Odey's main fund is up about 48% YTD (refs. FT, Bloomberg). UK short bets dominate top short positions of Odey Asset Management. When it comes to shorting persistence, hardly anybody beats Odey in all of our records - some of the shorts have been in place for more than 5 years.*

The Biggest Shorts of Odey

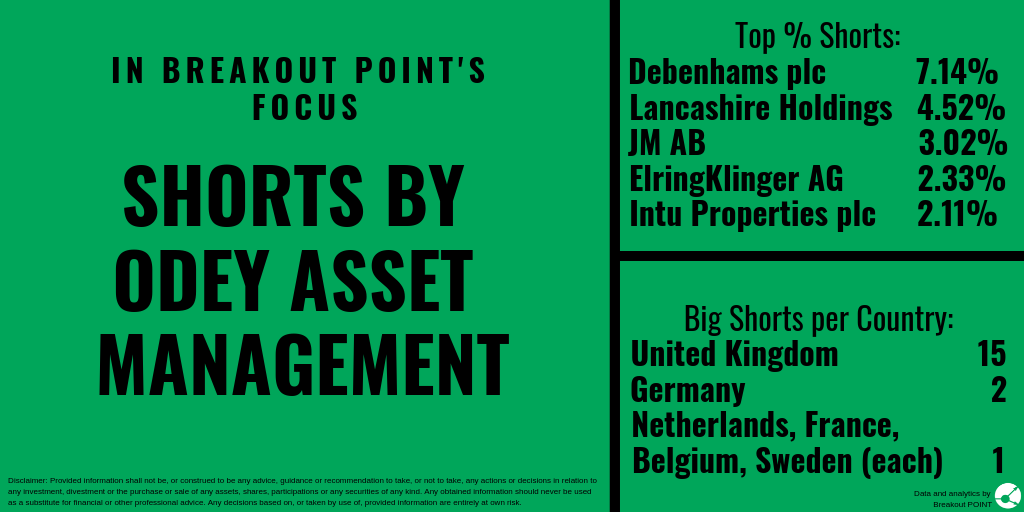

Three out of five top % Odey's shorts are in UK companies: Debenhams plc (7.14%), Lancashire Holdings Ltd (4.52%) and Intu Properties plc (2.11%). Short interest above 4% is rather rare, so Debenhams and Lancashire Holdings shorts are also among top 10 shorts in terms of % held by any individual fund in all of EU countries we track.

Our records indicate now (and have indicated in the past) that Odey's fund short selling is strongly focused on UK. Out of 21 currently held short positions above 0.5% ("big shorts"), 15 are targeting companies in UK, 2 in Germany, while remaining 4 big shorts target companies in 4 different EU countries. Industry split of shorts is far more balanced, with the most big shorts in Consumer Discretionary (6), IT (5) and Finance (4).

