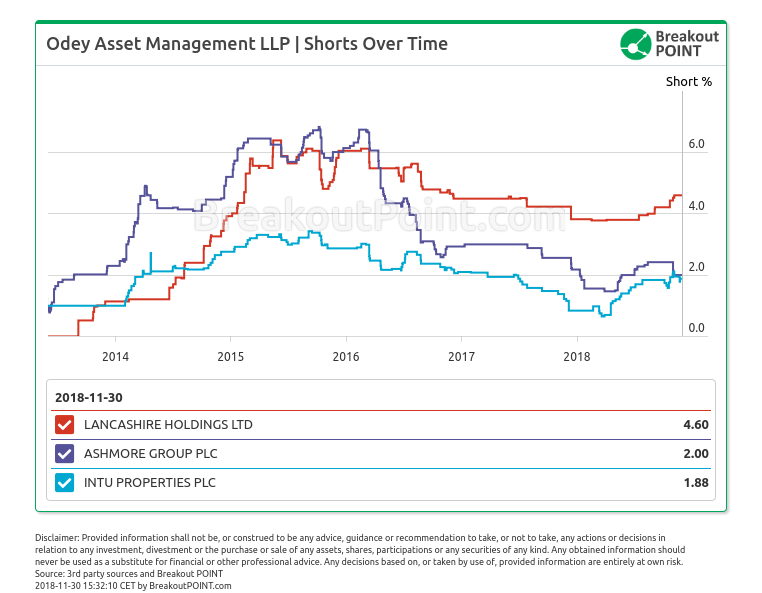

Odey's fund is the big winner after Intu shares dropped about 40% on Thursday. Odey Asset Management has been continuously holding a short >0.5% ("big short") for more than 6 years.

Intu Properties shares slumped and are trading about 115p on Friday after a take over bid was pulled (ref. Daily Mail).

Odey's bet against Intu is one of the longest standing big shorts in our records and it goes back to 2012-11-01 when Intu was trading at about 315p.

This short position is 1.88% big and it resulted in a profit of about £20m only on Thursday for Odey Asset Management.

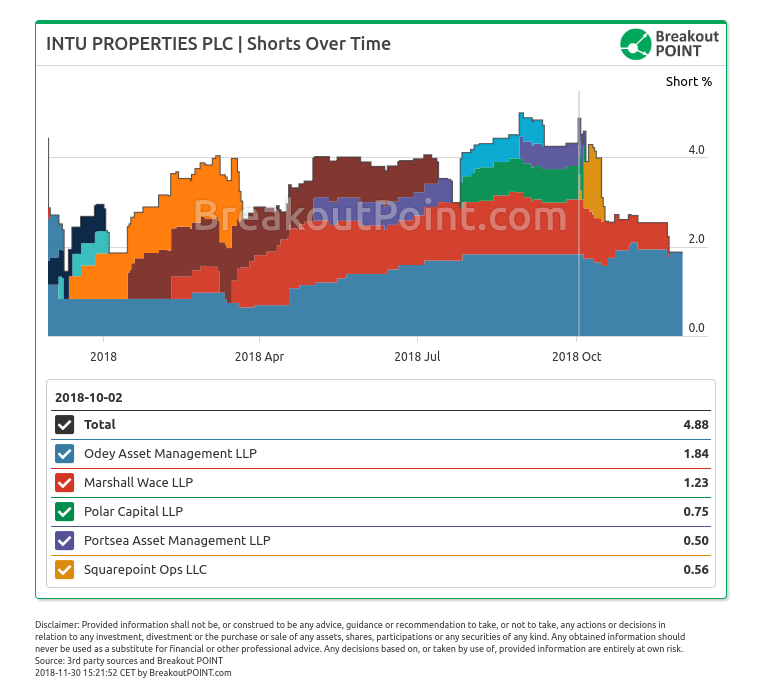

Several other hedge funds were holding big shorts in Intu recently. However, they have reduced them before the latest drop: Marshall Wace LLP reduced their big short on 2018-11-22, while Squarepoint Ops LLC, Portsea Asset Management LLP, and Polar Capital LLP did it in October.

Odey's Long Terms Short Bets

As we already mention in our recent post "Odey is Back. What is he Shorting?", Odey Asset Management is, in our records, quite unique when it comes to a holding period of some of the short positions. Not only Intu Properties, but also Ashmore Group, and Lancashire Holdings shorts have been held by Odey for more than 5 years.

Know what influential investors and activists do. Cancel anytime. Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide further related data and analytics? A: Sure, LET'S TALK and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.