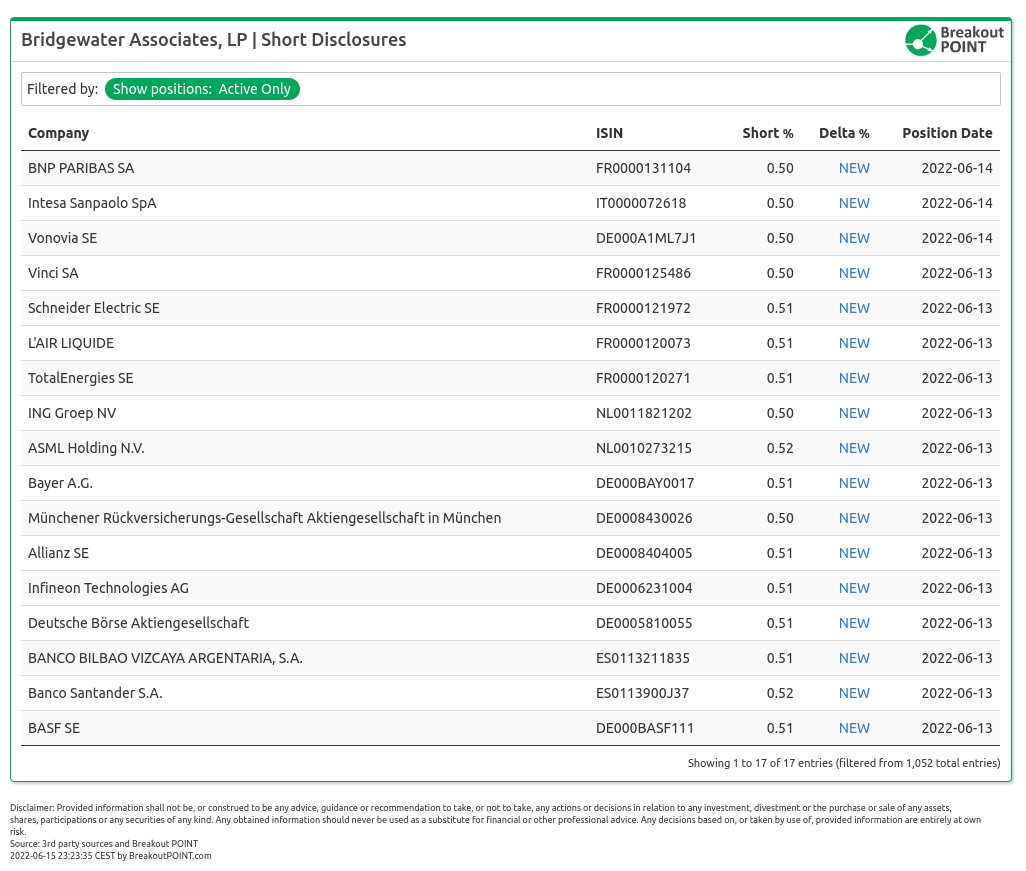

17 new short positions by Bridgewater were disclosed so far this week. All are bets against major EU companies, including, Allianz, TotalEnergies and BNP Paribas. We estimated that, as of Wednesday's close, cumulative short position is worth about €5.2b.*

Bridgewater back with Big EU Shorts

We captured 17 new big shorts out of which seven are in Germany, five in France, two in Netherlands, two in Spain, one in Italy.

We estimated more than €5.2b of worth in these short bets, as of Wednesday close. Among the biggest short positions of the world's largest hedge fund are a 0.52% short in ASML Holding N.V. (short about €1b at a mkt cap of €194b), a 0.51% short in TotalEnergies SE (short about €700m at a mkt cap of €138b), and a 0.51% short in Allianz SE (short about €390m at a mkt cap of €76b).

