- In the first six months of the year we saw 65 new major short and critical campaigns. This is in line with the rate last year.

- On average, shares declined 11.3% following the release of the report, which compares well to the +14.5% return of S&P 500 index.

- Among the most successful were campaigns targeting sub-billion segment. Bleecker took the crown with their LuxUrban Hotels (LUXH) campaign. Hindenburg saw a significant decline in Renovaro Inc. (RENB), and Culper saw success with their China Hustle 2.0 stock.

- We also highlight other activists who had success in the past six months. Apart from Bleecker, who took the spot among activists who published at least 2 calls, we also saw great returns for Fuzzy Panda, Kerrisdale or Hindenburg who even managed to release six campaigns.

- Lastly, we talk about the newcomer Hunterbrook and what could the second half of 2024 bring.

H1-2024: The grind continues

As you can see in the summary, the activists continue to bring alpha defying the skeptics that still pop up occasionally and try to argue about the motives or value of short-sellers. The campaigns were 'outperforming' the market by over 20%. The performance continues to show there are plenty of stocks to target and the alleged 'Golden Age of Fraud' is nowhere near the end. The environment is also likely helped by the interest rates, which make it harder for companies to obtain cheap financing.

At the same time we would also note that the reactions to some of the activist reports are changing. It seems the days of 30%+ immediate declines are gone, and most reports usually record little initial volatility. The stocks usually fall on earnings or news supporting the bearish thesis or simply drift lower over the course of a few months. We believe this supports what we do even more as the relevancy of tracking existing campaigns is now more important than ever to see which allegations could still hurt which stocks in the near future.

All in all, activists continue to successfully spot dubious companies, but the market sometimes takes time to recognize the reports. Thus, the grind to call out bad actors and questionable businesses continues.

