- This week we have not registered any new major short campaigns.

- Despite low activity in new publishing, we are seeing plenty of updates. Muddy Waters continues to grapple with RUN, Spruce is close to hitting its target on FIGS and NINGI Research talks about how rates could push its target lower.

- Lastly, we are tracking the most recent stock price gyrations at several previous targets. We feature a surprise comeback of a dubious biotech, a failing EV company and cybersecurity company almost hitting short-seller's target.

Save time and ask us for independent short thesis verification. Get our custom support. Contact Breakout Point!

Bits and Pieces

- Hedge funds take aim at UK fund management groups (via FT with Breakout Point data)

- Founder of Muddy Waters calls crypto 'almost entirely tulip (via FNLondon)

- Audits of Chinese Companies Start to Face U.S. Inspections (via WSJ)

Big Movers

This week we saw several stocks that moved in the right direction for the short-sellers. Among the biggest movers was yet again Ironnet (IRNT), which dropped about 28% in the past week. This cybersecurity company was initially targeted by White Diamond Research due to allegations of a dubious business model.

Most importantly, the activist believed the company is unlikely to create much shareholder value as the business is losing a significant amount of cash, and few developments would suggest IRNT can sell its product.

Now it seems the thesis has worked out completely, and White Diamond is just a couple of percentage points from achieving its intended downside of 92%. Currently, the stock is down 87%. The continuation of the downtrend this week seems to be due to lack of news that would spur bulls to come back. The retail chatter is also lower than last week as traders seemingly abandoned the shares.

Another stock which moved in the direction of the short-seller thesis was Mullen Automotive (MULN), which fell about 27% in the past five days. Initially, it was Hindenburg who targeted this EV company due to classic allegations of pump and dump scheme.

Most importantly, the report believes MULN's hyped solid state battery tech is unlikely to generate much value. Recent PR which talked about the performance was apparently a rehashed news from 2020. The testing partner also allege MULN misrepresented the results. MULN also apparently does not have the needed EPA certificate to even produce its own EV vans.

The thesis has almost played out as the stock is down 86% since the initial report as the broader EV sector saw a rapid cooldown of retailers' interest. This week MULN is dropping further as the company announced an acquisition of ELMS out of bankruptcy. This is seen by some as a last ditch effort to revive the business plan. The EV activist, Fuzzy Panda, is not buying it and believes both companies might end up bankruptcy.

$MULN buying $ELMS & Bollinger assets in bankruptcy is an insult to hard-working auto employees in the Midwest

— FuzzyPandaPA (@FuzzyPandaPA) September 21, 2022

MULN burnt $54m FCF cash and had 99m in cash (6-30)

So in 2 quarters all 3 co's will be bankrupt again?

Reminder - $EVGO called $ELMS & $MULN their key customers pic.twitter.com/dHNJBq8fgp

The activist also implicates their other short, EVGO. That stock is up 15% since Fuzzy's report, and thus it seems this specific thesis has been harder to push across the market.

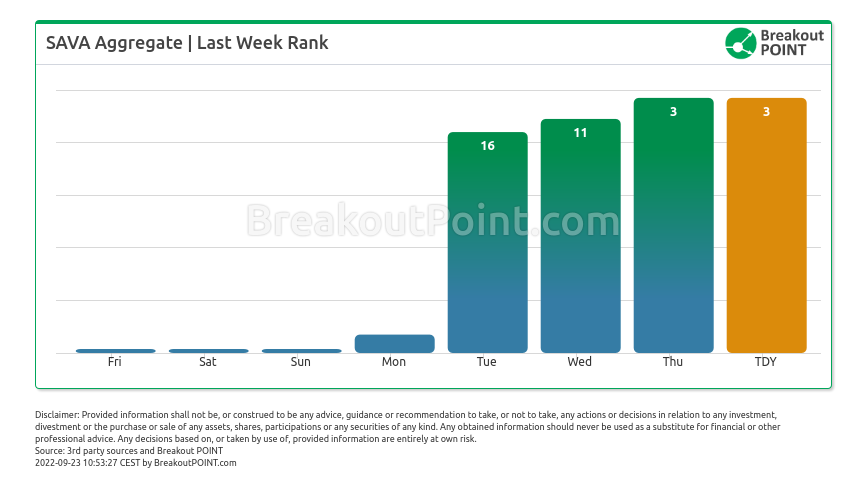

On the other side of the tracks, there were several movements against short-sellers. One of the most significant surges was seen in Cassava Sciences (SAVA), which jumped 64% in the past week. Initially, it was targeted by QCM and a group of PhDs due to allegations of an insider enrichment scheme and dubious product.