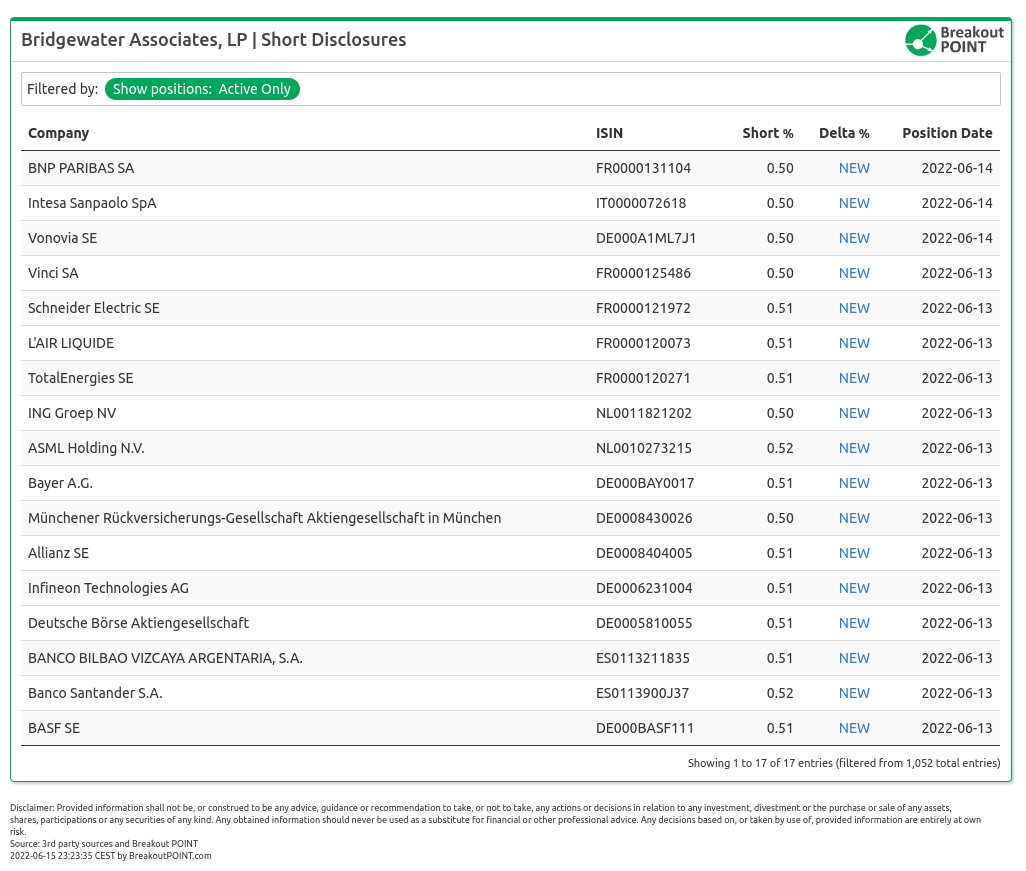

Here are all so far disclosed shorts:

The fact that all these shorts appeared within few days indicates index-related activity. In fact, all of shorted companies belong to the STOXX Europe 50 Index. If this is indeed the STOXX Europe 50 Index-related strategy, that would imply that other index's components are also shorted but are currently under disclosure threshold of 0.5%. It is unknown to us to which extent these disclosures may be an outright short bet, and to which extent a hedge against certain exposure.

As recently reported by FT, Bridgewater bets against US and European corporate bonds on slowdown fears.

When it comes to magnitude of short selling, we don't recall any other money manager coming close to this, except for Bridgewater itself. They had something similar back in Q1-2018 and then Q1-2020.

What about 2020 shorts by Bridgewater?

A the start of pandemic, in Q1-2020, Bridgewater disclosed more than 40 well-timed EU short positions (in Italy, Spain, Germany, France, Netherlands, UK,...). However, the last of these short positions were cut under 0.5% of issued share capital in March 2020.

Beyond above three occurences, Bridgewater appears very rarely in our records.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: How can I get more related data and analytics? A: Join Breakout Point to benefit from unique short-selling insights.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital. „Big short“ refers to a short position above 0.5% of company issued capital. Presented data and analytics is as of available on 2020-06-15 20:00h CET.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.