- This week we have registered three new major short campaigns.

- Perhaps the most successful one was by Hindenburg Research, who again added another win to their already storied track record. They are six for six this year with an average performance of -38%.

- We also look at the developments in Australia. JCap seemingly won a battle in the campaign against Nearmap as the company is sued for patent infringement.

- Lastly, we are tracking the most recent stock price gyrations at a cybersecurity company and a plastics recycling operation.

Bits and Pieces

“The plan is to look for really fraudulent names, as well as ideas where we think there’s a strong accounting angle.” Short Seller Soren Aandahl Chases Targets With New Hedge Fund

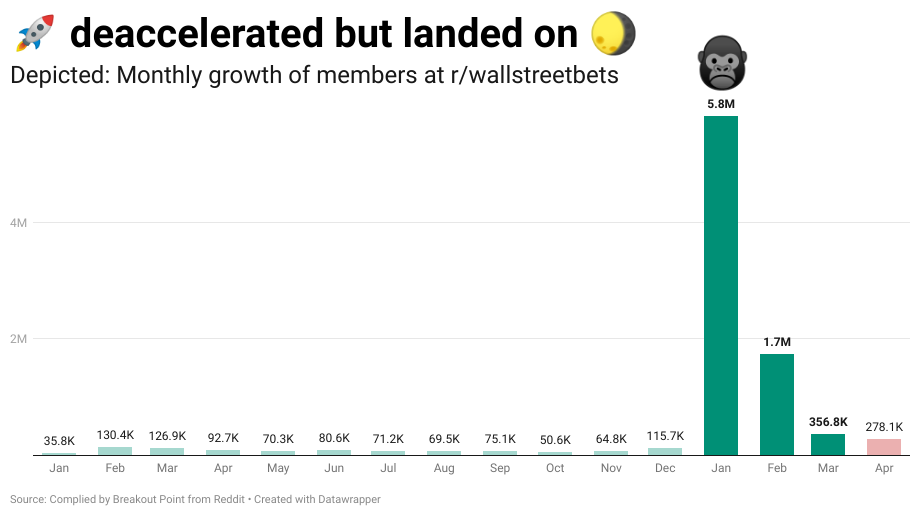

r/wallstreetbets reaches 10 000 000 members

- Shaping to be a year of exciting activist shorts comebacks, recently Bleecker Research returned and now:

Some exciting personal news: At the end of May I’ll be leaving Pacific Square Research to start a new venture in activist short selling. Stay tuned for details!

— Herb Greenberg (@herbgreenberg) May 5, 2021

Get most popular retail stocks. Track real time retail sentiment and popularity via our APIs and dashboards.

Big Movers

This week’s we saw several stocks that moved in the right direction for the short-sellers. One of the biggest movers was Intrusion (INTZ) which was down about 31% for the week. This cybersecurity company was targeted by White Diamond Research due to allegations of dubious product and questionable track record.

Most importantly, the report believes the company's core new product is supposedly without any significant underlying intellectual property and is based on open-source tech, which is freely accessible. The beta test of the product was also done by associated parties with INTZ. The product documentation is apparently filled with buzzwords but leaves out any meaningful information.

The company collapsed after releasing Q1 numbers, which disappointed, unable to show much-needed growth. Furthermore, White Diamond pointed out this quote from a sell-side report.

$INTZ "B. Riley analyst Zach Cummins downgraded Intrusion...Further, Intrusion declined to provide any insight into the current number of paying seats for Shield."

— White Diamond (@WhiteResearch) May 5, 2021

Oof. The CEO told people in private that all 50K seats were paid for.

Thus it seems there is still a downside opportunity as the company might struggle to keep up appearances. White Diamond initially saw a downside of more than 80%. Currently, the stock is down roughly 64% since the initial report.

The second stock that also tanked was Danimer Scientific (DNMR), as it lost about 26% of its value in W18. Spruce Point targeted this plastic recycling stock due to allegations of dubious corporate governance.

Most importantly, the report believes the company features several red flags connected to the company's insiders. The current CEO is tied to an entity involved in a potential cover-up of a deficient product. That entity also had troubles with accounting. The previous CEO of DNMR sued the company, and the alleged board of directors is controlling the whole enterprise. DNMR settled the suit.

On Tuesday, Spruce released an update to their thesis and added claims of overstated production by the company, as can be seen below.

come on @SEC_News@SEC_Enforcement@NewYork_SEC@SECEnfDirector here's smoking gun evidence on $DNMR - where are these production restatement figures disclosed to investors? Why no mention of env't regulation. Negative production results? Please investigate immediately pic.twitter.com/rRz3B2cMkY

— Spruce Point Capital (@sprucepointcap) May 4, 2021

The company issued a quick response and denied the allegations. They also said that they will be happy to provide an operational update on their upcoming conference call.

On the other side of the tracks, we have not really seen so many major upward moves in tracked stocks. The 'biggest' mover was Credit Acceptance (CACC) was up by about 2%, but there was no significant news that would carry the stock other than the broader market action. CACC was initially targeted by Citron and later by Eisman. The core thesis was revolving around regulatory pressures. Both short-sellers believed the CFPB might press the company to reduce profits. So far, this trade has worked against them. The stock is up 22% since Eisman spoke about the short.

Hard-hitting Hindenburg

This week we also saw the short-seller behind many successful campaigns target Purecycle Technologies (PCT). Hindenburg wrote about this SPAC due to allegations of dubious business model and questionable track record of insiders.

Most importantly, the report believes the company is unlikely ever to generate much...

(Get full weekly report and stay on top of activist short selling developments - Join Breakout Point).

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our workpétrir in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us, and we'll try to help as soon as possible.

* Note: Presented data and analytics is as of available on 2021-05-10 UTC 11:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.