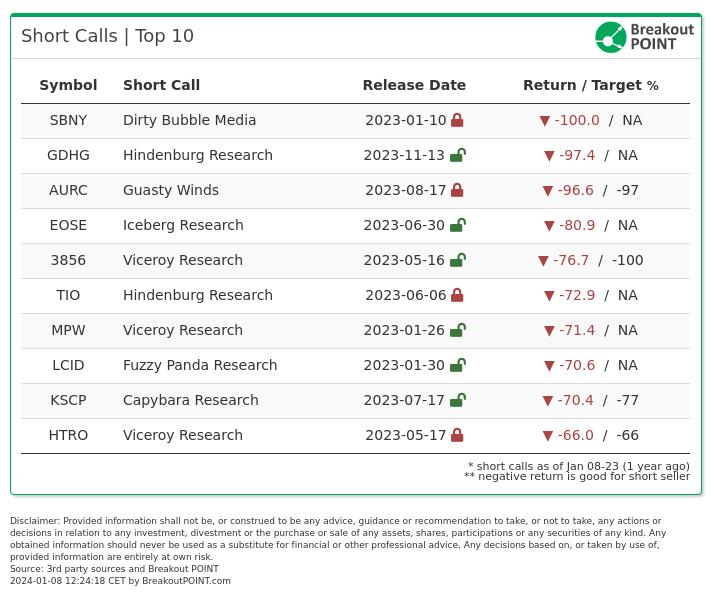

Another year in the activist short-selling community is now in the books, and what a year it has been. The market environment is unchanged. The golden era of fraud seems to continue unabated. In 2023, we saw 129 new major short calls, up from 113 calls in 2022 and down from 135 in 2021. Here are the top 10 performing short reports/calls of 2023.

We cover the best-performing short, Dirty Bubble Media on Signature Bank (SBNY), as well as campaigns by other newcomers in a separate post. Hindenburg Research’s shorts are also covered in a specific post looking at an overview of Hindenburg’s activity in 2023. Therefore, we would like to highlight the unlikely Japanese campaign launched by Viceroy Research. The activist is now known to visit all sorts of geographies in their effort to stamp out fraud in the public markets. Outside of Europe and the US, Viceroy targeted Abalance due to allegations of regulatory issues.

The campaign was hard at first. The company and the shareholders fired back, but the allegations were eventually seemingly accepted by the market. Viceroy also managed to record the best-performing European-focused short campaign with Swedish target Hexatronic (HTRO). Finally, Viceroy was able to run a victory lap at the very start of 2024, after negative news about the company that sued them following their public short report came out:

$MPW appoint restructuring specialists, A&M to recover unimpaired rent from its largest tenant & 10% subsidiary.

— Viceroy (@viceroyresearch) January 4, 2024

The writing is on the wall.https://t.co/GS8iQiqjxF

It is wort noting that amazing 3 of overall 10 best performing short calls were authored by Viceroy Research. Hindenburg achieved a similar success with 3 calls in top 11.

Iceberg Research also saw a significant win as they reshorted Eos Energy (EOSE). This shows the power of our database as some of the stocks previously targeted sometimes seem to catch a second breath even though the thesis remains partly the same. Iceberg did exactly this with EOSE. The activist first saw the shares cratered by over 90% in 2021, but then the stock rebounded. Iceberg noticed and swiftly reiterated and complemented their view that the energy storage technology that EOSE is touting is apparently still subpar.

Interestingly enough, the sectors tied to COVID boom times are still being targeted. Fuzzy Panda continued their EV focus and notched a significant win with the Lucid (LCID) campaign. ChargePoint (CHPT) by Sunshine was tied to EV charging, and Blue Orca focused on Piedmont Lithium Ltd (PLL), a lithium company. Aurora Acquisition (AURC), by Guasty was a deSPAC short (Better Home & Finance Holding).

A notable mention should be B.Riley (RILY). While the Friendly Bear is mentioned as the one having the best return, the campaign is a team effort with many activists collaborating on Twitter, eg Marc Cohodes, that shared how RILY is seemingly facing significant corporate governance challenges, which are, according to the shorters, increasingly worse with time. Also, notably Wolfpack Research had a first full report on RILY almost six months before the Friendly Bear.

Get most popular retail stocks. Track real time retail sentiment and retail popularity via our APIs and dashboards.

We would also like to highlight the best activists with at least two calls this year.

Fuzzy Panda takes the crown as their second short of 2023 can also be seen in the top 20. Xponential Fitness (XPOF) is a fitness chain company which is unlikely to recover from the corporate governance allegations raised by Fuzzy. We cover the stories behind Guasty and Capybara in a separate post about newcomers.

Here, we would like to profile Blue Orca. Perhaps one of the more low-key activists has had a tremendous year with their public calls. Only one is up so far since the initial report. Apart from the successful lithium short, the activist also targeted a energy storage provider, an agribusiness with allegations of lack of disclosure and a fintech with supposed dubious accounting. The last campaign is the only one struggling to make a dent. The stock is up 3% so far.

However, that does not mean only smooth sailing for the activists. The average shares decline following a short campaign is 3.8% since the initial report, but that still shows we are far from automatic decreases in share price just because of the short-selling campaigns. Without the top five losers, the average would fall down to 11.1%. However, having in mind that the S&P 500 soared about 24% in 2023, an average shares decline of 3.8% demonstrates that they were able to navigate a very bullish environment. Country-wise, and as often seen, the best performing short calls were, on average, those targeting Canadian companies:

In terms of the worst performers, probably unsurpisingly, among top 5 worst performers are two crypto targets, which mooned because of the late 2023 bitcoin price action. Both are up over 100% since the initial call.

Last but not least, we would like to pay our respects to Jim Chanos, who decided to step away from actively managing short positions through his fund, Kynikos, in November of this year. Mr Chanos managed Kynikos for 38 years. In that time, he amassed many successful campaigns, perhaps chiefly among them Enron, which he successfully shorted while ringing the bell and cautioning investors. He was not as public as some of the top activists of today but was a key supporter of all things short-selling. We hope to see him active in the space in any shape or form for many years to come.

Don't miss latest activist short selling reports and insights - Join Breakout Point

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, join Breakout Point and start benefiting from our services.

* Note: Presented data and analytics is as of available on 2024-01-08, UTC 12:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.