- This week we have registered three new major short campaigns.

- All of them targeted EV plays. Peabody and Fuzzy Panda aimed at EV charging businesses and Grizzly Research took a shot at the Chinese favourite, Nio. Fuzzy is ahead so far with their stock down about 16%.

- Lastly, we are tracking the most recent stock price gyrations at several previous targets. We feature a failing biotech, a crypto company and a traditional Chinese medicine business.

Save time and ask us for independent short thesis verification. Get our custom support. Contact Breakout Point!

Bits and Pieces

- Kynikos’s next ‘big short’ is data centres - Short seller bets against Reits that own big server warehouses on risks that customers will become rivals (via FT).

- Boatman continues to pound on AVZ shares which are still suspended.

The dispute over @AvzMinerals ownship of its DRC lithium mine drags on into a third month. Shares still suspended. $AVZ only told investors about the problems in May but has known about them since 2021. This appears to be a failure to disclose material information. @ASXpic.twitter.com/NQ8yZMnpWg

— TheBoatmanCapital (@BoatmanCapital) July 1, 2022

- Viceroy does not see SBB's recent moves as sufficient clarification and continues to allege improper accounting.

SBB confirms previous non-cash entries in cashflow statement, & mild disclosures of acquisitions. Investors can, for the first time, actually analyse the cashflow of $SBB. "Industry standard" rhetoric is finally out the window. 1/3

— Viceroy (@viceroyresearch) July 1, 2022

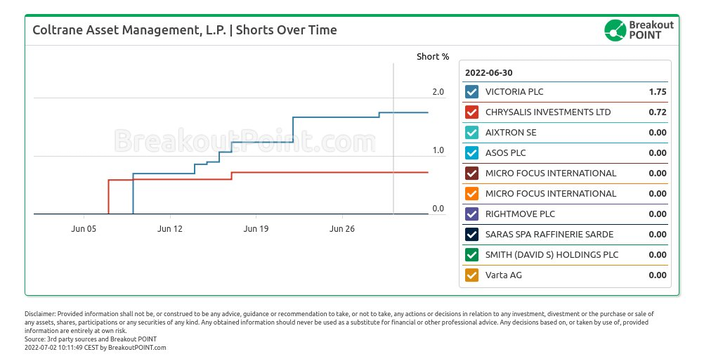

- Nice shorting by Coltrane. Several weeks ago, we uncovered Coltrane's timely Chrysalis big short, Chrysalis is UK investment trust with a huge Klarna holding. Chrysalis -25.5% since Coltrane's big short appeared. Klarna's valuation went from $45b in 2021 to $6.5b in 2022.

Big Movers

This week we saw several stocks that moved in the right direction for the short-sellers. Among the biggest movers was Enochian Biosciences (ENOB) which dropped 42% in the past week. This biotech was recently targeted by Hindenburg Research due to allegations of dubious management.

Most importantly, the report believed the co-founder and key asset of the company is a fraud and a repeat felon. As per Hindenburg, the co-founder does not seem to have any medical degree despite touting many pre-clinical assets which have been licensed to ENOB from co-founder-controlled entities among other things. Apparently, the co-founder siphoned over $20m from shareholders over the years.

The thesis started to play out and the stock is now down already 63%. There does not seem to be any news that would specifically showcase why the stock continued to drop apart from an article in WSJ that talks about the troubles of the co-founder. Hindenburg eagerly shared the news which is further supporting their own research.

New from the WSJ on $ENOB: Biotech Wizard Left a Trail of Fraud—Prosecutors Allege It Ended in Murderhttps://t.co/bpd11wT01C

— Nate Anderson (@ClarityToast) June 27, 2022

Another drop was seen in Core Scientific (CORZ) which went down 28% in the past five days. Initially, it was Culper Research who targeted this hosting and mining company due to allegations of dubious transactions and overvaluation.

