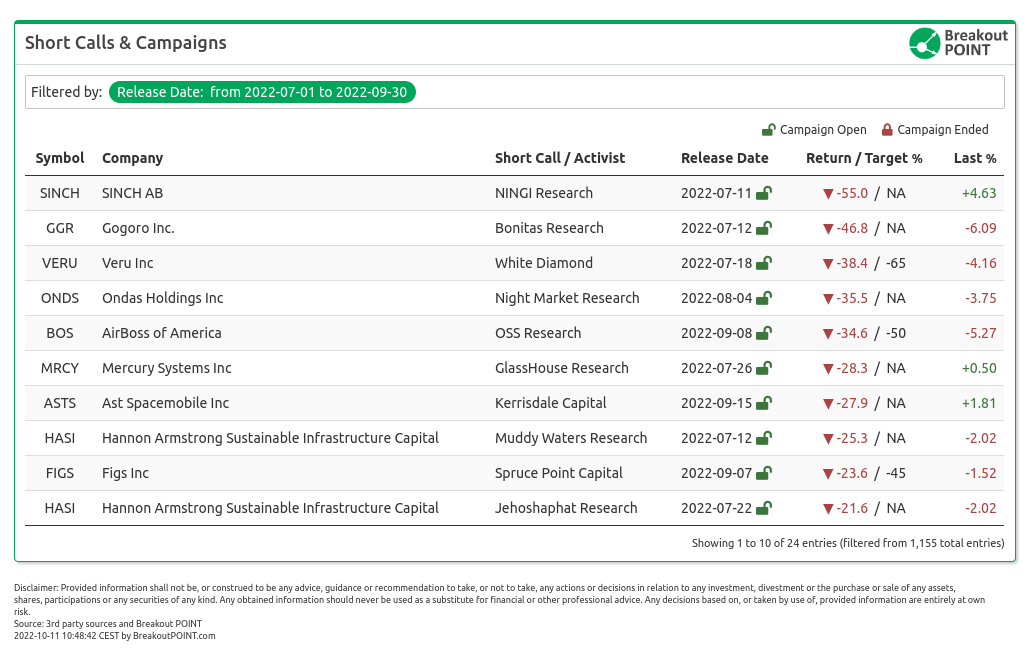

- In summerly third quarter we have seen 24 new short campaigns. Shares of companies in short focus are down 14.4% on average. This compares to S&P 500 declining about 5.3% in Q3.

- We highlight some of the best performers with NINGI taking the first place for a European short of a telecoms company with allegedly fraudulent accounting. Others scored with allegations of dubious business models, economics and questionable accounting.

- While there were several successful campaigns, the winner of Q3 might be Hindenburg to some extent. The activist went on and joined the wild discussion about Twitter and Musk. They wrote up a short report in Q2, the shares tanked. Hindenburg then assessed the news and went long in Q3. The stock followed. Perfect timing.

- We also touch on Q4 and what we believe could be in store for the activists and investors tracking the space. We see a potential for increased scrutiny of ESG, starting with Muddy's recent target Sunrun. For now, the stock is defying the allegations of dubious economics and questionable accounting. We also note how activists are going outside the usual focus more often.

Favourable Winds

The market's erratic trading in Q3 definitely allowed many activists to prosper, especially since S&P 500 eventually ended down at about 5.3% for the quarter (ending 30th September). This is despite what seemed like an effort to recoup some of the losses in the middle of the summer. The summer period was also a bit slower in terms of brand new reports, so that Q3 ended with 24 reports, versus 32 in Q2.

Furthermore, the trends we have noted in the past few months continued. While there were pockets of retail favourites, such as Bed Bath & Beyond Inc. (BBBY), which were trending due to the infamous short-squeeze thesis, the overall mood of Reddit was much more favourable to shorts.

The positive results for shorts can be seen below.