Most importantly, the reports believed the company has forged research that it used to test its Alzheimer-focused drug. The Phase 2 trial was also apparently mired with serious irregularities. The drug is supposedly worthless as the excitement was built on various cherry-picking of seemingly promising data.

Initially, it seems the activists are winning over the whole market as SEC announced an investigation and the investment community started to scrutinize SAVA's data points. The stock was down as much as 77% at one point, and bulls were resorting to a short-squeeze thesis. However, in the past few days, the whole situation changed. The market got excited that SAVA's SEC investigation is about to end, and seemingly the bull case will return. SAVA might be able to continue its research, and the market seems to again care about the potential.

This spurred many retail traders to jump on the bandwagon and push SAVA up. This was not entirely hard as there is still a material short interest present in the stock. The chatter was lively on Twitter.

In terms of new material, the activists are relatively mute for now. However, they do closely follow the price movements and have commented on it:

What’s been happening to $SAVA stock during the last few weeks, and particularly during the last 48 hours, looks to me like a textbook case of market manipulation.

— Quintessential Capital Management (@QCMFunds) September 23, 2022

Some watchers said that end of an investigation might not mean much.

This headline on $SAVA is misleading. The SEC “officially clears” no one when it ends one of its investigations. The agency even tells a party under investigation that its termination implies no such thing. Copy of a real termination letter here - https://t.co/p6jFGasQPEpic.twitter.com/N9Rmvlg8IH

— Disclosure Insight® / Probes Reporter® (@direports) September 22, 2022

A couple of updates

Since we have not seen any new reports by activists, we are going to focus on updates to the existing campaigns. First, it was NINGI Research that shed a bit of light on how the interest rate hikes could hurt BRP, the latest target of the activist. NINGI targeted this insurance product company due to allegations of dubious accounting and a weak business model.

Most importantly, the report believes the company has masked a decline in organic growth via an affiliate relationship. This was used to prop up the organic growth, while it should have been classified as inorganic. The difference is about 7% and is even below analyst estimates. The future estimates by the company are also tainted in this way. Here the activist believes the growth is likely to be 27% instead of the advertised 70%.

The stock is down 15% for now, but the activist sees further trouble ahead.

With yesterday's #FED decision and the new median forecast, we think that $BRP's interest expense jumped by $10m to $88m for full-year 2023. With the #correction in the #housing market, $BRP's revenue and margins will compress even faster. No deleveraging in the future. https://t.co/CMwovJmwKU

— NINGI RESEARCH (@NingiResearch) September 22, 2022

The interest rate hike is likely to reverberate throughout the market and other stocks are likely to be impacted as well.

Another update came from Spruce Point. The activist tweeted the following which seems to confirm their thesis on FIGS, a healthcare apparel company.

Anyone catch $FIGS hot sale yesterday - 25% off. Looks like the discounts increasing; why do this if inventory is turning over fast...?? #skepticpic.twitter.com/wEQzKyRigp

— Spruce Point Capital (@sprucepointcap) September 22, 2022

The stock is down 20% and thus on its way to the intended target of about 45%. Spruce targeted FIGS due to allegations of a poor business model.

Most importantly, the report believes the company is unlikely to sustain its revenue from the past two years. These were apparently helped by COVID-19 boost, which is allegedly not going to repeat. The demand is likely to normalize, and competition is springing up. This is a problem for FIGS as they allegedly do not have any product advantage.

Last but not least, Muddy Waters continues to grapple with Sunrun (RUN). This solar company is up almost 14% since the report, and it seems the allegations are failing to uproot the bullish thesis. However, that does not mean the questions went away.

1/7 Hey @MaryGPowell; can you help my team understand why in $RUN's response to the @muddywatersre' report on August 2, 2022, it seems the numbers you stated are NOT supported by your deals or NREL's numbers? Specifically, $RUN stated:...

— Gordon Johnson (@GordonJohnson19) September 20, 2022

Muddy targeted RUN due to allegations of a dubious business model. Most importantly, the report believes the company could face a dire need for equity issuance to stay afloat. First, RUN is allegedly overestimating the value of their current assets due to the use of questionable accounting. Muddy adjusts 'Net Earnings Assets' down as much as 90%. Second, the company is apparently misleading IRS about its Power Purchase agreements. Third, RUN's ABS securitization could expose the holders to the bankruptcy of the company due to a lack of reserve.

FAQ | Q: Can I publish parts of the above data and analytics in an article? A: As long as you reference our work - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us, and we'll try to help as soon as possible.

* Note: Presented data and analytics is as of available on 2022-09-23 UTC 10:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.