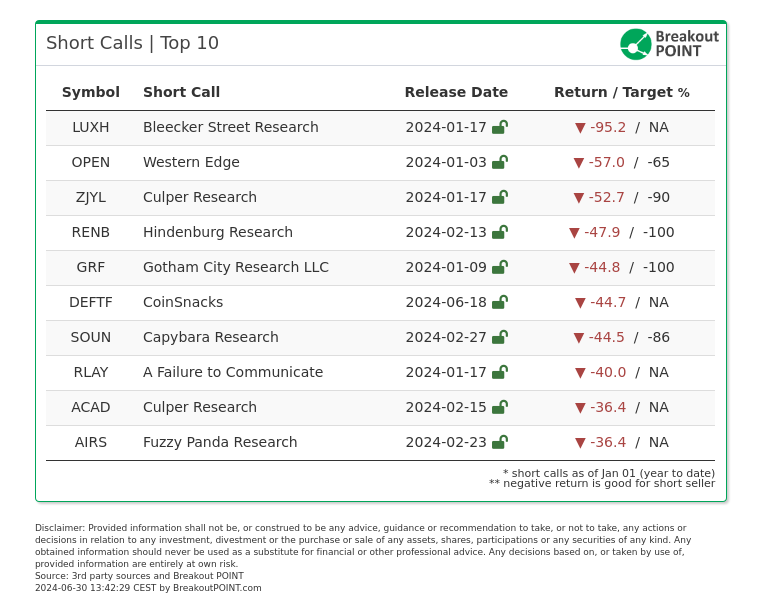

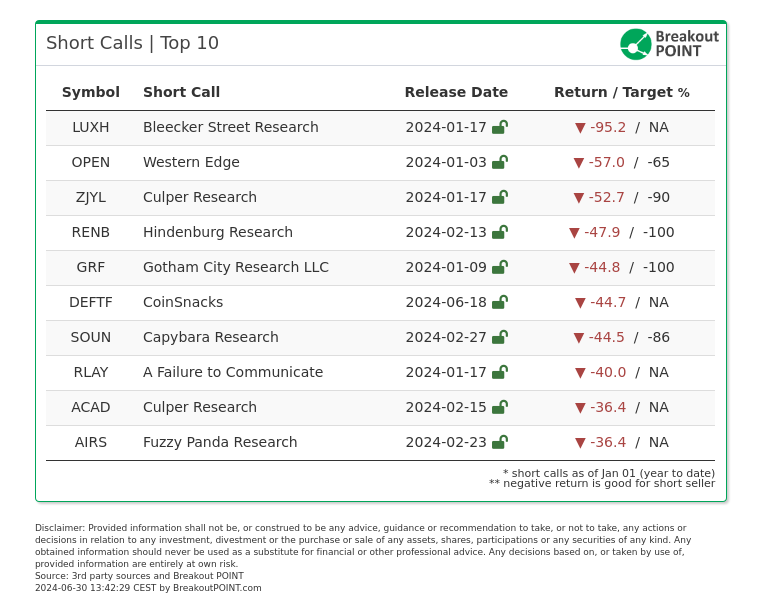

In H1-2024, we registered and tracked 65 new major short campaigns. This is on pace to reach the same number of campaigns recorded in 2023. At the time of this report, on average, targeted stocks were down 11.3% following a short call/report. The ten best-performing from H1-2024 are:

The mid-year crown was taken at this time by Bleecker Research, who carved out a specific niche of targeting small to micro-cap companies. LuxUrban Hotels (LUXH) was a perfect example of some of the stocks that the activist wrote about recently. As per Bleecker, the hotel company apparently had a questionable management who wanted to increase confidence by aggressively talking up the growth among other things. According to the activist, at the same time, the fundamentals of the business were allegedly deteriorating and bad to begin with, yet there were plenty of bullish investors who wanted to believe the story. The report was released in January, but most of the declines transpired over the next few months.

Other than the success of Bleecker in the microcap land, we would want to highlight Culper's Chinese target Jin Medical International (ZJYL). While China Hustle 2.0 is not as frequent as in the past, when there is actually a campaign, it seems to work out quite well. Culper used all the usual allegations concerning ZJYL's business in China and abroad.

While there are plenty of successful campaigns in the Top 10, the one with the most interest might be Gotham's crusade against Grifols. The activist came out with a rare new report and this $9.5bn Spanish-based pharma company got hit significantly. Since then the company rebounded somewhat, but Gotham continues to see significant red flags and therefore we are likely to see further developments. We covered the recent developments in our weekly posts.

Lastly, we would like to highlight the success of Capybara in SoundHound (SOUN). The company was initially targeted by Culper, who saw the stock rise against them; SOUN is still up over 60% since Culper's first report. However, Capybara took another swing at the business and, this time, managed to take it home.

Looking at the campaigns from a geographical perspective, as usual, U.S. companies were most often the focus of short and critical reports. On average, following 46 U.S.-focused reports, corresponding shares declined by 11.7%. More lucrative geographies for short-sellers were Europea and China, each with an average decline of 14.9%, though latter was based on only three short calls.

We do not see any major changes in the trends. The most available market is in the US with interesting trends such as developing whistleblower program. Europe remains attractive but is plagued with its well-known "defensive" behavior when it comes to short-sellers (see Grifols), and China is no longer the key focus as there are not that many new companies coming on the public market.

We also compiled statistics on the main allegations that activists present when publicly sharing their critical research.

Activists in Our Focus

As per usual, we also compile the average returns of activists with at least two calls.

Bleecker takes the first spot again given their success with LUXH. Their second best campaign was Lithium America (LAC). While you might think all lithium-related shorts are already gone, Bleecker still managed to find yet another junior mine trying to get rich off of supposedly unviable business model.

Fuzzy Panda takes the second spot for what is an unusually busy year for the activist. They struck success with two campaigns targeting stocks trading below $1bn due to allegations of fraudulent products and questionable corporate governance. Fuzzy is also one to look for in the future as their Globe Life (GL) short is down 20% so far, but the campaign is far from over as other activists are also joining on the case.

Kerrisdale Capital continued their almost exclusive focus on stock popular with the retail crowd. The activist even dared to go against MicroStrategy (MSTR) and recently focused on Riot Platforms (RIOT), another crypto-related stock. While RIOT has not moved much yet, MSTR is down 29% since the initial report.

We would also highlight the effort of Hindenburg Research. Perhaps the most notorious activist short-seller right now managed to release six new pieces. Their biggest success was with RENB, which is a company that was previously the infamous ENOB, a biotech company linked to a spoon-bending person. It seems that once associated with spoon bending, it is hard to shake off bad performance.

We would also note their campaign against LPP. The activist confirmed their ability to fly around the globe and pop alleged frauds as they see them. LPP is a Polish company that was targeted by Hindy due to alleged fraudulent corporate governance, as LPP seems to continue their business in Russia despite the war. The stock is now down 6% so far.

Get most popular retail stocks. Track real time retail sentiment and retail popularity via our APIs and dashboards.

