- This week we have registered two major campaigns and a couple of smaller updates.

- After a longer period of silence, Viceroy has come out and published about an oil exploration company in Africa supposedly riddled with many issues.

- J Capital and Jehoshaphat Research provide updates on their recent campaigns. Both still see a significant downside.

- Lastly, we are tracking the most recent stock price gyrations at several previous targets, from COVID-19 vaccine stock to dubious renewable diesel company.

Bits and Pieces

- Stunning Confessions of a Short Seller (via Institutional Investor):

Anonymous short activist Rota Fortunae profited from put options on Farmland Partners — and now admits the relevant report he authored was riddled with errors.

London hedge fund that bet against GameStop shuts down (via FT)

The Stock Market Enters Late-Stage Fanaticism (via Bloomberg):

"The fervor surrounding even tiny stocks seems unhealthy and largely unsustainable."

BlackRock and Citadel cut Morrisons bets after share price surge (including Breakout Point's data and analytics via FT)

"Citadel upped its bet to 0.53 per cent of the company’s shares on June 10 and then three more times in recent days, leaving it with a 0.8 per cent short position just before the bid was reported."

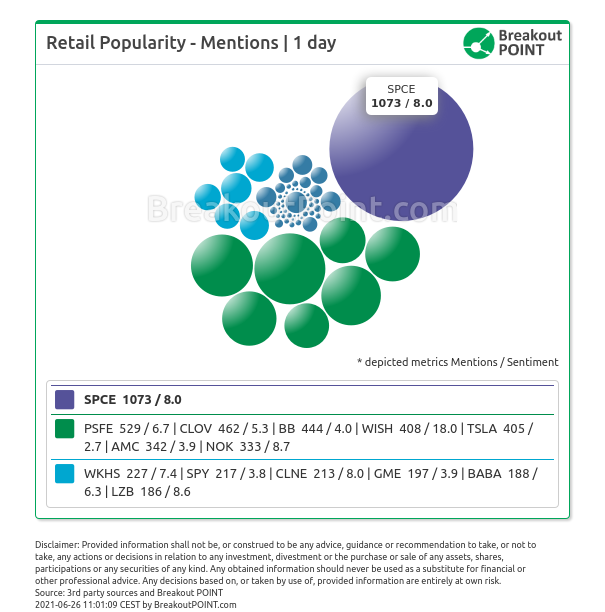

Get most popular retail stocks. Track real time retail sentiment and popularity via our APIs and dashboards.

Big Movers

This week’s we saw several stocks that moved in the right direction for the short-sellers. One of the biggest mover was Bit Mining (BTCM) which was down about 17%. We cover why the stock lost some of its steam in the section 'smaller updates', where we explain what J Cap thinks about the latest developments.

On the other side of the tracks, we have seen some movements against the short-sellers.

The most notable mover was Virgin Galactic Holdings (SPCE), June short of Kerrisdale, that ended the week more than 50% up. This long-standing retail favorite got in instant focus on Friday morning after getting the green light from the FAA to fly passengers to space. It ended the week as the most popular retail stock in our retail popularity and sentiment records.

Among notable movers was also Cielo Waste Solutions (CMC) which was up 10% in the past five days. Initially, Night Market targeted this $600m renewable diesel company due to allegations of dubious joint ventures and weak finances.

Most importantly, the report believed the company is unlikely to go through with its joint venture plan. The JV partner, which should come up with financing for the business, has only $300k in cash and struggles to attract investors. The partner is also a related party as the person behind it used to run Cielo's investor relations team. Cielo itself is struggling to come up with any outside money. They did find an allegedly dubious zero-interest loan, but Night Market questioned who would lend Cielo such money given their financial state.

It seems the market has not been giving the claims much importance. On top of this week's rise, which was likely spurred by approval to list on TSX Venture Exchange, the stock is up over 20% since Night Market's report which was published in late May.

We would also mention Ocugen (OCGN), which was back up by about 27%. This COVID19 vaccine biotech was initially targeted by logphase Research in March of this year as the short-seller believed the drug is unlikely to be approved. Even if it should, according to the activist, it will face significant challenges given other competing solutions. The stock has been on a wild ride ever since the report, first appreciating and then crashing as it became obvious that the company will have to do another test to get approved in the US. The stock is now down slightly by 2% since the report, but it seems retail traders are still following the story. Thus the campaign is unlikely to be at its end.

African pipe dream?

This week we also saw a well-known short-seller start a campaign aimed at a $1.6bn Canadian junior oil company due to allegations of being an insider enrichment scheme.

Most importantly, the Viceroy Research believes the company will not discover oil in the purported area they are supposedly operating in. According to the short seller, this is mainly due to the lack of data to support the idea that there might be oil. Moreover, Namibia, where the area is located, allegedly does not...

(Get dashboards access and full weekly report. Stay on top of activist short selling developments - Join Breakout Point).

FAQ | Q: Can I publish parts of the above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, join Breakout Point and start benefitng from our services.

* Note: Presented data and analytics is as of available on 2021-06-26 UTC 14:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.