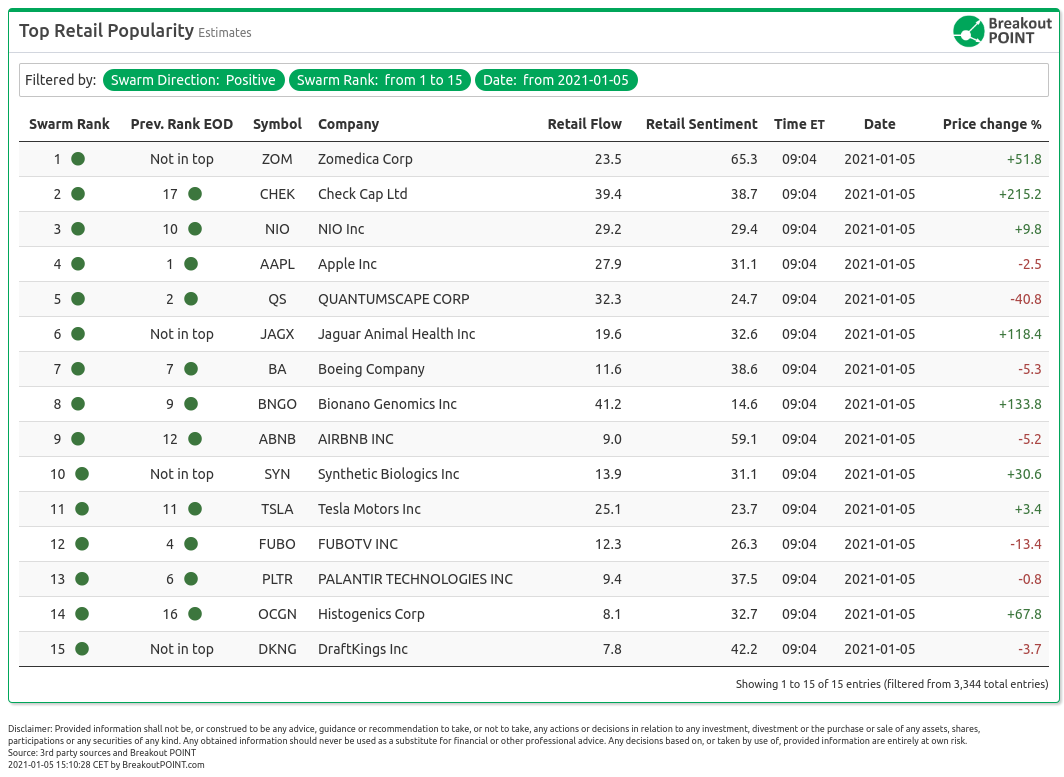

Today in premarket on January 5 we are seeing the following stocks with high retail popularity estimates:

Positive Retail Sentiment

Today's notable positive retail sentiment stocks in the list include QuantumScap (QS), Zomedica (ZOM), Check-Cap (CHEK), Jaguar Animal Health (JAGX) and Airbnb (ABNB).

One of the few popular stocks that had a hard start to this year is certainly QS. This battery-orientated company has seen its shares crater by about 50% and the trend seems to be continuing as the shares are down another 7% in the pre-market. While the start of this negative trend was perhaps driven by profit-taking, yesterday the stock fell by about 40% as they have announced a large share offering. However, there are bulls present. Jim Cramer who was shared on r/SPACs recommended buying into the weakness. Some shared the same sentiment despite the company's lengthy timeline to get a product on the market.

Today's list also features several stocks heavily mentioned by r/pennystocks. ZOM, a pharma company focused on pets, got popular as they have announced they are getting near the commercialization of one of their products. This sparked a lively debate about the potential in many threads which even included some comments from supposed people in the industry who are bullish. It is likely the momentum might last for a while since pre-market points to about 37% appreciation.

CHEK is a similar story as this medical device company focused on cancer screening has risen over 200% yesterday and is up 35% pre-market. Four days ago r/RobinHoodPennyStocks shared one thread which basically laid out the bullish argument which was then likely partially responsible for the run-up. The stock is now hitting the original target price of the thread, but it seems that many have jumped on the bandwagon and see further appreciation as per below.

$CHEK

— biostockGuru (@biostockguru) December 30, 2020

Potential 20X bagger with #patience

Expect $8 + in #2021

Massive disruptive potential $EXAS & valuation is currently (-)ve https://t.co/hLdRZi1MsZ

And the last pharma company we are seeing in the crosshairs of the retailers is JAGX. This stock has been talked about around the relevant penny forums on Reddit for a couple of weeks as they have announced smaller business developments. These sparked a smaller initial rally which then supported yesterday's action. The shares have jumped over 100% and are up 11% pre-market. As the excitement was built upon relatively weak newsflow, it will be interesting to see whether the retailers will be able to support the current gains. There is even one thread which is discussing whether to own JAGX or ZOM. Some comments are saying that both are still valid.

Finally, we are seeing the return of ABNB on the list. This might be due to the fact that the sell-side coverage of the stock commenced yesterday. Two firms have a buy rating, Deutsche Bank and Citigroup are more conservative. Other than that ABNB seems to be a favourite portfolio pick for many retailers sharing their ideas around Twitter and Reddit.

Dominant retail selling pressure

Finally, we mention tickers with estimated dominant retail selling pressure: MSFT

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us and we'll try to help as soon as possible.

* Note: Presented data and analytics is as of available on 2021-01-05, UTC 13:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.