New Model?

We also saw several newcomers in the first half of the year. The one that got the most attention is certainly Hunterbrook. After all, how many times can you read about an activist in the New Yorker? The reason why the attention turned to the launch of Hunterbrook is tied to the model it is apparently operating. The activist has two entities, Hunterbrook Capital and Hunterbrook Media. The latter publishes the research and discloses whether the fund has a position in the stock. The innovation the activist is aiming for is the use of a wider journalistic team compensated partially based on how the fund is doing. By this, they are trying to invigorate investigative journalism that does not necessarily need to be tied to publicly traded companies.

They assembled an impressive team of people behind Hunterbrook media that are now publishing the campaigns. The launch started with targeting a mortgage lender due to questionable corporate governance. The campaign went out in a big way, but the impact is yet to be seen. The shares are up 4%. In June, they made waves with a report about a telehealth business that apparently sells Ozempic-knock-offs and is supposedly exposed to serious legal and FDA risks. This report was circulated widely as many of the industry veterans reposted.

Great great story by @hntrbrkmedia. My favorite line: "...what Dr. Angela Fitch, former director of the Massachusetts General Hospital Weight Center, has called “the largest uncontrolled, unconsented human experiment of our lifetime.”https://t.co/up0diHRv1u

— Bethany McLean (@bethanymac12) June 27, 2024

The activist short-selling community is less enthusiastic. There was already pushback on some of the campaigns and the self-proclaimed watchmen of activists, Fiat Lux, published several threads in which they discuss the model of Hunterbrook.

Activist short seller Hunterbrook Capital / Hunterbrook Media published a short report on $UWMC. We have nothing to say about the report for now. But we do have a comment on Hunterbrook: it should own the fact that it is an activist short seller. It is otherwise being deceptive.

— Fiat Lux Partners (@FiatLuxPartners) April 4, 2024

They also discussed the latest campaign, seeing apparent red flags in the research.

Since we’ve become the Hunterbrook foil, people have been asking for our thoughts on its activist short report on $HIMS. This will be lighter-touch from us, but we once again take issue with its content and tact. Some of its $HIMS claims are oversold.

— Fiat Lux Partners (@FiatLuxPartners) June 27, 2024

It is not entirely clear how Hunterbrook might innovate within a well-established community, but it seems that the activist is here to stay.

What to expect in H2-2024?

We wonder how the US election will shape the market. While individual stocks are unlikely to be affected and short-sellers are going to just continue focusing on the next one, we do wonder if there is going to be any reversal in the type of action DOJ or SEC will pursue.

Other than that, we expect more of the same. There are still plenty of campaigns that are waiting for the catalysts. Viceroy has most of these under the belt as they also targeted Globe Life (GL) which is likely to see some action in the next six months. They also continue to pound on Arbor (ABR). Outside of Viceroy, we also wonder about B. Riley Financial (RILY). The stock is under pressure again, but it did stage a significant rebound in the past, so we wonder how investors will react again. When it comes to their Medical Properties Trust (MPW) campaign, Viceroy pointed out how private intelligence firms surveilled members of Viceroy Research:

The @OCCRP obtain footage of private intelligence firms illegally surveilling members of Viceroy Research.

— Viceroy (@viceroyresearch) July 1, 2024

Below is video footage of Fraser Perring in his own home. $MPW

This is outrageous, and disgusting. We will pursue these criminals to the full extent permitted by law. https://t.co/GeALRqyVoa

However, one thing continues to hold for now. Justice is slow, but it still works, as QCM saw another success with one of their ancient campaigns.

BREAKING: Folli Follie fraudsters found guilty! Sentences: 11-17 years. Justice served. This is a triumph for transparency & accountability in finance. We commend Greek institutions for their unwavering commitment to justice.

— Quintessential Capital Management (@QCMFunds) June 27, 2024

Activist short sellers play a crucial role in…

While it seems Greek institutions warmed up to transparency and accountability, India might not be on the right track.

Adani Update – Our Response To India’s Securities Regulator SEBIhttps://t.co/4IIF948v0j

— Hindenburg Research (@HindenburgRes) July 1, 2024

Is perhaps SEBI pulling a BaFin? We will see.

Don't miss latest activist short selling reports and insights - Join Breakout Point

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide more related data and analytics? A: Sure, join Breakout Point and start benefiting from our services.

* Note: Presented data and analytics is as of available on 2024-06-30, UTC 12:00.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.