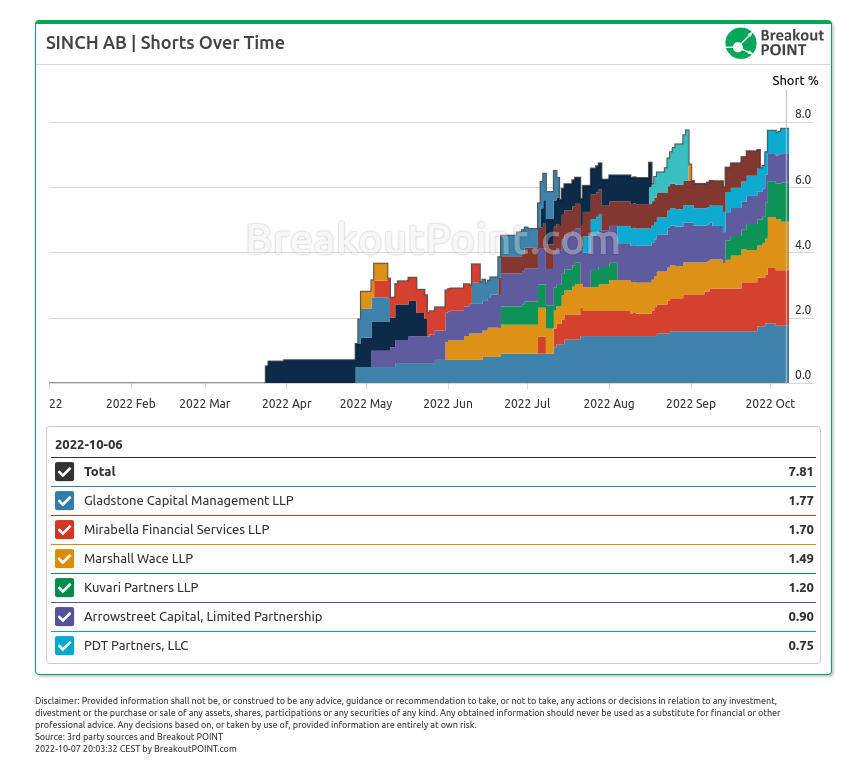

In terms of shares declines following the report, the crown for the quarter is taken by NINGI who targeted a 1.7bn Swedish-based telecommunications company due to allegations of fraudulent accounting. Most importantly, the report believed the company has significantly overstated its profits and revenue by aggressively recognizing topline. As per the activist, while SINCH received an unqualified audit, the auditor did mention weakness in trade receivables.

The thesis was seemingly accepted by the market as investors started to sell. The company also released a slew of negative news from profit warnings to divestments. NINGI was also not alone in the short as several notable institutions also had a position.

The activist did not update its position for a while, but suggested the Swedish stocks are not doing well as Viceroy's Samhallsbyggnadsbolaget i Norden AB (SBB) also went down significantly.

Good morning #Sverige, looks like after yesterday's report on $TRUE by @viceroyresearch, investors are getting margin calls and don't answer their phones. $SINCH down 10pct and $SBB down 6pct.

— NINGI RESEARCH (@NingiResearch) September 29, 2022

Another success was registered by White Diamond Research who wrote about a COVID-19 stock. The pandemic might be garnering a lot less interest, but there are still some stocks with a downside. According to the activist, Veru Inc. (VERU) is one of them. White Diamond wrote up a report due to allegations of dubious product.

Most importantly, the report believed the FDA is unlikely to give VERU a EUA for a COVID-19 drug. The results so far suggested the drug might be working, but the activist sees several red flags in the data. The company is apparently using too small of a sample size, questionable high mortality in the placebo group, the difference in baseline patient populations and several other factors which might have boosted the actual results.

White Diamond were not the first ones to write about VERU. In fact, it was Culper who released their own take with similar allegations in May of this year. However, White Diamond managed to have slightly better 'timing'. The stock is actually down 'only' 9% since Culper wrote about it, but even White Diamond recognizes they could have been more precise.

We were too soon on $VERU. This earnings call pump was the next chapter in the story. Given that the company said the FDA isn't going to audit any more clinical sites, this will likely be the last pump.

— White Diamond (@WhiteResearch) August 11, 2022

At the same time Culper believes their initial take did not change much and that significant downside is still there.

$VERU's AdCom docket for public comment is now open, and another commenter (no affiliation) again raises concerns and calls for a larger trial. We agree and believe an EUA remains a non-starter.https://t.co/xJIAfAGn0h

— Culper (@CulperResearch) September 15, 2022

We would also like to point out the meaningful decline in AST Spacemobile (ASTS) which was written about by Kerrisdale. The reason for the highlight is that the stock used to be a retail favourite. On the day of the report, Reddit featured several disparaging threads about the activist, but overall the reaction was muted. This continues to show that activists are now facing less pressure when writing about some names which seem to have at least some following.

Kerrisdale targeted ASTS due to allegations of a dubious business model. Most importantly, the report believed the company is unlikely to be able to develop its unique product which would eventually connect a mobile phone directly with a satellite. The company launched the initial product and will now start unrolling the satellite. Allegedly, many experts believe ASTS will not be able to unroll the product.

The rest of the stocks on the list are almost exclusively shorts targeting stock with dubious economics or questionable accounting. A sort of bread and butter of short-selling before the pandemic. HASI by Muddy or MRCY by Glasshouse serve as good examples.

Hindenburg's Twitter Reversal

While the stocks that dropped the most were not connected to the activist, we can say that Hindenburg saw another interesting quarter for them.

Perhaps the most notable event was the Twitter saga. Hindenburg first went short in Q2, only to then understand the potential for reversal of the events and bought stock in Q3. The shares were acting as Hindenburg dictated.

We have closed our long position in Twitter. pic.twitter.com/wsmbhxtyz9

— Hindenburg Research (@HindenburgRes) October 4, 2022

For now, it seems the saga might be over, but who know what will the activist see next. In the meantime, the activist was also able to share plenty of news about their previous shorts playing out as intended such as LOOP.

On Friday, the SEC charged multiple individuals over an alleged deceptive scheme to promote and secretly dump shares of $LOOP.

