We want to highlight Hindenburg Research’s activity this year outside our usual annual activist short-selling review. This is due to the prominence of the activist well outside the usual borders of the short-selling world. While many seasoned short-sellers continued to publish new campaigns, we believe Hindenburg did take a special spot this year.

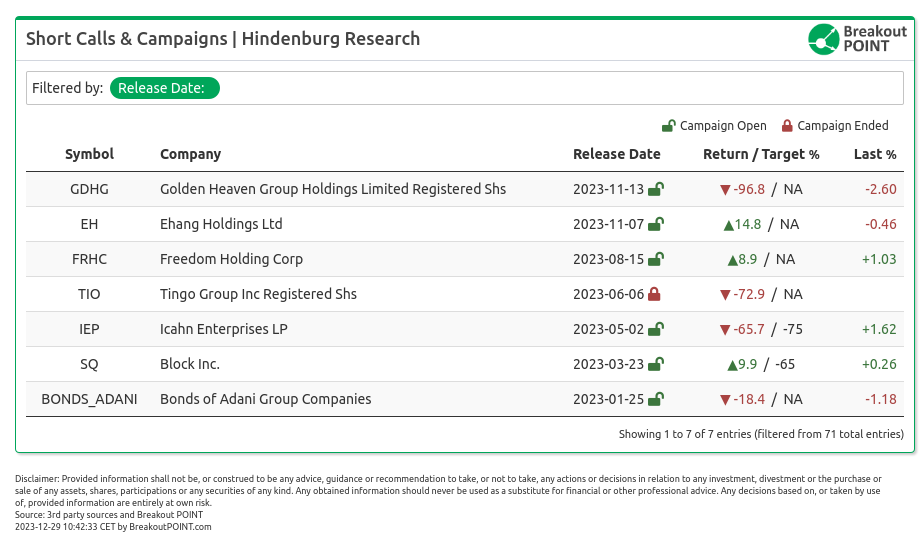

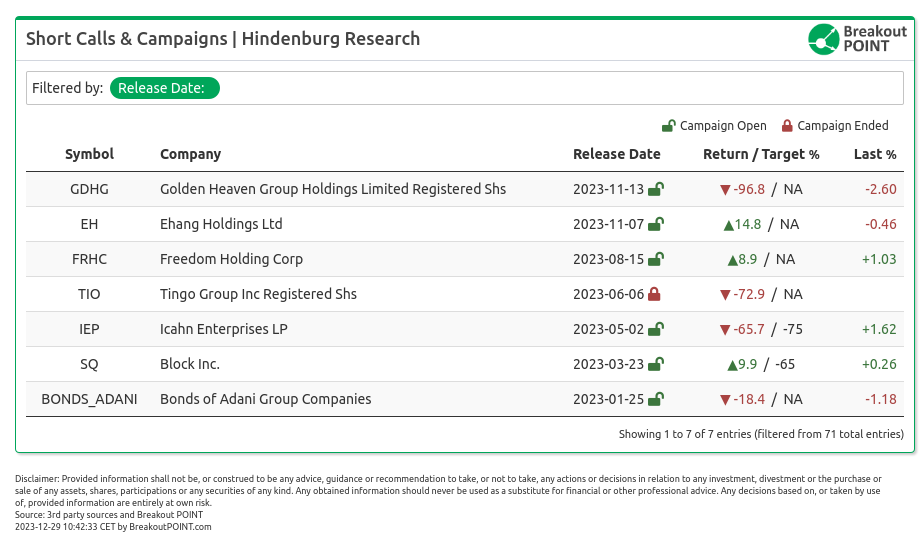

The reasons are quite simple and point to the stellar track record Hindenburg is building. Stocks that Hindenburg Research focused on in 2023 are, on average, down 31.5%. This is despite S&P 500 being up almost 25% in 2023.

Above-mentioned 31.5% decline, does not even include their recent successful brief flag on Maison Solutions (MSS):

Maison Solutions is a company that took 6 California Asian-themed grocery stores public on the Nasdaq in October.

— Hindenburg Research (@HindenburgRes) December 15, 2023

The company also owns a 10% equity interest in a Dai Cheong Trading, a distribution company owned by $MSS controlling holder, Chairman and CEO, John Xu.

(1/x)

Not only did Hindenburg notch one of just three zeroes this year and amassed other wins, but the research had a profound impact on the markets. We would be repeating ourselves if we were to describe the Adani saga all over again, but we want to highlight that the findings continue to put pressure on the group.