New and Old Short Postions

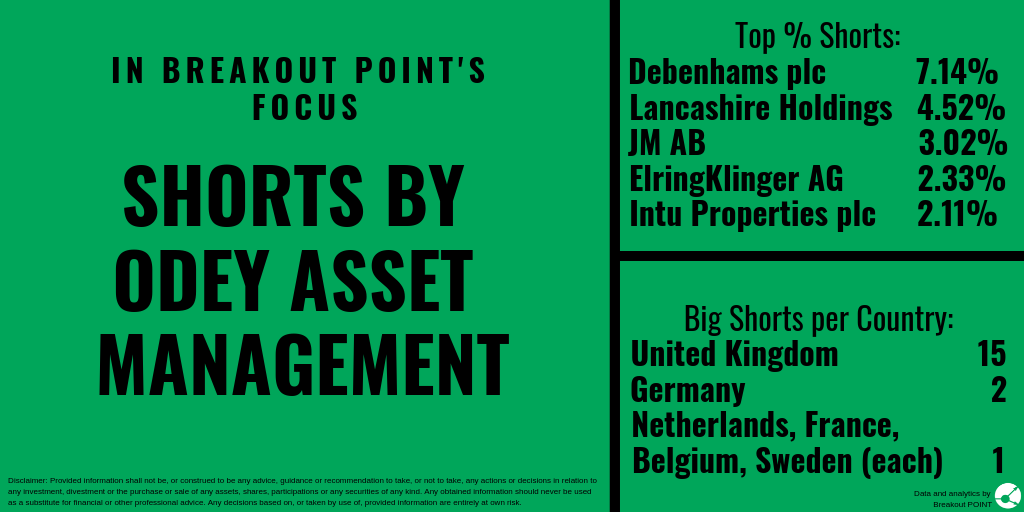

Odey Asset Management is, at least in our records, rather unique when it comes to a holding period of some of the short positions. For example, Intu Properties, Ashmore Group, and Lancashire Holdings shorts have been held by Odey for more than 5 years.

A number of new big shorts by Odey Asset Managment popped up in the past few weeks, among these are: a 0.54% short in DS Smith (mkt cap about £5.21 B), a 0.54% short in Bunzl plc (mkt cap about £7.54 B), a 0.92% short in IQE plc (mkt cap about £0.72 B), a 0.64% short in Melexis N.V. (mkt cap about €2.37 B) and a 0.51% short in Wereldhave N.V. (mkt cap about €1.24 B).

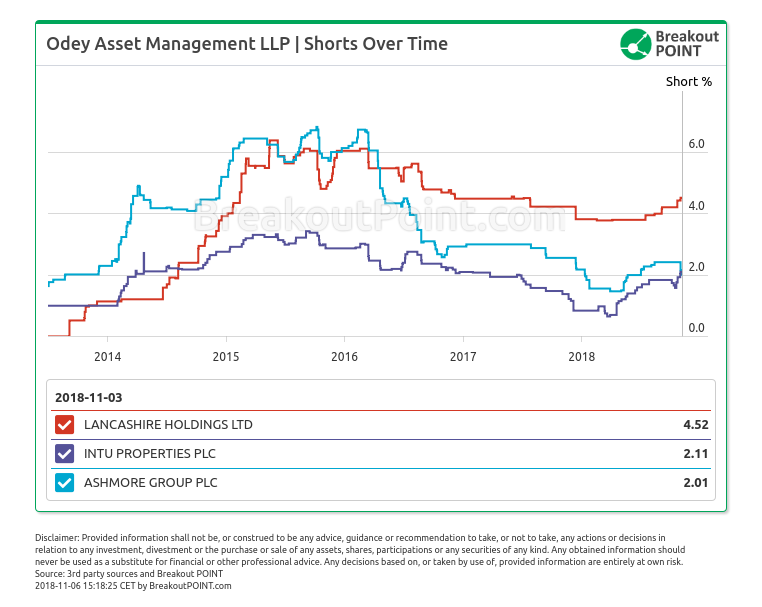

Also, Odey's short stands out among eight big shorts in Metro Bank (mkt cap about £2.2 B). Odey's short position has been publicly disclosed since April 2018 and is currently at 1.7%.

UK Shorting by Peers

The most big shorts in UK are held by: Marshall Wace LLP (46) and GLG Partners LP (44). Such high number of Marshall Wace's short positions is not unexpected. As we noted in our "Who Shorted EU?" post, they have by far the highest number of significant short positions across EU.

Know what influential investors and activists do. Cancel anytime. Join Breakout POINT.

FAQ | Q: Can I publish parts of above data and analytics in an article? A: As long as you reference our work in your article - yes, you can.

FAQ | Q: Could you provide further related data and analytics? A: Sure, LET'S TALK and we'll try to help as soon as possible.

* Note: Presented short selling data is based on European net short position data which is disclosed to the public when short positions at least equal to 0.5% of company issued share capital.

The services and any information provided by Breakout Point or on the Breakout Point website shall not be, or construed to be any advice, guidance or recommendation to take, or not to take, any actions or decisions in relation to any investment, divestment or the purchase or sale of any assets, shares, participations or any securities of any kind. Any information obtained through Breakout Point and its services should never be used as a substitute for financial or other professional advice. Any decisions based on, or taken by use of, information obtained through Breakout Point and by its services are entirely at own risk.