— Hindenburg Research (@HindenburgRes) October 4, 2022

This includes former $LOOP director Donald Danks, featured prominently in our report.$LOOP CEO Daniel Solomita was named as a relief defendant. https://t.co/ecYbyLcOSTpic.twitter.com/5pi6EMJ8yU

The activist also continued its crusade against EBIX which was targeted by Hindenburg due to allegations of dubious accounting and questionable customers.

Given that the court order only covers our original $EBIX report tweets, it won’t cover this tweet.

— Hindenburg Research (@HindenburgRes) August 25, 2022

So here is our report (again) for any Indian readers who may have missed it.

We continue to expect its planned IPO will flop or fail.https://t.co/2edgsB96qH

The stock is down only 15% so far.

The activist also managed to share news about the Trevor Milton trial, including this impressive 'counter-espionage' action which Hindenburg undertook.

From what we gather, Trevor Milton (likely through law firms) hired an army of spies across the nation to harass and intimidate critics/suspected critics.

— Hindenburg Research (@HindenburgRes) September 29, 2022

Most people aren’t aware that these activities go on, but they are becoming common weapons for the rich & powerful.

(44/x)

We can't wait to see what will be Hindenburg's next step.

What is next?

Apart from expectations regarding Hindenburg we believe the next quarter might be about ESG. Several activists continue to highlight how this movement has created companies which are, according to the short sellers, completely out of touch with the core principles. One such example that we are going to monitor is going to be Sunrun (RUN).

Just out - FT Article in which I talk about how $RUN and $HASI are non-economic BS artists, and #ESG is filled with carnival barkers, by @ftmoralmoneyhttps://t.co/KfDBTPzwM3

— MuddyWatersResearch (@muddywatersre) October 5, 2022

This solar company was initially targeted by Muddy Waters due to allegations of a dubious business model. Most importantly, the report believes the company could face a dire need for equity issuance to stay afloat. First, RUN is allegedly overestimating the value of their current assets due to the use of questionable accounting. Muddy adjusts 'Net Earnings Assets' down as much as 90%. Second, the company is apparently misleading IRS about its Power Purchase agreements. Third, RUN's ABS securitization could expose the holders to bankruptcy of the company due to a lack of reserve.

Despite showcasing strong allegations, the stock failed to budge. The shares are down 12% since the report, but that is a far cry from where Muddy believes the stock should trade. However, since then others have joined in as per below.

Despite the bounce in the stock, $RUN zero coupon bonds are getting hit today and are back to their recent low prices. The 10.5% yield is making a mockery of Sunrun’s 5% discount rate in their NPV calculation. pic.twitter.com/h2ChKvv1yL

— Diogenes (@WallStCynic) September 30, 2022

Another short-orientated research outfit is likely to support Muddy with a detailed analysis of the business.

1/8 Hey @MaryGPowell... based on our understanding of a recent @muddywatersre report on $RUN, can you help us understand why resi rooftop solar companies - $RUN, $SPWR, $HASI - are still using "appraisals" from companies like Novograndac & Alvarez & Marsal (who I blv are both...

— Gordon Johnson (@GordonJohnson19) October 7, 2022

Given the interest from activists, it is likely RUN will be on the defensive in Q4 and the outcome might well create a precedent for targeting other companies which are trying to fit into the ESG movement.

On that note we would also highlight that activist shorts continue to expand their focus. During the worst of the COVID-19 market, there were only a few who ventured outside the classic and proven fraud allegations or serious breaches of corporate governance. Now it seems the shorts are not afraid to target companies due to allegations of overvaluation or broader and perhaps more general issues with the business model and or management teams.

An example can be Fuzzy Panda who targeted EVGO, another EV stock, but this time mainly talked about the broken economics rather than post cars catching on fire. Another one could be the latest campaign by Iceberg. The activist targeted what seems like a stock with the potential to be labelled a pump and dump. As per Iceberg, the company is dealing with quantum computing even though its R&D spent is minimal, and they are unable to generate much revenue. Their management team does not seem to have much experience with the complex topic of quantum computing.

Some could argue that even just 18 months ago, suggesting shorting this could pose a serious threat due to the trendiness of the business model. Reddit could have caught wind of the potential for QUBT to be the next IBM or whatever one might come up with and run with the story.

It will be interesting to see whether shorts will start picking apart other types of companies as well. We might also see more very interesting additions to the short-selling world as this one "Founders of Gotham and Portsea join forces in new short selling fund" and this one:

A BIG ANNOUNCEMENT today! @elementmacro sits down with @RodBoydILM of @FFJ_report. After a long and successful career as an investigative journalist, Roddy reveals that he has officially joined the short selling community: https://t.co/Uy7j2jmuN5. #ShortSelling

— zer0es.tv (@zer0estv) October 10, 2022

(Stay on top of short selling developments - Join Breakout Point).

FAQ | Q: Can I publish parts of the above data and analytics in an article? A: As long as you reference our work - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, contact us, and we'll try to help as soon as possible.

* Note: Presented data and analytics is as of available on 2022-10-11 UTC 08:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.