Major new FT investigation into Adani shows trade-based money laundering involving $5b in imports since 2021 alone.

— Hindenburg Research (@HindenburgRes) October 12, 2023

Report reveals ongoing dummy invoicing & overseas entities used to inflate coal prices, passing costs on to customers.https://t.co/T1gHylxRfp

The stocks might have rebounded, but Hindenburg managed to uncover what seems like a large mystery in the fifth largest economy in the world connected all the way to the ruling elites.

Get most popular retail stocks. Track real time retail sentiment and retail popularity via our APIs and dashboards.

Hindenburg also did not hesitate to shake up the US financial community when they launched a campaign against Icahn Enterprises, alleging Carl Icahn is using it to prop up its investments and lure people in for an unsustainable dividend. The stock is now down about 66% since that call which prompted interested parties to comment.

I have been fascinated by the @HindenburgRes$IEP situation, and there are some interesting learnings here. For example, one learns from $IEP that a controlling shareholder of a company with a small float that pays a large dividend can cause his company to trade at a large…

— Bill Ackman (@BillAckman) May 24, 2023

In 2023, Hindenburg also saw plenty of regulatory action connected to Hindenburg’s previous picks. Towards the end of December alone, the activist saw three major developments confirming their research and unravelling the stocks in question.

Most notably, EBIX recently entered Chapter 11. The activist wrote about the stock in 2022, alleging that the IPO of a subsidiary is not going through.

Update: Indian software company $EBIX just filed for Chapter 11 bankruptcy.

— Hindenburg Research (@HindenburgRes) December 18, 2023

The company failed to IPO its subsidiary, EbixCash, as predicted.https://t.co/xUHCIZSeO7https://t.co/8WGhP5JAM0

EBIX was also a target of several other activists before Hindenburg. Another big news on the regulatory front came from Nikola. Yes, the founder of that 'rolling down the hill' EV has been sentenced to four years in prison for fraud.

BREAKING: Nikola founder Trevor Milton has just been sentenced to 4 years in prison for fraud. https://t.co/r6X52i9IcT

— Hindenburg Research (@HindenburgRes) December 18, 2023

Hindenburg worked with whistleblowers to uncover Nikola and their dubious business in 2020. One recent campaign also got significant confirmation from the regulatory bodies. Tingo (TIO), African agri-fintech businesses, is now in the crosshairs of the SEC as the founder and three affiliated US entities were charged with ‘massive fraud’.

“The Scope Of The Fraud Is Staggering”

— Hindenburg Research (@HindenburgRes) December 18, 2023

This morning the SEC charged $TIO founder Dozy Mmobuosi and 3 affiliated U.S.-based entities with “massive fraud”.https://t.co/6GfGqK2MYL

(1/x) https://t.co/FihtENH3Nn

Given the high activity of Hindenburg, they released seven campaigns this year, some of the stocks are not moving yet. It will be interesting to track stories such as Freedom Holding (FRHC), which is up over 8% so far. The stock is holding despite Hindenburg's allegations and pressure.

Hindenburg followed other activists and dug into alleged FRHC’s dubious corporate governance. Despite the findings, the market does not seem to care, at least for now. However, Hindenburg is patiently asking questions.

$FRHC Chairman & CEO Timur Turlov's response to our questions. pic.twitter.com/xeDMgsXtrZ

— Nate Anderson (@NateHindenburg) September 26, 2023

Another stock that refused to go down is Block (SQ). There, Hindenburg came out with allegations of regulatory risk due to CashApp. The research was followed up with a peculiar video material.

“I paid them hitters through Cash App”— Block even paid to promote a video for a song called “Cash App” which described paying contract killers through the app.

— Hindenburg Research (@HindenburgRes) March 23, 2023

The song’s artist was later arrested for attempted murder. (10/n) pic.twitter.com/alCWo4QNLL

So there you go, Hindenburg is able to bust a national conglomerate in India and at the same time research potential money laundering in the US. The scale of their activity is certainly making Hindenburg one of top short-sellers right now in the eyes of the public. We can’t wait to track their activity in the upcoming year. Unfortunately, the golden age of fraud seemingly continues unabated.

Don't miss latest activist short selling reports and insights - Join Breakout Point

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, join Breakout Point and start benefiting from our services.

* Note: Presented data and analytics is as of available on 2023-12-29, UTC 12:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.