Most importantly, the report believed the company went public by buying a bitcoin mining entity that was formed just a few months before CORZ acquired it. As per Culper, the management apparently tried to paint a favourable picture for the price tag, but the entity was initially funded with $58m and then bought for $1.46bn in seven months. This is allegedly dubious and creates significant questions about the transaction.

Unsurprisingly, the stock continues to tank as the crypto market is struggling to rebound. CORZ is down 80% since Culper highlighted the alleged issues. The stock was not even lifted by the news that it is set to join Russell 3000.

On the other side of the tracks, there were several movements against short-sellers. One of the most significant surges was seen in Regencell (RGC) which went up 15% this week. This traditional Chinese medicine company was targeted by Peabody Street Research in February of this year due to allegations of corporate misconduct.

Most importantly, the report believed the company has failed to disclose that its strategic partner is guilty of professional misconduct. According to the activist, this also raises red flags in RGC's effort to further its projects. Their COVID19 venture partnered with a company owned by a hotelier. This apparently raises questions as to the validity of the research being done.

Since the report, the stock is trading sideways and is almost flat in terms of performance. Thus, it seems the thesis might not be getting into the market easily. The retail chatter is present, but most people talk about RGC as a short-squeeze candidate.

EVs are on the chopping block again

This week we also saw three new campaigns. All of them targeted businesses focused on the booming EV industry. First, we saw a bombshell of a report by Grizzly Research who set their sights on Nio (NIO), a Chinese EV darling. Grizzly targeted this $41bn Chinese EV manufacturer due to allegations of accounting fraud.

Most importantly, the report believes the company is using a seemingly unrelated entity to juice up their revenue and net income numbers. The entity is allegedly allowing NIO to pull forward its battery revenue which is normally sold under a 7-year subscription. The entity is also supposedly oversupplied with NIO's batteries which could lead to further revenue inflation at the NIO level. Grizzly estimates the entity could represent 60% of the earnings beat last quarter. Curiously, since NIO disclosed this entity, the company was always able to handsomely beat estimates.

In an apparent violation of these “Users” trust, Li pledged these shares to UBS to secure a personal loan. With $NIO stock declining 50+% since the pledge, we believe shareholders are unknowingly exposed to the risk of a margin call against the Users Trust shares.

— Grizzly Research (@ResearchGrizzly) June 28, 2022

Moreover, there are also clear red flags when it comes to management. The battery entity has two top executives which are apparently employed by NIO as a Vice-President and Battery Operating Executive Manager. This could present a clear conflict of interest. The CEO of NIO is also a red flag due to its alleged connection to the people behind the Luckin' Coffee fraud and his actions where he pledged shares in NIO as collateral for a personal loan.

Due to all this, the short-seller sees a significant downside and a risk of significant dilution ahead.

Yes, you read that right, the Chinese government invested ~$1bn in 2020 in $NIO China and already was paid back ~$2bn and is owed another ~$6bn. Ask yourself who is getting the short end of the stick.

— Grizzly Research (@ResearchGrizzly) June 28, 2022

The report drew a lot of interest from the market. The stock did not budge, but the company saw the need to issue a boilerplate response denying all the allegations. Several other market participants joined the company's side as per below.

BREAKING : JP Morgan dismantles Short-seller report, remains positive on NIO — EV $NIOhttps://t.co/1biJnlpz7q

— Afonso (@AfonsoEV_) June 29, 2022

We also saw one well-known long/short analyst publish his critical thoughts about Grizzly's work behind the paywall.

The other two campaigns were aimed at smaller targets. We saw Fuzzy Panda, an activist who already has several successful EV campaigns behind them, target EVgo (EVGO). Fuzzy targeted this $1.7bn EV Charging company due to allegations of a broken business model.

Most importantly, the report believes the fundamentals are simply not...(get full report and dashboards access - Join Breakout Point)

(Stay on top of short selling developments - Join Breakout Point).

FAQ | Q: Can I publish parts of the above data and analytics in an article? A: As long as you reference our work - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us, and we'll try to help as soon as possible.

* Note: Presented data and analytics is as of available on 2022-07-02 UTC 10:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.